Bull Put Spread

Among the bullish strategies, we find the Bull Put Spread Strategy.

The Bull Put Spread is part of a series of multi-leg strategies that consist of the simultaneous selling and buying of options with the same expiration but different strike prices.

The Bull Put Spread is a bullish strategy that has a limited maximum profit. The strategy benefits from the rise in the price of the underlying asset. The trader’s view is bullish.

It is a strategy that involves selling an In-the-money put and buying an Out-of-the-money put with a lower strike than the sold put. The option’s expiration is the same.

- In this case, we sell a put and collect the premium and buy a put with a lower strike to limit the risk in case the price of the underlying should fall.

- This is a credit strategy as we receive the difference between the two premiums. Unlike the selling of a put or Short Put, our premium is reduced as we have a buying leg of a put in which we pay for this option.

- The wider the spread between the sold put and the bought put, the greater the premium or credit collected.

Bull Put Spread Payoff Diagram

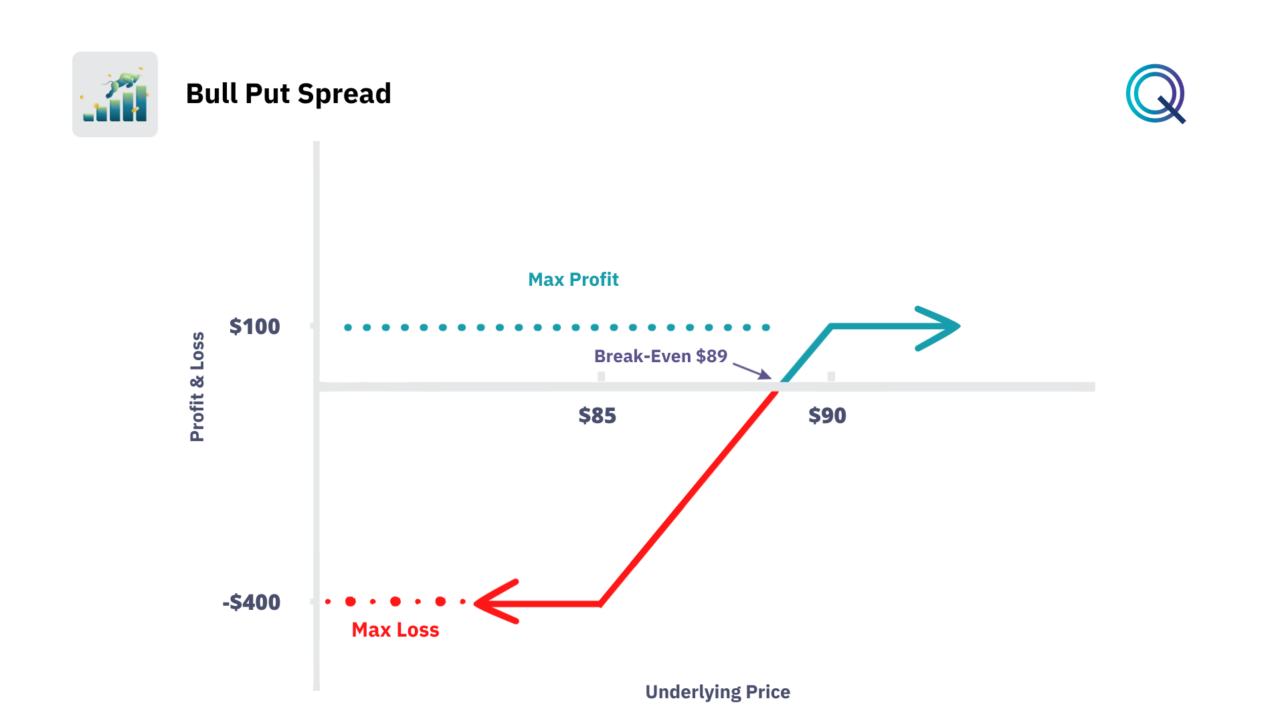

The Bull Put Spread strategy is a credit spread. The trader receives a premium when entering this structure. The Bull Put Spread has a payoff diagram with a risk and return defined from the time of purchase. Let’s look at this example.

We sell a put option with a strike at $90 and buy a put option with a strike at $85 at a net credit of $1.

- We collect in this case a credit of $1 for having a spread between the two strikes of $5. Our maximum profit in this case is represented by $100 ($1 * 100 shares).

- Our breakeven price is represented by the strike of the sold put – received premium ($89).

- The maximum loss in the case where the price of the underlying at expiration should fall is $400, which is the difference between the breakeven and the strike of the bought put: ($89 – $85) * 100 shares.

The Bull Put Spread is used to take exposure to the underlying through leverage but reducing the risk compared to the simple sale of a put.

Variables to Evaluate on the Bull Put Spread Strategy

- Optimizing the Bull Put Spread for Market Conditions. The Bull Put Spread, while bullish in nature, provides traders with a degree of protection against downside risk. It is a strategy that combines the potential for profit with a conservative risk profile, making it a favored tactic in times of uncertain market uptrends.

- Strategic Entry Points. Market entry timing is critical for the Bull Put Spread. Traders often look for signs of stabilization or modest upward trends in the underlying asset’s price before initiating the spread. The selection of strike prices is equally important, as it will determine both the risk level and the potential return.

- Capitalizing on Premiums. The strategy generates immediate income through the net premium received when the position is opened. This premium serves as the maximum profit if the underlying asset’s price stays above the higher strike price of the sold put.

- Managing the Spread. The distance between the strikes, also known as the width of the spread, is a pivotal factor. A wider spread can potentially increase the net premium received, but it also increases the maximum risk. Traders balance this spread based on their risk appetite and market analysis.

- Risk Management. A key advantage of the Bull Put Spread is its defined maximum loss, calculated as the difference between the strike prices minus the net premium received. This loss is realized if the underlying asset’s price falls below the lower strike price of the bought put.

- Breakeven and Maximum Profit. The breakeven point—where the gains from the rising asset price equal the cost of the spread—is an important threshold for traders. It allows them to set clear targets for profit-taking and to manage positions effectively to avoid potential losses.

- Implied Volatility and Time Decay. Since the Bull Put Spread involves writing options, a decrease in implied volatility after the position is opened works in favor of the strategy by devaluing the sold puts. Additionally, time decay (Theta) benefits the trader as the value of these short options declines over time.

- Position Management. Traders can adjust the Bull Put Spread in response to market movements or changes in outlook. This might involve rolling the spread to extend its duration or adjusting strike prices to reflect new market realities.

- Integration with Broader Strategies. The Bull Put Spread can be part of a diversified options strategy, working in tandem with other positions to create a balanced portfolio. For instance, it can be combined with Bull Call Spreads to form an Iron Condor, targeting profits within a specific price range of the underlying asset.

We talk about this in detail in our Academy.

How to structure a Bull Put Spread

The Put Credit Spread (PCS), also known as a Bull Put Spread, uses margin to borrow stock so you can sell it, then buy it back at a lower price in the future.

In this example the spot price of Ford (F) is at $11.46. We are selling a Put with a $11.35 strike for $0.11, reducing our costs and limiting our risk by buying the $11 strike for $0.03. We are going to receive a credit of $8 up front because we sold the $11.35 strike for more than we bought the $11 strike.

- If Ford is above $11.35 at expiration, both puts expire worthless and we keep the entire upfront credit of $8.

- If Ford is below $11 at expiration, both puts are ITM (In the Money). Transactionally, we are obligated to purchase 100 shares of Ford at $11.35. We offset this purchase by executing the 11 strike for a total cost of $0.35 per share (11 – 11.35 = – $0.35 loss).

- Our loss is partially mitigated by the original $8 credit we received when we established the position. Our maximum loss is $27 ( -$35 + $8 = -$27 ).

- We have risked $27 to potentially make $8 (29% return ). But we had zero out of pocket up front because we used margin. Our losses are limited to $27 because losses from our $11.35 Put are offset by the gains of our $11 Put. We start losing money when Ford drops below $11.27 which represents our breakeven price.

Our view on the asset for this strategy is bullish. There are several reasons why you might prefer to open a Put Credit Spread instead of a Bull Call Spread. One obvious reason is no upfront cost, but it requires a margin account.

Another potential reason is because the market historically tends to move up. This particular example requires the stock to decrease before we lose money. Yet another reason is because we’re allowing time to work in our favor. The longer Ford stays above the $11.35 strike, the more value is extracted from the position. Since we’re in a credit position, as value disappears, we are making money.

It is similar to when we sold the Covered Call with the intention of it expiring worthless. In the case of selling calls, we want the market to go down and stay away from our call strike. In the case of selling puts, we want the market to go up and stay away from our put strike.

Conclusion

The Bull Put Spread is a strategic tool for investors who seek to benefit from bullish market sentiments while keeping risks in check. It exemplifies the flexibility and sophistication of options trading, allowing for tailored strategies that match the trader’s outlook and risk tolerance.

To recap:

- The Bull Put Spread Strategy is a bullish strategy

- Our position is Short Options

- It is a Credit structure

- Our View is bullish on the underlying

- The strategy benefits from a decrease in volatility

- Time is a positive factor for this strategy

Other Bullish Strategies

Here are other Bullish strategies with Options: