Short Straddle

Among the “market neutral” strategies, we find the Short Straddle Strategy. The Short Straddle strategy involves selling a call option and a put option with the same strike and the same expiration date.

- This strategy seeks to take advantage of low volatility of the underlying asset and the passage of time.

- The Short Straddle is a credit strategy with unlimited risk.

- This strategy profits if the price of the underlying asset moves little.

The trader receives two premiums: Short Call and Short Put.

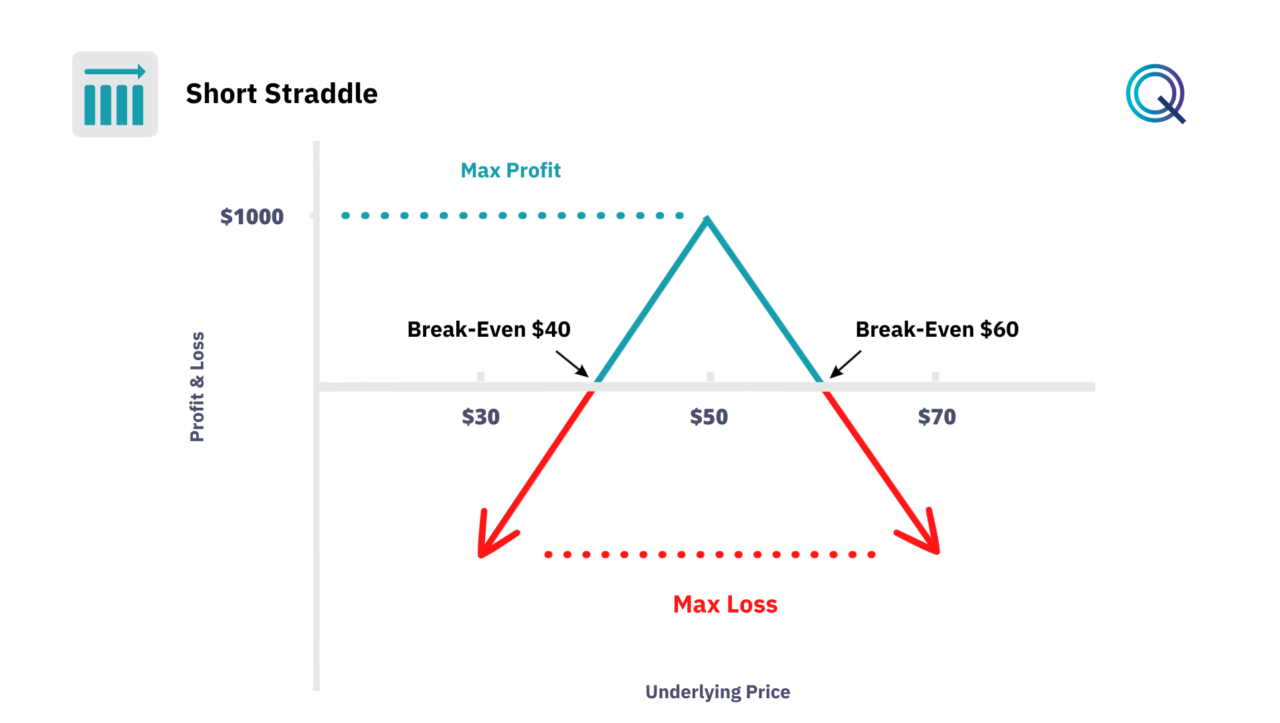

Payoff Diagram of the Short Straddle

Let’s look at the payoff of the Short Straddle Strategy. In this example, we sell a call with a $50 strike and a put with a $50 strike, collecting a premium of $10.

- Our maximum profit is $1000 ($10 * 100 shares), which is the sum of the two premiums received.

- The potential risk of the strategy in this case is unlimited.

- The breakeven price is represented by the strike +- the premium collected, which is $10. In this case, the breakeven points are $40 and $60. The price of the underlying must stay within this range for this strategy to be profitable.

Variables to evaluate on the Short Straddle Strategy

To understand the Short Straddle strategy, it’s important to consider the different factors:

- Stable Market Conditions. The Short Straddle is most effective in stable market conditions where significant price movements are not expected. It is particularly useful when the market is awaiting news that may not have as big an impact as anticipated, leading to a decrease in implied volatility post-event.

- High Premium. Engaging in Short Straddles can be beneficial when option premiums are high due to elevated implied volatility, allowing the seller to collect larger premiums upfront.

- Active Position Management. Due to the unlimited risk profile, it is important for the trader to actively manage the position. This might involve setting stop-loss orders or adjusting the position if the market starts to move against the trade.

- Hedging. Traders may hedge Short Straddle positions with other options or futures contracts to limit downside risk. This, however, may reduce the net credit received.

- Rolling the Straddle. If the underlying asset begins to move towards either strike, the trader may ‘roll’ the straddle to different strikes or expiration dates to collect more premium and maintain a market-neutral stance.

- Assignment Risk. There is always a risk of early assignment, especially if the underlying moves close to the strike price of the call or put.

- Interest Rate Changes. Variations in interest rates can affect option prices, which in turn can influence the outcomes of a Short Straddle strategy.

- Volatility Skew and Smile. Understanding how volatility skew and smile affect the pricing of options can be critical in choosing the right strikes for a Short Straddle.

- Option Greeks. Aside from just Theta and Vega, monitoring Delta and Gamma can provide insights into the risk profile of the position as the market moves.

We discuss this in detail in our Academy.

Conclusion

Incorporating the Short Straddle strategy within a diversified trading portfolio requires a balance of vigilance and strategic agility. Traders must remain attuned to market sentiment, earnings calendars, and geopolitical events that could spur volatility, potentially disrupting the expected stability essential for this strategy’s success.

Additionally, integrating risk mitigation techniques, such as using protective stops or diversifying with other options strategies, can help manage the unlimited risk exposure inherent in Short Straddles.

To recap:

- The Short Straddle Strategy is a Market Neutral strategy.

- Our position is Short Options.

- It is a Credit structure.

- The potential risk is unlimited.

- The strategy benefits from a decrease in volatility.

- Time is a positive factor for this strategy.

Other Market Neutral Strategies

Here are other neutral strategies with Options: