Bid Ask Spread

The bid ask spread represents the difference between the highest price that a buyer is willing to pay for a security (the “bid” price) and the lowest price at which a seller is willing to sell that security (the “ask” price).

The spread is an essential component of trading because it represents the cost of executing a trade. When you buy a security, you typically pay the ask price, and when you sell, you receive the bid price. The difference between these two prices is what the market maker or broker earns as compensation for facilitating the trade.

A narrow bid-ask spread indicates that there is minimal difference between what buyers are willing to pay and what sellers are asking for, which generally indicates a more liquid market. A wider spread suggests a less liquid market and can result in higher trading costs for investors. It is particularly important when Trading Options.

Via the Premium Membership you can access the Bid Ask Spread Model on a ticker via the command: /bidask

Why do we look at the Bid Ask Spread?

Because it is the transaction cost and liquidity of the options market. But in this case, there are reasons that affect the bid ask spread by strike.

What are these factors?

- Time to expiry: Options with shorter time to expiration generally have smaller bid/ask spreads. So we know that this spread will reduce as we get closer to maturity. The options become less valuable. You can use VEX in our model as confirmation of this.

- Option liquidity: Highly liquid options tend to have smaller bid/ask spreads because there are more buyers and sellers actively trading those options. Less liquid options, especially those with wider strike price intervals, may have larger bid/ask spreads. NetGEX should be a good confirmation of this.

- Volatility: Higher volatility in the underlying asset can increase the bid/ask spread for options. When the market is more uncertain, traders may demand a higher premium, leading to a wider spread. Also you can use the Term Structure, for example, put strikes with high IV should generally coincide with higher bid ask. As people run for protection, we see this spike.

- Option volume: Options contracts with higher trading volumes often have tighter bid/ask spreads due to increased liquidity and market participation.

- Supply and Demand: The bid ask spread is also influenced by the supply and demand for the asset, with greater demand typically leading to narrower spreads and greater supply leading to wider spreads. Again you have the volume tab to confirm this.

The Menthor Q Bid Ask Spread Model

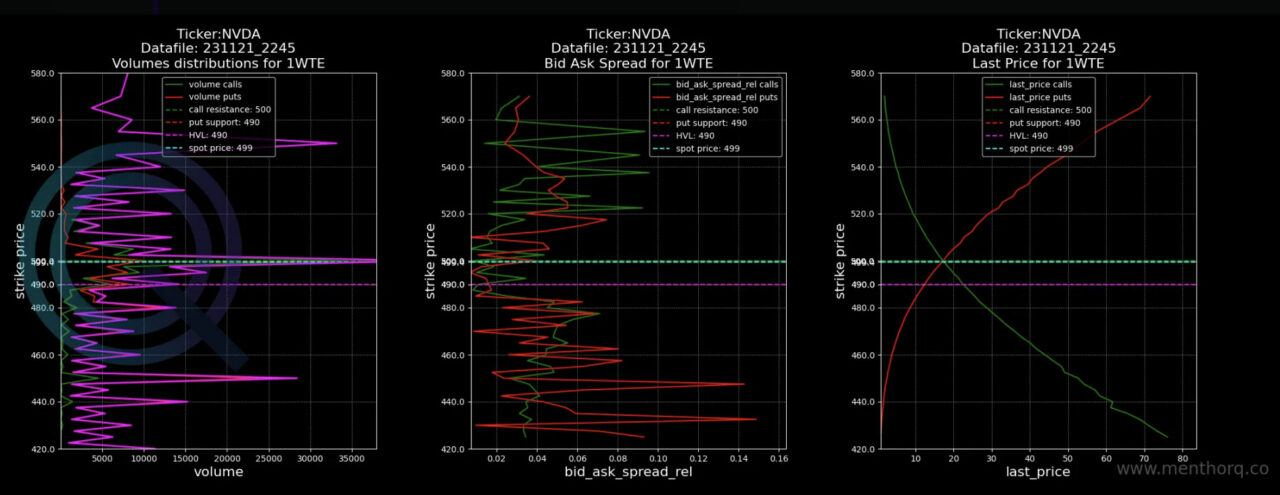

As you can see from the chart below, we track and compare:

- Volumes

- Bid Ask Spread by Put and Call

- Last Price per Calls and Puts

This data is all tracked by strike price, this way we have a better understanding of what is happening at each individual strike.

Bid Ask Spread when trading options

The bid-ask spread is particularly important in options trading for several reasons:

- Price Discovery: Options, especially those with less trading activity, can have wider spreads than highly traded stocks. The bid-ask spread helps determine the fair market price of an option at any given moment. The ask price represents the lowest price a seller is willing to accept for the option, and the bid price represents the highest price a buyer is willing to pay. The midpoint between the bid and ask is often used as the current market price.

- Cost of Trading: The spread directly affects the cost of trading options. When buying an option, you’ll generally pay the ask price, and when selling, you’ll receive the bid price. The wider the spread, the more you’ll pay when buying and the less you’ll receive when selling, increasing the overall cost of your trade.

- Liquidity Assessment: The spread can be an indicator of the liquidity of a specific option contract. A narrow spread typically indicates a more liquid option, meaning there are more buyers and sellers, making it easier to enter or exit a position without significant price slippage. A wide spread may suggest lower liquidity and can make it harder to trade without affecting the option’s price.

- Market Orders vs. Limit Orders: Understanding the bid-ask spread is crucial when placing orders. If you use market orders, you’ll buy at the ask price (potentially paying a higher price) or sell at the bid price (potentially receiving a lower price). Using limit orders allows you to specify a particular price at which you’re willing to trade, which can help you control the impact of the spread on your trade.

- Options Pricing: The bid-ask spread is one of the factors that can affect the pricing of options. Option pricing models like the Black-Scholes model consider factors such as the underlying asset’s price, time to expiration, implied volatility, and the bid-ask spread. Wider spreads can lead to less favorable prices for options, which can affect the cost of initiating option strategies.