How to trade using Call Resistance Level

Last Friday, following the Non Farm Payroll data (NFP) we saw an interesting price movement in the market (SPX Index). In the last few weeks we have seen consolidation around Menthor Q’s Key Levels.

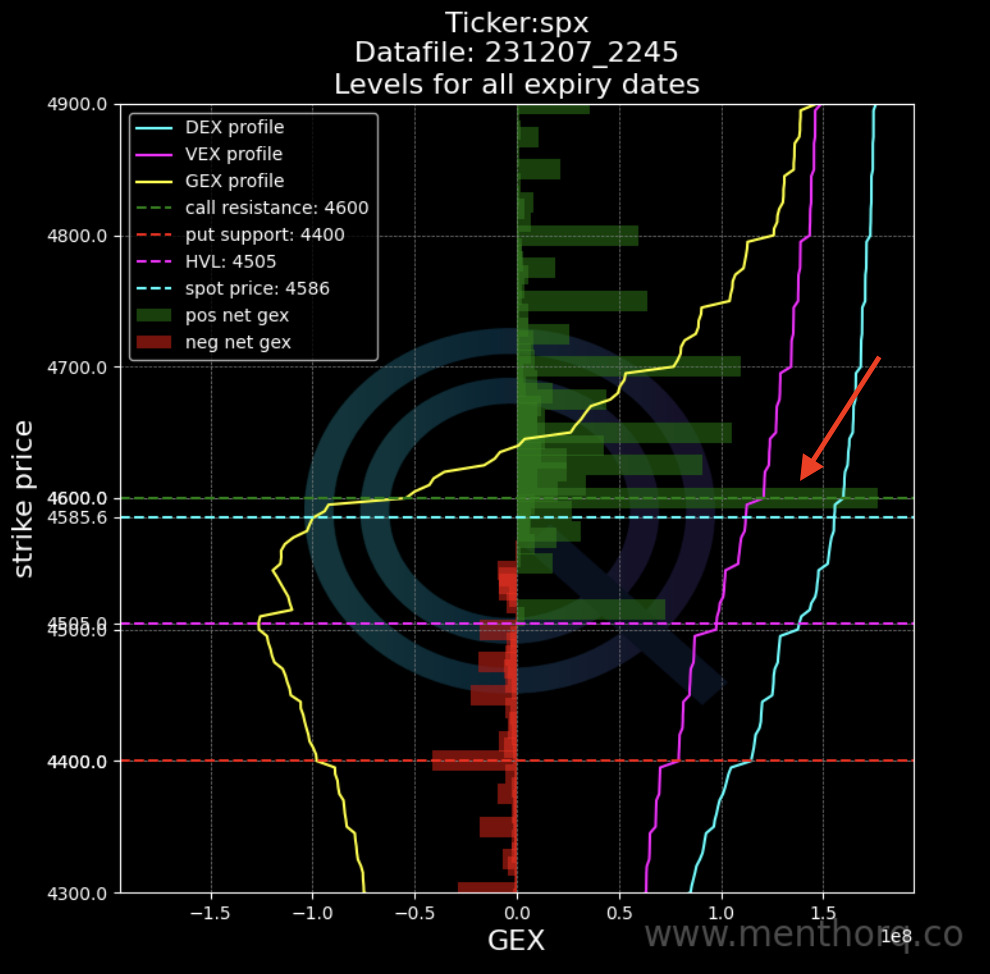

One of the most important strike prices had become and still is (at the time of writing this article) 4600. That strike price at open on Friday as per our models was also the Call Resistance Level. The Call Resistance level, like the Put Support level, is one of the key levels in our models. This is the price level where there is more Call GEX. This is the level that our model projects as a potential level for:

- A resistance where the price bounces back down. Just like in the case of the Put Support level where prices find support, in the case of the Call Resistance the price find a resistance that has the potential to slow down price breakout.

- An inflection point for an accelerated upside.

We have an article dedicated to the Call Resistance Level.

Pre Market Action

Before the market opened, as we had discussed in our Trade Structuring channel, we knew we expected NFP Data to be released one hour before the market opened at 8:30 EST. What we do know, that ranges have a higher tendency to be breached on news and event days. We also wrote a thread on X about this.

The SPX 1 Day Max range in the morning was wider than usual. That is typical on days where we have major events like NFP. You could have seen the 1D Max range in two ways. Download our script in TradingView or use the Query bot to download the main chart. Either way this was the max range before job data.

ATM straddle pricing was 32 point move + or -, in line with the 1D expected move. Read more about our 1D Expected Move indicator here.

Just before the release of the job data, futures were up 1% pre-market. Note, before big data, generally, we believe that it is better to stay out of the market and assess. If you place your bets before big data releases, ensure appropriate and tight risk management.

Non Farm Payroll Data 8.30 EST

Job data came in stronger than the market expected. We saw the market move right to the first GEX level 1, which acted as the first support level.

What is the GEX Level 1?

This is one of our secondary GEX Levels. The secondary levels are more dynamic and can be used for intraday trading and price discovery. These levels are taken out of our Net GEX Chart, and are the stickiest gamma levels after the primary levels. You can read more about the 0 to 10 GEX levels here.

How could we have used our levels to place trades? Let’s look at a hypothetical case.

First trade 9.30 EST: Put Spread

As we touched the first GEX level 1, being an important support level we could have started thinking about placing our first trade. Those that follow us know that we like to think about risk management first, so spreading tends to be the best option because it allows you to cap your worst case scenario.

In this case, if we expected the price to bounce off, we could have sold a Put spread as follows:

- Sell a Put at around the 1D Expected Move (between 4550 to 4555)

- Buy a Put at around the Put Support 0DTE level (between 4540 to 4535)

- Through this strategy you would have taken approximately $1K in risk to try to pocket approximately 50 to 70 cents or $50 to $70 per contract.

- How wide you place the strikes of your spread really depends on your risk profile.

Price Action at 10 AM EST: Call Resistance Level

In this example, the price action worked out for our sold Put Spread as we bounced off right to the Call Resistance Level (4600 strike). As that happened our Put Spread would have got in the money and we could have monetized and closed the position at a profit.

As we touched this new resistance level these were some of the assessments we could have made, if we want to continue to trade during the day.

This new resistance level was a sticky level and coincided with the Call Resistance Level of 4600, the level that in the last few weeks had been consolidating. We could have used the Net GEX Chart for confirmation. You can find it in the Query Bot using this command /netgex.

The other thing that we should have noticed was that this level was a convergence of different levels including 0DTE Call Resistance, GEX level 0, Gamma Wall 0DTE and GEX Level too. Emphasizing once more that this was a very strong resistance level.

Note, we could have also used our Momentum indicator to confirm the stickiness of that level. Read here about our Momentum indicator.

At this point, we could have re-entered the market with a new trade.

Second trade 10 EST: Call Spread

At this point, if we thought that this resistance level would have not been broken, we could have sold a Call Spread using the levels as follows:

- Sell a Call at around the 1D Max Expected Move (between 4617 to 4620)

- Buy a Call at around 10 or 15 points above the 1D Max Expected move (between 4530 to 4535)

- How wide you place the strikes of your spread really depends on your risk profile.

The spread would have made money if the resistance level worked at such and price moved the opposite way, which is what happens in this case.

To conclude, this is a backward looking example, and makes it all easier. But the case study was just to give you an example of how you can think about using key levels for your trading and risk management.

While things don’t always work the same in the markets, the levels can help you filter some of the noise. We have also created two case studies around risk managing iron condors that you can find at these links:

Every day these strategies and set ups are discussed within our Premium Membership.