Reverse Iron Condor

Among the “Market Neutral” strategies, we find the Reverse Iron Condor. The Reverse Iron Condor strategy is part of a series of advanced options strategies. It is a neutral or Market Neutral strategy.

- This type of strategy aims to generate returns from an increase in volatility.

- It is a strategy similar to the Long Strangle but with the addition of two selling legs of out-of-the-money options to decrease the cost of the strategy.

It is a strategy similar to the Iron Condor, but inverted.

How to set up a Reverse Iron Condor

A Reverse Iron Condor can be created by executing trades for the purchase and sale of out-of-the-money options.

For example, if a stock is quoting at $50, we can create a reverse iron condor in this way:

- Short Put with a $40 strike

- Long Put with a $45 strike

- Long Call with a $55 strike

- Short Call with a $60 strike

The idea behind this strategy is the purchase of two options with strikes closer to the current price and the sale of two options with strikes further away to reduce the cost of the strategy by collecting these two premiums.

- It is a debit strategy as we pay a premium, which is represented by the difference between the premiums paid for the purchase of options and those collected for the sale.

- The trader has the flexibility to choose the distance of the strike prices from the current price. The wider the spread between the strikes of the long positions and the short ones, the higher the premium paid.

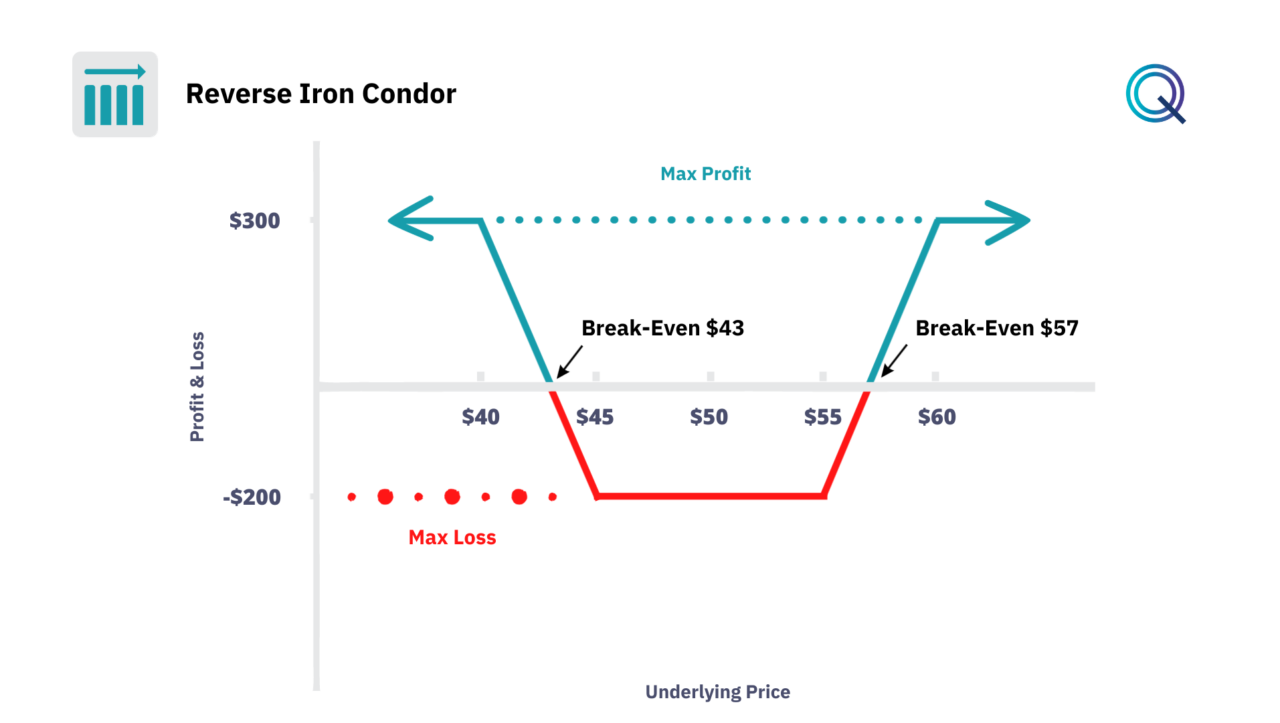

Payoff Diagram of the Reverse Iron Condor

Let’s look at the payoff of the Reverse Iron Condor Strategy. In this example, the stock is quoting at $50, and we execute four trades: we buy a put with a $45 strike and sell one with a $40 strike. On the other side, we buy a call with a $55 strike and sell one with a $60 strike. Let’s assume our cost (the difference between the premiums collected and those paid) is $2.

We have a defined risk and return.

- The maximum loss is represented by the cost of the premium paid. In this case, $200, which is $2*100 shares.

- The breakeven prices are calculated by adding and subtracting the premium paid from the strikes of the long positions or purchase. In this example, $43 and $57, which are $2 below the strike of the purchased put and $2 above the strike of the purchased call.

- The maximum profit is $300, which is the difference between the break-even prices and the strikes of the sold options.

Variables to evaluate on the Reverse Iron Condor Strategy

In this strategy, we are long options. When we are long options, we must therefore evaluate the impact of the following variables:

- Strategic Positioning. Traders often use the Reverse Iron Condor in anticipation of specific events that are likely to cause significant price swings, such as product launches, earnings reports, or regulatory announcements.

- Volatility. A sudden increase in implied volatility could be a favorable condition for entering this strategy.

- Selection of Strikes. Choosing the right strikes is key. The strikes of the sold options should be sufficiently out-of-the-money to reduce the risk of assignment while still collecting adequate premiums.

- Risk Management. Given the strategy involves both long and short options positions, it’s essential to manage risk by determining maximum acceptable losses and setting up stop-loss orders accordingly.

- Monitoring the Greeks. Keeping a close eye on the Greeks, especially Delta and Vega, can give insights into how market movements and volatility changes are impacting the position.

- Responsive Adjustments. If the market moves against the position, traders may need to adjust the strikes or even the expiration dates of the options involved.

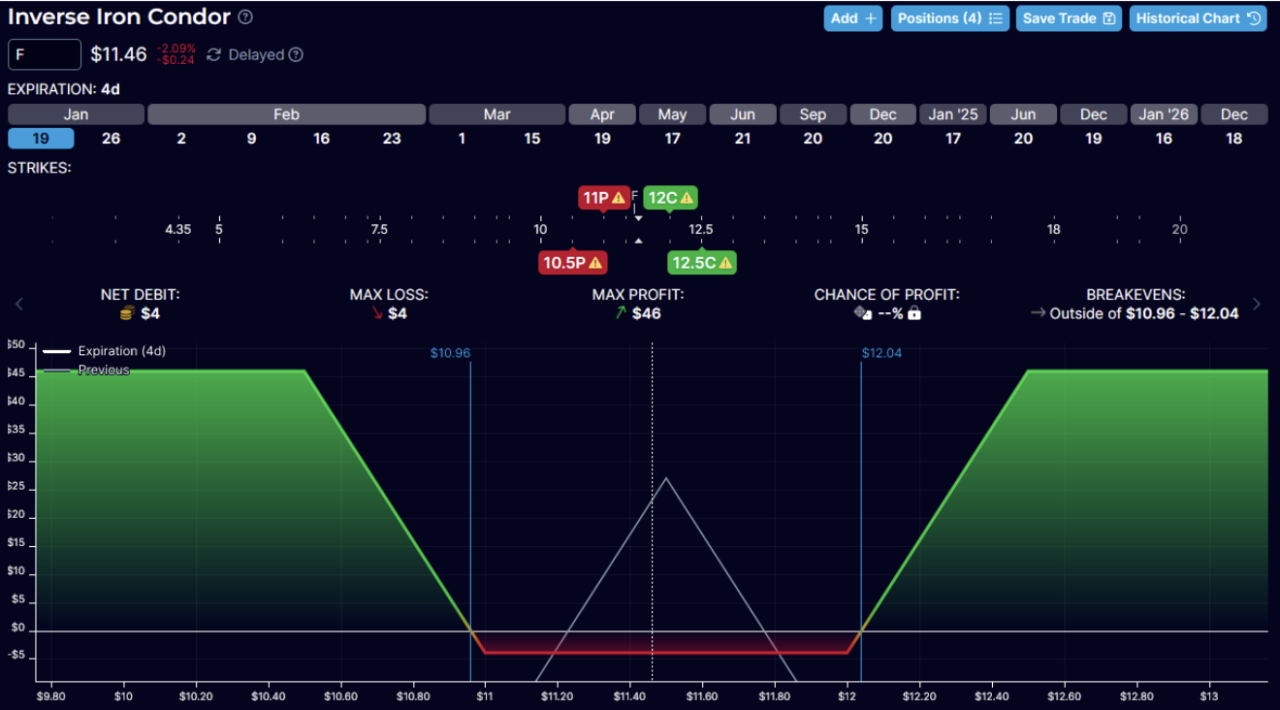

How to structure a Reverse Iron Condor

While the Iron Condor Strategy benefits from low volatility and the price ending up within a defined range, with the Reverse Iron Condor we benefit if the price moves. This strategy makes money when the market moves in any direction. You lose money if the market trades in a range, or if it doesn’t trade far enough outside of the range you select. Let’s take a quick look at an example of this position.

In this particular example we buy a put with a strike of $11 and we sell a put with a $10.5 strike and buy a call with a $12 strike and sell a call with a $12.5 strike. The cost of our premium is $4. Because it is not a very likely outcome, we are only risking $4 to make a potential profit of $46. Our breakeven prices are $10.96 and $12.04. Anything lower or higher and we are making money.

Conclusion

To recap:

- The Reverse Iron Condor Strategy is a Market Neutral strategy.

- Our position is Long Options.

- It is a Debit structure.

- The strategy benefits from an increase in volatility.

- Time is a negative factor for this strategy.

Other Market Neutral Strategies

Here are other neutral strategies with Options: