The Menthor Q High Vol Level

The High Vol Level (HVL) is one of the Key Levels that you can find in our Free Daily Report on SPX, QQQ and VIX. You can access the High Vol Level on Stocks, Indices and ETFs also via our Premium Membership via Discord.

We feel there is a bit of confusion around what this level actually represents. In simple terms, this is the point at which the slope of the cumulative GEX curve changes. Let’s break it down to visualize. Here we can see the Gamma Regime:

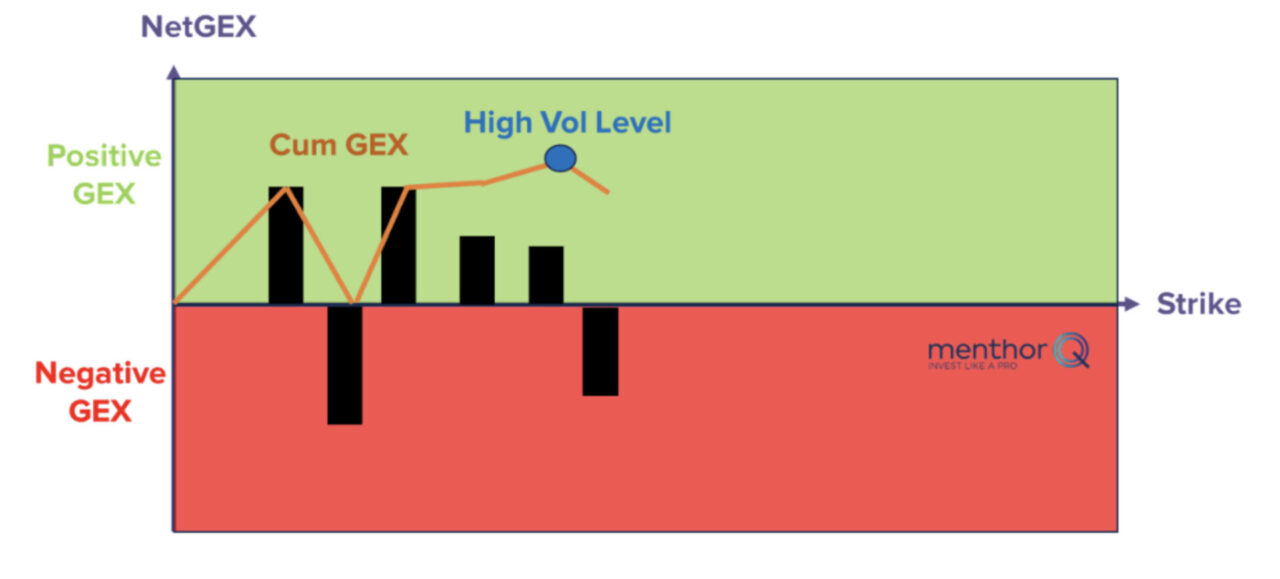

- Positive GEX: That is when the total GEX is positive

- Negative GEX: That is when the total GEX is negative

Positive and Negative Gamma

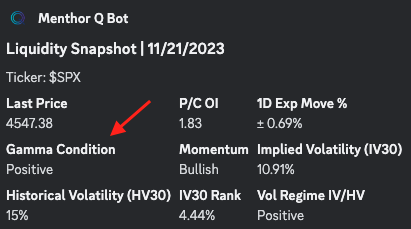

There are two ways to check whether we are in positive or negative Gamma via our Premium Membership.

1. Liquidity Snapshot

First you can use the /liq_snapshot command on a ticker and look at the Gamma Condition field.

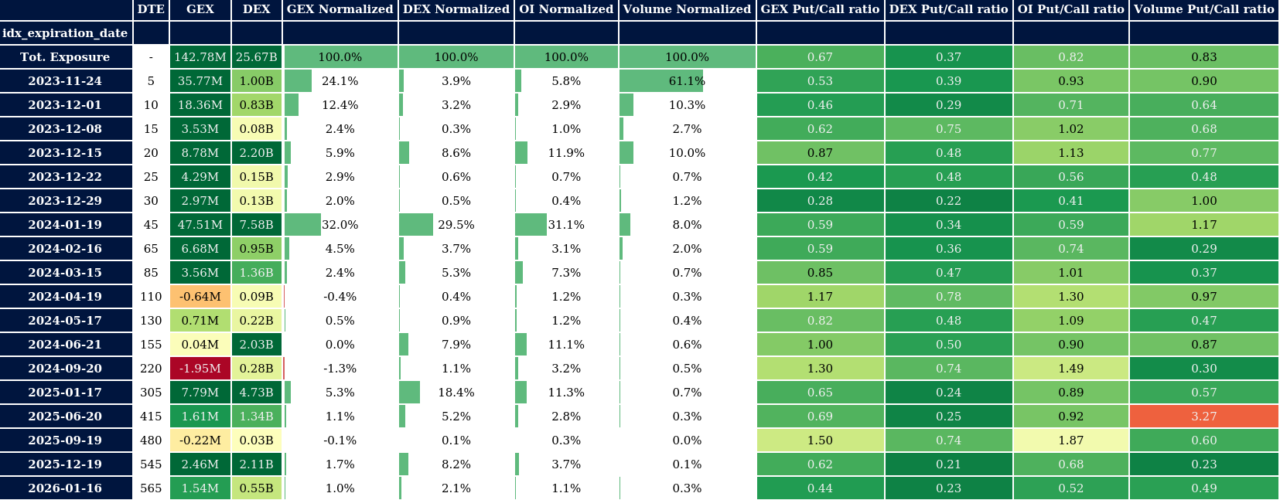

2. Option Matrix

Via the /matrix command you can look at the total exposure for a ticker and look at the Gamma Condition and GEX.

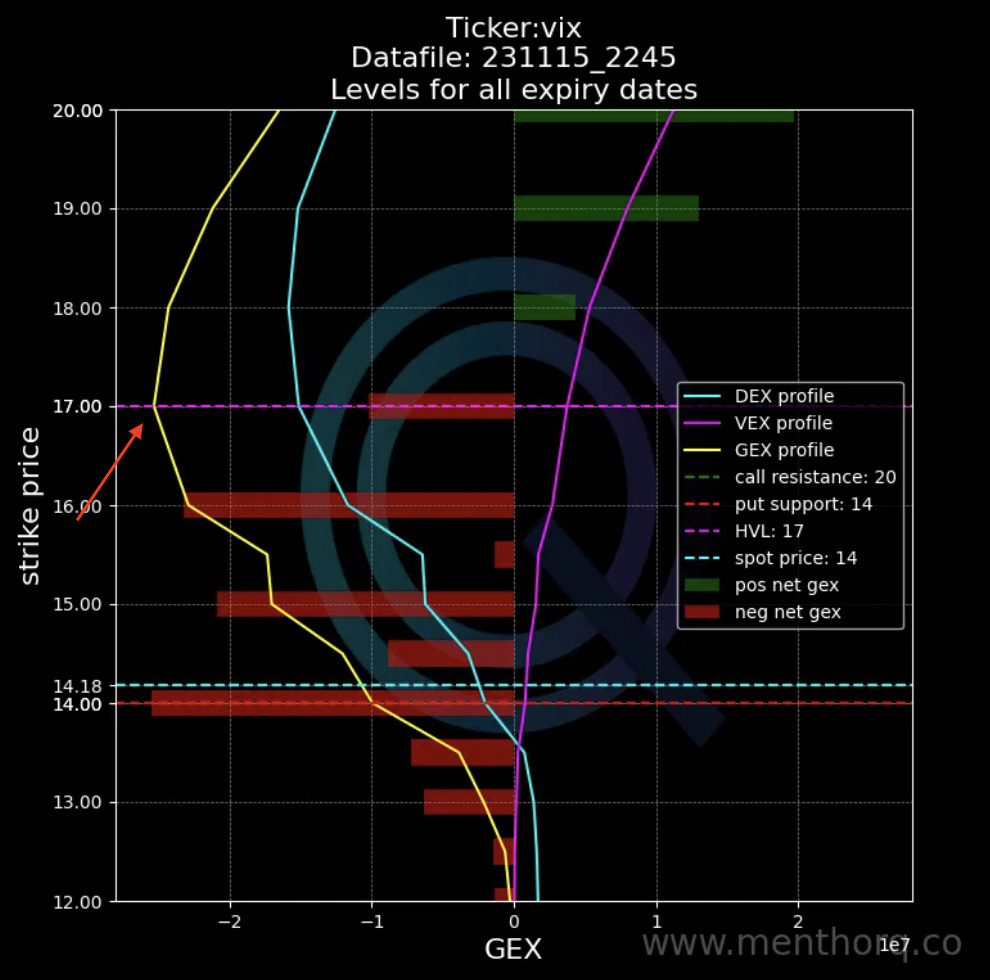

On the X axis you have the Net GEX, while on the Y Axis you find the strike prices. The black bars are the Net GEX by strike. That takes us to the Cumulative GEX.

Every strike is added/subtracted to give you the Cumulative GEX number that you can see on the orange line. The Cum GEX is really the Cumulative Net GEX across the different strikes.

Positive Slope vs Negative Slope

So contrary to how some read it, the High Vol Level is not the level at which we switch from positive to negative gamma. While it is possible to experience a change in the GEX regime when we touch this level, that is not what the indicator actually does.

If you take the GEX for each strike and create a cumulative sum, you get a curve that gives you the total GEX up to that strike. This curve is the GEX profile. The High Vol Level tells you at which point the slope of the GEX profile changes from negative to positive.

A positive slope is good because it means that if prices rise, so does the Net GEX. So, being above or below HVL changes the relationship between GEX and price. Above, if the price increases, GEX also increases; below, if the price increases, Net GEX decreases.

High Vol Levels as a Momentum indicator

The High Vol Level should be thought of as a momentum indicator. It prepares the investor for a potential positive or negative gex environment. On a rolling basis it can be an accelerator or decelerator based on the slope of the cum gex slope.

Let’s take our main chart, to show how the level can be interpreted. If we look at the Net Gex profile for all expiry, we can we how the GEX profile in yellow, changes its shape as it hits the High Vol Level.

It is an important level, because as you can see above or below that level, the gamma profile changes and as that profile changes Market makers may change the way they hedge. Also that change may also be to do with a shift in sentiment by the participants who are now increasing bullish or bearish positioning based on where the spot is.