Short Put

In this article, we discuss the strategy of selling a put, or Short Put. Each sold put option contract gives exposure to 100 shares of the underlying. By selling a Put, we have the obligation at expiration to buy from the buyer 100 shares of the underlying at the strike price if exercised.

Selling a put is equivalent to going Long on 100 shares.

Why Sell a Put Option?

Selling options has its advantages for the trader:

- Income Generation. Selling options can generate additional income through the premiums paid by buyers purchasing the options. The option seller collects the premium.

- Acquiring shares at lower prices. If we want to go long on shares, we can either buy them on the market or sell a put. By selling a put at a strike lower than the market price, we first collect a premium and have the opportunity to buy at a lower price if the price of the underlying drops.

- Generating returns from non-directional movements. Selling options can generate profits if it is believed that the price of the underlying will move within a range or will not reach our strike price.

We sell a Put option if we have a bullish view on the underlying.

Short Put Strategy Payoff Diagram

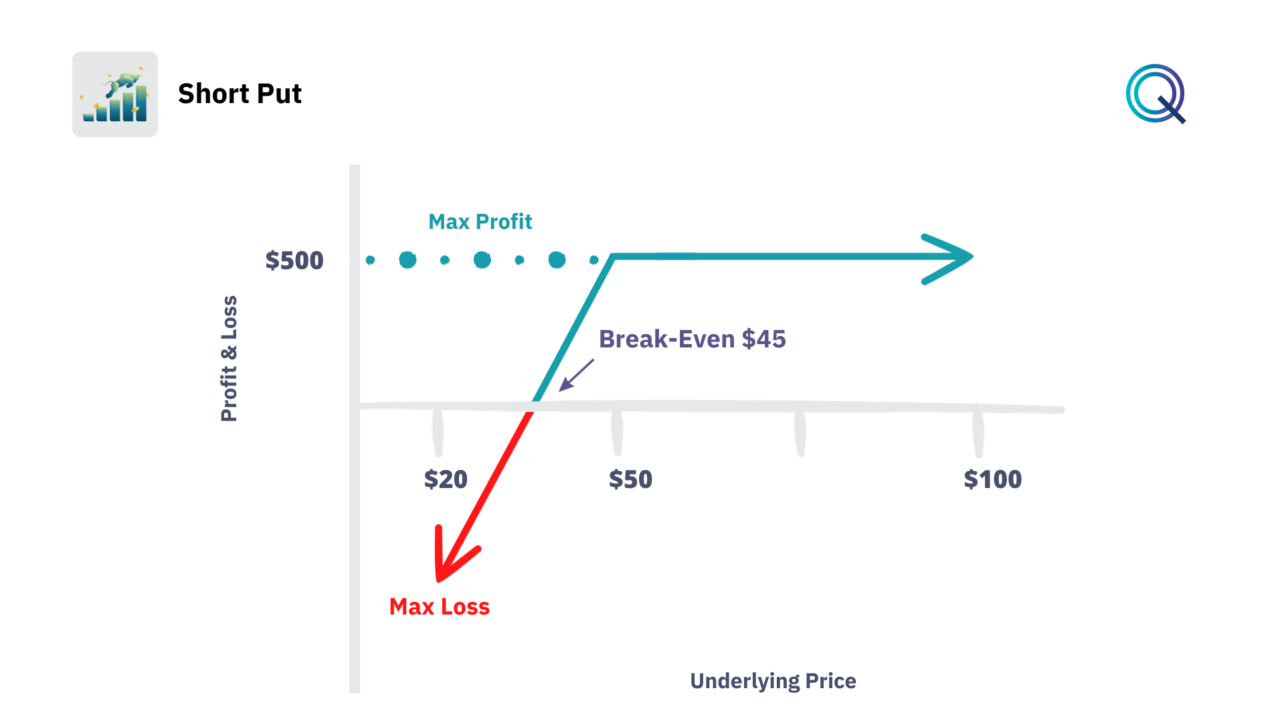

Each option strategy has a potential return and a maximum potential loss. These two values can be displayed through the payoff chart. Selling options also involves risks. Let’s look at the payoff of this strategy.

When we sell options, we have a limited profit represented by the received premium. Looking at the payoff from selling puts, in this example, we have sold a put option contract with a strike price of $50 for a premium of $5.

- The received premium is $500, which is $5 x 100 (number of shares). The premium represents our maximum gain. If the price of the underlying at expiration is higher than the strike price, the option expires worthless, and we fully collect the premium.

- The breakeven price is $45, calculated as the strike – the option’s premium. If at expiration the price of the underlying is below the breakeven, our strategy incurs a loss.

- Our maximum loss in this case is the difference between the breakeven price and zero. Indeed, the price of a share can drop to a maximum of zero.

Here is the formula:

Maximum Loss: [(Strike Price * 100 shares – 0) – Premium Collected].

Variables to consider when Selling a Put

When we decide to sell a put option, we must consider some very important factors.

- Advanced Insights into Short Put Strategy. When an investor opts for a Short Put strategy, they’re essentially betting on the underlying asset’s price staying flat or rising. This strategy is often employed by investors who wish to acquire the underlying asset at a discount or simply earn income through the premiums received.

- Strategic Positioning with Short Puts. When implementing a Short Put, investors need to have a clear understanding of the market sentiment regarding the underlying asset. Optimism about the asset’s stability or growth potential is key, as the strategy thrives in a bullish or at least not bearish market environment.

- Risk and Reward Balance. While the income generation from premiums is a definitive upside to the Short Put, investors must be prepared for the obligation to purchase shares at the strike price, should the option be exercised. This could result in a significant investment in the underlying asset, which may not be ideal if the market conditions have deteriorated.

- Margin Requirements and Capital Allocation. The margin held by brokers acts as a safeguard and is something investors must factor into their capital allocation plans. It is crucial to ensure that sufficient funds are available to cover the margin without affecting other investment activities.

- Implied Volatility (IV). IV plays a key role in the pricing of options. A decrease in IV after selling a put option is good for the strategy, as it reduces the option’s premium, making it cheaper to buy back if necessary. Professional investors monitor the IV closely and may choose to sell puts when IV is relatively high, capitalizing on the inflated premium.

- Time Decay and Theta. One of the advantages of selling a put is leveraging time decay. As options approach expiration, their value diminishes if they remain out of the money, which works to the seller’s benefit. This time decay accelerates as expiration nears, highlighting the importance of timing in executing a Short Put strategy.

- Rolling. Rolling is a tactic used to manage and extend the life of an options position. If the market moves against a Short Put position, an investor might roll the option to a further expiration date or to a different strike price. This can buy time or adjust the position to a more favorable strike, though it may incur additional costs.

- Assignment Risks. There’s always a possibility of early assignment with American-style options, where the option buyer exercises their right before expiration. Investors should have a plan for such scenarios, which may include having the capital ready to purchase the underlying asset or a strategy to sell it promptly if it does not align with their investment goals.

We talk about this in detail in our Academy.

The Bottom Line on the Short Put Strategy

The Short Put strategy is a powerful tool for an investor, offering potential income generation and entry into stock positions at a reduced cost.

However, like any strategy, it comes with risks that need to be carefully managed. A successful Short Put trader is one who is well-informed about market conditions, understands the nuances of option pricing, and manages their capital and positions with a clear strategy in mind.

In the broader context of options trading, the Short Put strategy is part of a spectrum of bullish strategies that investors can tailor to their market outlook, risk tolerance, and investment objectives.

By combining Short Puts with other strategies like Long Calls, Bull Call Spreads, and Bull Put Spreads, investors can create a diversified approach to options trading that balances potential risks and rewards according to their unique investment profiles.

To recap:

- The Short Put Strategy is a bullish strategy

- Our position is Short Options

- It is a credit structure

- Our View is bullish on the underlying

- The strategy benefits from a decrease in volatility

- Time is a positive factor for this strategy

Other Bullish Strategies

Here are other Bullish strategies with Options: