Reverse Butterfly

Among the “Market Neutral” strategies, we find the Reverse Butterfly.

This type of strategy aims to generate returns from an increase in volatility. It is similar to the Long Straddle but adds two selling legs of out-of-the-money options to reduce the cost of the strategy.

It is similar to the Iron Butterfly strategy, but reversed.

- This strategy involves buying an at-the-money call and put with the same strike, and selling an out-of-the-money call and put with the same expiration date, comprising four contracts.

- Selling out-of-the-money calls and puts allows the trader to collect premiums to decrease the strategy’s cost.

How to set up a Reverse Butterfly

A Reverse Butterfly can be set up by executing trades to buy at-the-money options and sell out-of-the-money options. For example, for a stock quoting at $50, we can create a reverse butterfly in this way:

- Long Put with a $50 strike

- Long Call with a $50 strike

- Short Call with a $60 strike

- Short Put with a $40 strike

The concept of this strategy is to buy two options with at-the-money strikes to benefit from volatility and sell two options with farther strikes to collect the premium and reduce the cost of the strategy.

- It is a debit strategy as we pay a premium represented by the difference between the premiums paid for buying the at-the-money options and those received from selling the out-of-the-money options.

- The trader has the flexibility to choose the distance of the strike prices from the quoting price.

- The wider the spread between the strikes of the long positions and the short ones, the higher the premium paid.

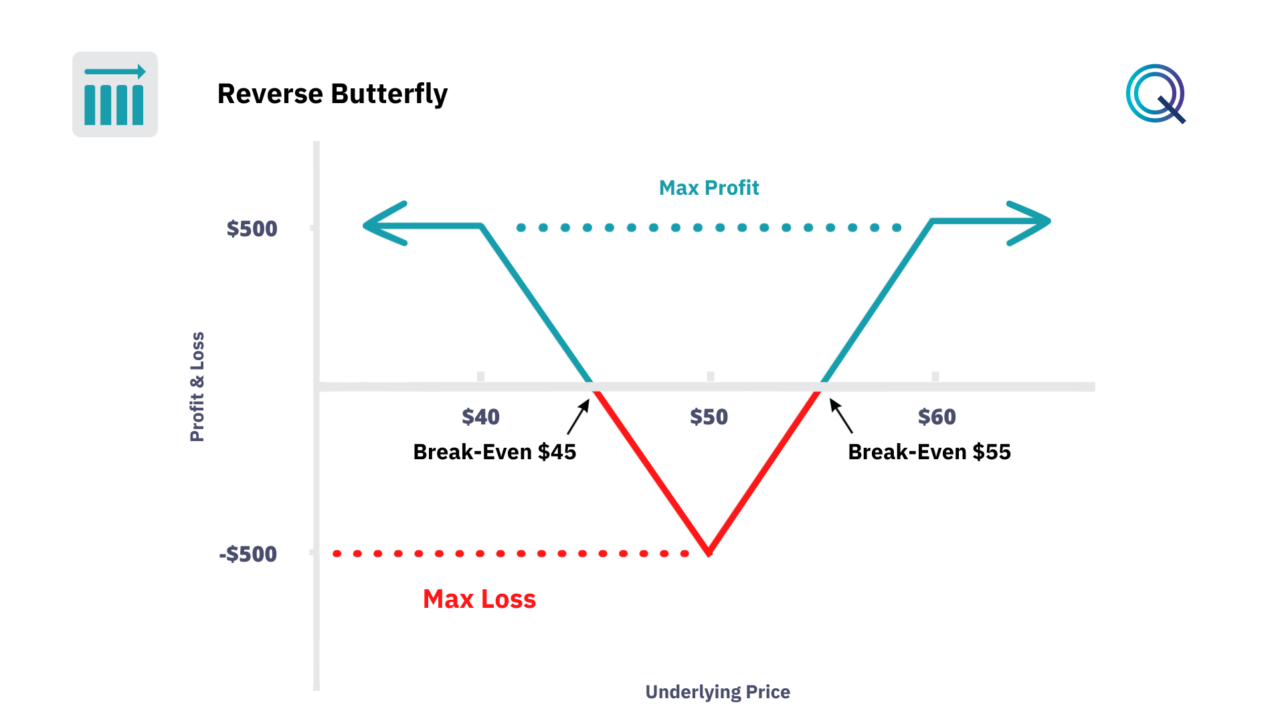

Payoff Diagram of the Reverse Butterfly

Let’s examine the payoff of the Reverse Butterfly Strategy. In this example, the stock is quoting at $50, and we execute four trades: we buy a call and a put with a $50 strike and sell a call with a $60 strike and a put with a $40 strike. Let’s assume our cost (the difference between the premiums paid and collected) is $5. We have a defined risk and return.

- The maximum loss is represented by the cost of the premium paid. In this case, $500, which is $5 * 100 shares.

- The breakeven prices are calculated by adding and subtracting the premium paid from the strikes of the long positions or purchase. In this example, $45 and $55, which are $5 below the strike of the purchased put and $5 above the strike of the purchased call.

- The maximum profit is $500, which is the difference between the break-even prices and the strikes of the sold options.

Variables to evaluate on the Reverse Butterfly Strategy

In this strategy, we are long options. When we are long options, we must therefore assess the impact of the following variables:

- Events. The Reverse Butterfly is particularly suited to capitalize on events that are expected to cause significant market movements, such as FDA decisions for healthcare stocks, tech product launches, or pivotal legal decisions.

- Adjusting for Market Conditions. Traders should be ready to adjust their strategies in response to changing market conditions. If volatility increases more than expected, it may be advantageous to close out the position early to capture profits.

- Defining Risk. Given the debit nature of the strategy, it’s critical for traders to define their risk tolerance clearly and to establish stop-loss levels to prevent significant losses.

- Implied Volatility. If implied volatility increases, this will positively impact the strategy as the premium will tend to rise. This strategy benefits from an increase in volatility.

- Time Decay. The Theta factor is negative for this strategy because it decreases the value of the option premiums.

Rolling. Once we have entered a position, we can at any time close or modify our strategy. For example, we can close one leg of the position and open another with a different strike based on the price movement, or we can roll the entire strategy.

Conclusion

To recap:

- The Reverse Butterfly Strategy is a Market Neutral strategy.

- Our position is Long Options.

- It is a Debit structure.

- The strategy benefits from an increase in volatility.

- Time is a negative factor for this strategy.

Other Market Neutral Strategies

Here are other neutral strategies with Options: