Short Strangle

Among the “Market Neutral” strategies, we find the Short Strangle Strategy. The Short Strangle strategy is part of a series of advanced options strategies. It is a neutral or Market Neutral strategy.

- The Short Strangle strategy involves selling an out-of-the-money call option and selling an out-of-the-money put option with the same expiration date. This strategy seeks to take advantage of the low volatility of the underlying asset and the passage of time.

- The Short Strangle is a credit strategy with unlimited risk. It is very similar to the Short Straddle strategy but with some differences. For example, the premium received from this strategy is lower than that of the straddle because the strikes of the strangle are out of the money.

- This strategy profits if the price of the underlying asset doesn’t move or stays within a range. The trader receives two premiums: Short Call and Short Put.

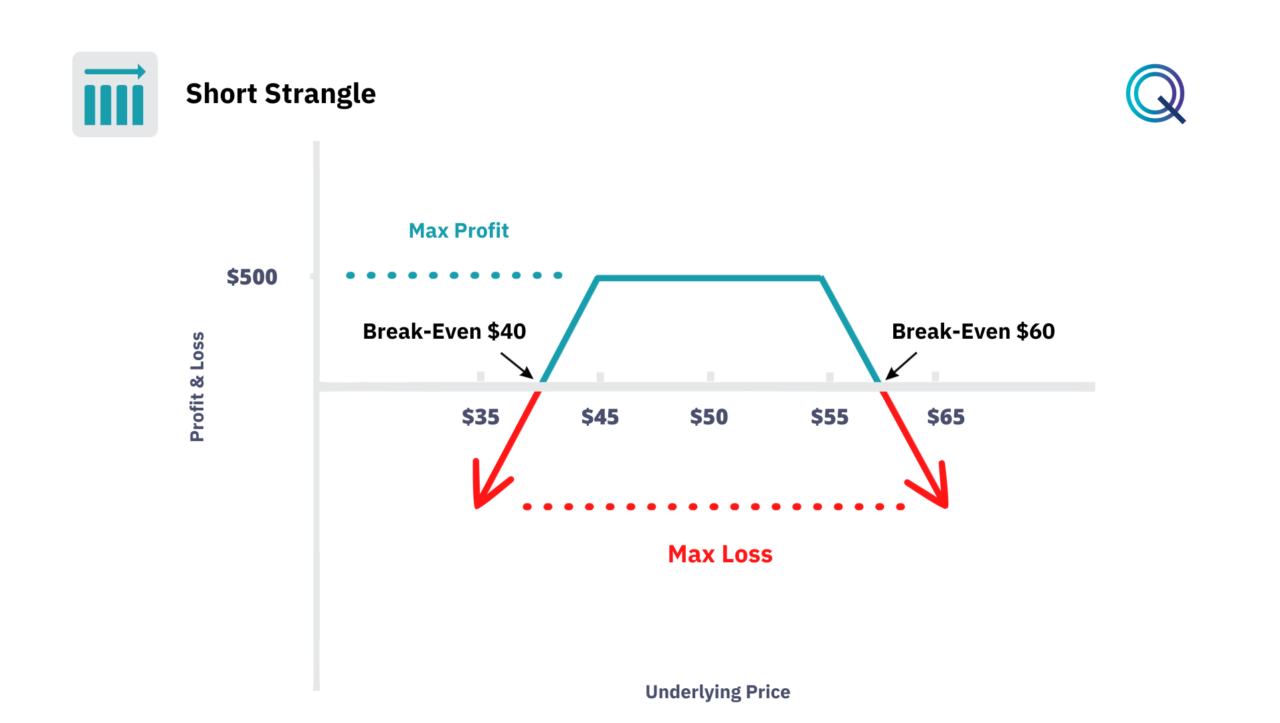

Payoff Diagram of the Short Strangle

Let’s look at the payoff of the Short Strangle Strategy. In this example, the stock is quoting at $50, and we sell a call with a $55 strike and a put with a $45 strike, collecting a premium of $5.

- Our maximum profit is $500 ($5 * 100 shares), which is the sum of the two premiums received.

- The potential risk of the strategy is unlimited below the breakeven.

The breakeven price is represented by the strike +- the premium collected, which is $5. In this case, the breakeven points are $40 and $60. The price of the underlying must stay within this range for this strategy to be profitable.

Variables to evaluate on the Short Strangle Strategy

In this strategy, we are short on two options. When we are short options, we must therefore evaluate the impact of the following variables:

- Risk Management. Given the unlimited risk potential, it’s essential to set strict risk management protocols, including predetermined points for exiting the trade to minimize losses.

- Market Analysis. Traders should conduct a thorough analysis of the underlying asset to ensure it’s not expected to make significant moves. This involves understanding the asset’s historical volatility and any upcoming events that could affect its price.

- Profit Maximization. Monitoring market conditions closely allows traders to potentially buy back the options at a lower price to lock in profits before expiration, especially if the underlying asset remains within a favorable price range.

- Strategic Rolling. If one side of the strangle becomes threatened (i.e., the underlying asset’s price is moving towards one of the strikes), the position can be rolled. This involves buying back the threatened option and selling another with a further out-of-the-money strike or a later expiration.

- Diversification. Using a Short Strangle as part of a diversified options strategy portfolio can spread risk. For instance, incorporating strangles with different underlying assets or combining them with strategies like Iron Condors can create a more robust market-neutral position.

- Economic Indicators. Keep abreast of economic indicators and news releases that could unexpectedly increase volatility and impact the underlying asset’s price.

- Earnings Season. During earnings season, the strategy should be employed with caution as unexpected results can lead to significant price movements, increasing the risk of loss.

- Interest Rates. Changes in interest rates can affect market volatility and the pricing of options, which should be factored into the strategy’s risk assessment.

- Pairing with Directional Strategies. Sometimes, pairing a Short Strangle with a directional strategy in a different underlying asset can balance out the overall portfolio risk.

Conclusion

To recap:

- The Short Strangle Strategy is a Market Neutral strategy.

- Our position is Short Options.

- It is a Credit structure.

- The potential risk is unlimited.

- The strategy benefits from a decrease in volatility.

- Time is a positive factor for this strategy.

Other Market Neutral Strategies

Here are other neutral strategies with Options: