Long Straddle

Among the “market neutral” strategies, we find the Long Straddle. These are non-directional strategies where the trader does not know which direction the price may go. The trader can profit if the price moves in either direction.

- The Long Straddle strategy involves buying a call option and a put option with the same strike and the same expiration date. This strategy seeks to take advantage of an increase in the volatility of the underlying.

- This strategy requires a strong movement of the underlying to bring profits by expiration.

- Many traders use this strategy in proximity to a macro event or a catalyst. For example, the release of central bank statements such as monetary policies on interest rates or the release of quarterly results can be events that increase the volatility of the underlying.

This strategy requires the trader to pay two premiums: Long Call and Long Put.

It can lead to high losses if the underlying does not move and volatility does not increase.

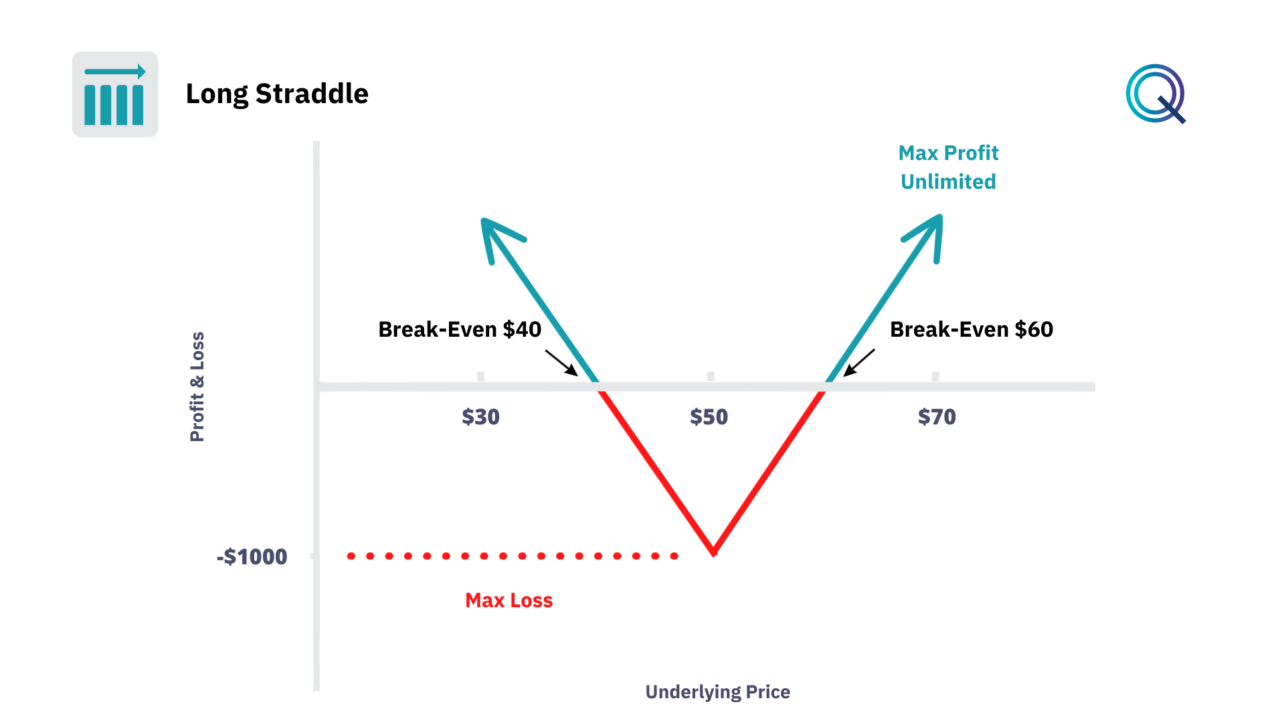

Payoff Diagram of the Long Straddle

Let’s look at the payoff of the Long Straddle Strategy. In this example, we buy a call with a $50 strike and a put with a $50 strike at a cost of $10.

- Our maximum loss is $1000 ($10 * 100 shares), which is the sum of the two premiums paid.

- The potential profit of the strategy in this case is unlimited. The breakeven is represented by the strike +- the cost of the premium which is $10.

The underlying must move at least $10 in one direction or the other for the strategy to start seeing profits.

- If at expiration the price of the underlying is below $40, the trader profits on the put side.

- If at expiration the price of the underlying is above $60, the trader profits on the call side.

Variables to Evaluate on the Long Straddle Strategy

It is important to understand the factors that could impact the Long Straddle Strategy.

- High Impact Events. Traders often use Long Straddles ahead of earnings reports, FDA announcements for pharmaceuticals, or regulatory changes that could lead to significant price movements.

- Low Volatility. Entering a Long Straddle when options are relatively cheap, often during periods of low volatility, can bring profit opportunities. This is because any unforeseen increase in volatility can increase the value of both options. During low volatility the cost of our premium will be lower.

- Time Decay. Since time decay (Theta) can erode the value of options, traders may choose to enter the trade closer to the event that’s expected to cause volatility, minimizing the time for Theta to have a negative effect.

- Profit Taking and Loss Management. Establishing predetermined levels for taking profits or cutting losses can help traders avoid emotional decision-making. This strategy can lead to great losses if the underlying price does not move.

- Volatility Skew. The skew between the implied volatility of call options and put options can affect the pricing of a Long Straddle. Traders must be aware of this skew as it can impact the potential profitability of the strategy.

- Delta Hedging. Traders may use delta hedging to make the position delta-neutral, protecting against small price movements in the underlying asset.

- Gamma Scalping. This involves adjusting the delta of the straddle by buying or selling shares of the underlying asset to capitalize on movements, a technique known as gamma scalping.

- Straddle to Strangle Roll. If a significant move doesn’t occur and time decay is affecting the position, traders might roll into a Long Strangle by selling the at-the-money options and buying options further out of the money, reducing the cost of the position and potential time decay.

- Break-Even Analysis. It’s crucial to calculate the break-even points and determine the necessary movement in the underlying asset to achieve profitability, taking into account the cost of premiums paid.

We discuss this in detail in the Academy.

Conclusion

To recap:

- The Long Straddle Strategy is a Market Neutral strategy.

- Our position is Long Options.

- It is a Debit structure.

- The strategy benefits from an increase in volatility.

- Time is a negative factor for this strategy.

Other Market Neutral Strategies

Here are other neutral strategies with Options: