How to Trade and Risk manage an Iron Condor

As we analyze data, and look at the Q-Models, we want to find ways to trade them, but also figure out how they can help us risk manage our position. Because you can enter a position, but you have to be able to risk manage it and know how to exit it.

Following what we had said in last week’s newsletter, before rolling out a new complex model, our aim at this point is to make sure you understand the data we are giving you, and give you practical examples to help you implement your trading views.

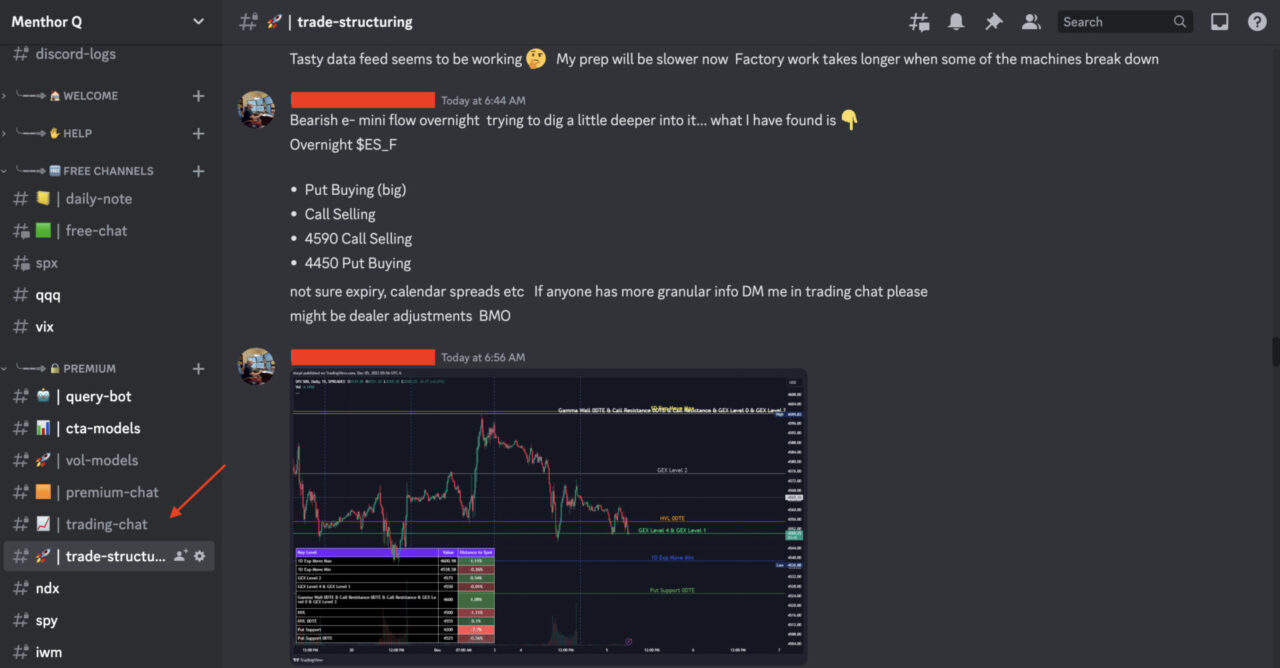

In this case study we look at how to manage an Iron Condor and still remain profitable during a downturn. In our Trade Structuring Channel within the premium membership, we start the morning with our traders actively discussing their research before the market opens.

The goal of the channel is to have our traders show you how to dig out the important data from our models. After the data is filtered and analyzed, then the discussion starts around the best trades.

If you want to Join our Premium Community sign up for Premium.

We have copied and pasted their discussion, this way you can see what you should be focusing on every morning.

Key Levels

First let’s look at the Levels on SPX for the day.

Today’s trade was a tricky one due to data coming after the market opened, so we want to break it down step by step. The strategy is an Iron Condor. You can find more information on the strategy in another article within our guides.

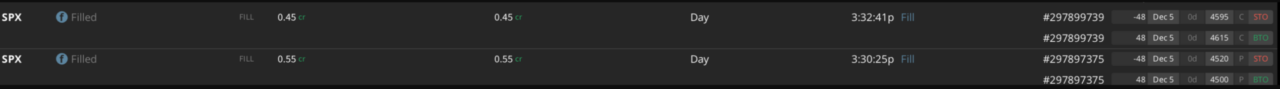

Our choice was to sell a Call Put Spreads (CPS) with the strikes of 4520/4500 and a Call Credit Spreads (CCS) with the strikes of 4595/4615.

The fill at market open was 55 cents for the Put Spread, and 45 cents for the Call Spread. Before Market Open (BMO) Gamma Levels showed not much action below 0DTE Put Support Level, which made this the easier sell.

The problem was always the Call Credit Spread – as we are in positive gamma and near support (1D min, 0DTE put support etc.), and we feared a potential pull back. The logic here is that if there isn’t an excessive amount of gamma, one would expect consolidation throughout the day, and this was supportive for the Put Spread.

Another issue: We had 2 sets of important data releases which were sure to rattle the market one way or another, 9:45 AM EST and 10:00 AM EST, respectively. This brings volatility, which is not ideal for Iron Condors, unless you are very far Out of the Money, targeting permitting (meaning that if one side hurts, the other benefits until theta slowly eats both sides and the seller profits). It is important to always look for Economic Events that could bring volatility to the market.

Market Open

As soon as the market opened, we got filled and got a push up and our Put Spread was doing great. We then immediately, per our rules, set an order to Buy to Close (BTC) our orders at 15 cents (this is not a hard rule; it depends on what market is doing etc.).

Note: we sold at 45 cents and closed at 15 cents collecting ~70% of the premium.

Then, when economic data came out, the market liked it and pushed up. We got filled on our puts at 15 cents and got out of one side of the trade, we closed the Put Credit Spread.

What about the Call Credit Spread?

What do we do to manage risk at this point?

We look at targeting intraday. We saw that the biggest volumes were likely buyers at the 4580 strike. When the price reached the next GEX level, we decided to manage risk.

Remember we were short a call at 4595 which meant that if price would have reached that level, we would have suffered losses. In this case we could have stuck to our guns and waited to see what would have happened, but in general we prefer to keep a tight risk management by keeping a close eye to volume changes. (Intraday data will be available shortly to all our users, this means you will be able to update intraday our models for better risk management).

Another thing we did see was buying pressure on big MAG 7 stocks like TSLA, AAPL, etc., which were very bullish for the market in general, so we deducted that there would be additional pressure on our sold call strike. Further confirming our view that tightening up our risk management was right.

Now, keep in mind, by then we had profits on the closed put spread, which was booked. So we were already green on the day. As a measure of safety, we decided to close everything there and, what do you know, market dumped almost immediately after, respecting our initial analysis of 4580 being the intraday target, which means we could have sat there, waited for the dump, and close the call spread at a nice profit.

Mistakes and insights. Do’s and Don’ts

- Remember economic data releases bring news volatility, which is stressful for market-neutral starts such as Iron Condor (IC). If at all possible, maybe fill after?

- Good news: most data is released normally at 8:30 AM, before we fill our trades, which gives us time to recalibrate our ranges.

- Stick to your plan. The 4580 strike held like a champ, like targeting showed, and was the high of the day.

- Don’t marry your positions. You see something you don’t like, get out. Market’s here tomorrow to play again, but you won’t if you get annihilated on a 0DTE trade. Trading is being flexible and showing up for work the next day! And we were green over all on the original IC, so still a green day!

If you want to access our daily insights join our Premium Membership.