Bear Put Spread

Among the bearish strategies, we find the Bear Put Spread Strategy. The Bear Put Spread is part of a series of multi-leg strategies that consist of simultaneously buying and selling options with the same expiration but different strike prices.

The Bear Put Spread is a bearish strategy that has a limited maximum profit and risk. The strategy benefits from a decline in the price of the underlying asset. The trader’s view is bearish.

- It is a strategy that involves buying a put and selling a put with a lower strike than the bought put. The option’s expiration is the same. In this case, we buy a put by paying the premium and sell a put with a lower strike to reduce the cost of the premium of the bought put.

- This is a debit strategy as we pay the difference between the two premiums. Unlike the purchase of a put or the Long Put strategy, our cost is reduced as we have a selling leg of a put in which we receive a premium.

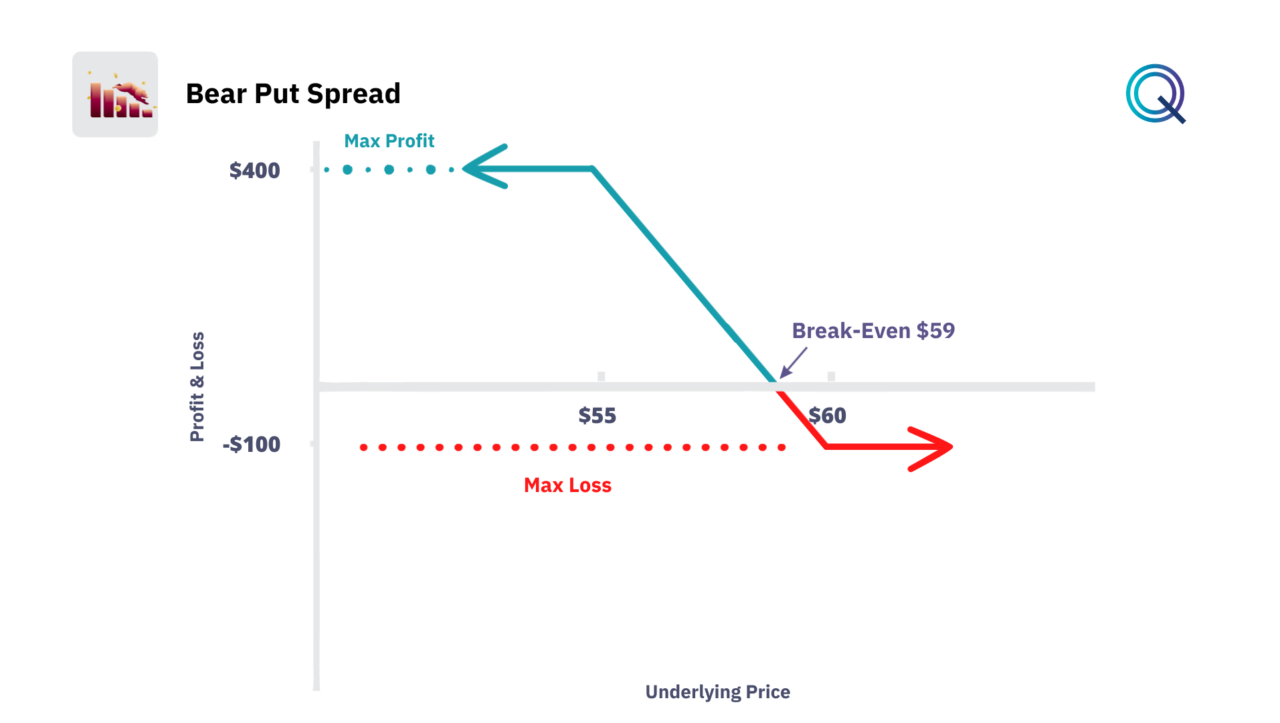

Bear Put Spread Payoff Diagram

The Bear Put Spread strategy is a debit spread. The Bear Put Spread has a payoff diagram with a risk and return defined from the time of purchase. Let’s look at this example.

We buy a put option with a strike at $60 and sell a put option with a strike at $55 for a net debit of $1. We receive a credit for the sale of the put and pay a premium for the purchase of the put with the higher strike.

- Our maximum loss is represented by the cost of the debit or the difference between the cost incurred and the premium received. In this case, it is $100 ($1 * 100 shares).

- Our breakeven price is represented by the strike of the bought put – the premium paid ($59).

- Unlike the Long Put strategy, our maximum profit is limited and is represented by the difference between the breakeven and the strike of the sold put: ($59 – $55) * 100 shares. The maximum profit of this strategy is therefore $400.

The Bear Put Spread is used to take exposure to the underlying through leverage, but reducing the cost of the strategy compared to simply buying a Put.

Variables to evaluate on the Bear Put Spread Strategy

The Bear Put Spread strategy provides a strategic avenue for traders who anticipate a bearish movement in the underlying asset, allowing for profit in a declining market while maintaining clearly defined risk parameters. There are a few factors to consider:

- Structure of the Bear Put Spread. Traders who utilize the Bear Put Spread buy a higher strike put, which costs more due to its intrinsic value, and sell a lower strike put, receiving a premium that offsets the total cost. This creates a net debit investment, with the premium from the sold put reducing the overall expense of the strategy.

- Maximizing Gains and Limiting Losses. The maximum gain in a Bear Put Spread is capped at the difference between the two strike prices minus the net debit paid. This gain is realized if the price of the underlying asset falls below the lower strike price at expiration. The maximum loss is limited to the initial debit paid, making it a more conservative strategy than a Long Put.

- Strategic Breakeven Point. The breakeven point is important in this strategy, as it represents the price the underlying asset must reach by expiration for the trade to begin profiting, after accounting for the cost of the spread. Calculating the breakeven point helps traders manage their positions and set clear targets for potential exit strategies.

- Implied Volatility. Implied volatility impacts the Bear Put Spread significantly; an increase in volatility can increase the value of the long put in the spread, potentially leading to higher profits if the trader decides to close the position early. Therefore, entering a Bear Put Spread when volatility is expected to rise can be advantageous.

- Time Decay. While time decay (Theta) generally works against long option positions by eroding the option’s time value, in the Bear Put Spread, the effect of Theta on the sold put can offset the time decay on the long put to some extent. This makes the strategy less susceptible to time decay than a simple Long Put position.

- Dynamic Strategy Adjustments. Traders have the flexibility to adjust their Bear Put Spreads in response to market movements. If the underlying asset’s price moves in the other direction, the trader can roll down the long put or roll out the entire spread to a longer duration to manage risk or salvage the position.

- Comparative to Other Bearish Strategies. Compared to other bearish strategies like the Long Put or the Bear Call Spread, the Bear Put Spread strikes a balance between risk and reward, making it a preferred strategy for traders who are moderately bearish and risk-averse.

We talk about this in detail in our Academy.

Conclusion

The Bear Put Spread is a sophisticated strategy that blends the potential for profit in a declining market together with risk management.

To recap:

- The Bear Put Spread Strategy is a bearish strategy

- Our position is Long Options

- It is a Debit structure

- Our View is bearish on the underlying

- The strategy benefits from an increase in volatility

- Time is a negative factor for this strategy

Other Bearish Strategies

Here are other bearish strategies with Options: