Delta Hedging: NVDA and the effect of Vanna & Charm

Last week NVDA beat estimates once again. Not really a surprise you may be thinking. The AI crazy is ripe, and that has taken over the market too. NVDA price action, is a perfect case study to help us understand the secondary effects in the market as a result of:

- A market move/event.

- Current investor and market maker’s positioning.

This case study will help us better understand Charm and Vanna flows, and what effect they can have on the market. This article will focus precisely on that. What are these flows, and what effect do they have on the market?

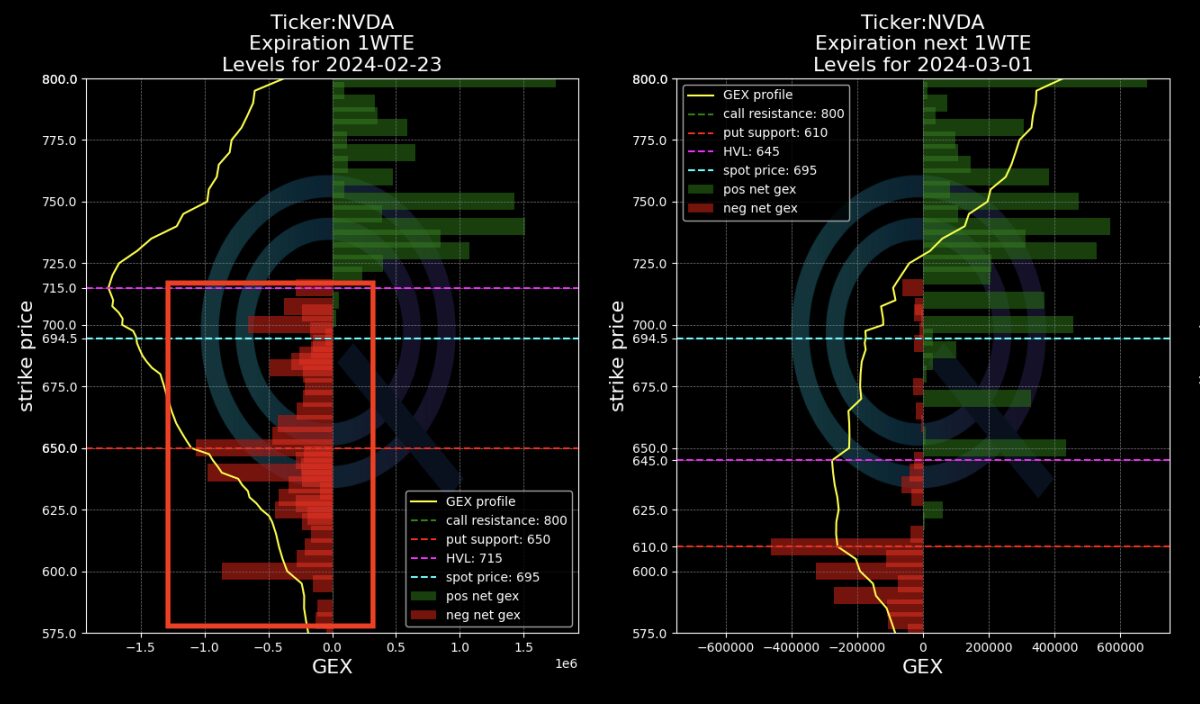

Positioning right before NVDA earnings

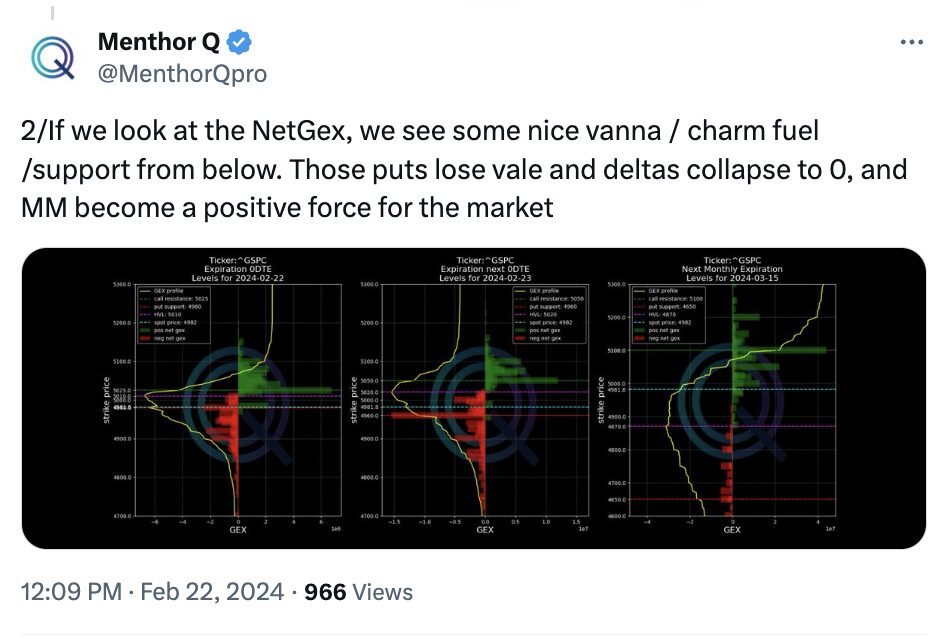

Before the big event, by looking at Net GEX we saw that there was a lot of Put Gamma activity. Looking at this chart it is pretty clear from the red, that positioning was skewed to the downside. A lot of that positioning was OTM Puts. Please check our FREE guide if you are new to Net GEX.

What was this telling us?

Those puts would have given the market a big push higher, forcing those Puts to expire worthless as their deltas moved towards 0. That was primarily due to technical re-adjustments in the market, more specifically adjustments driven by Charm and Vanna flows.

You can read the full thread on NVDA here.

Let’s talk about Delta

First things first. What we know for sure is that in markets nothing is constant. The same is applicable to an option’s Delta. As things change intraday, we know that an option delta is affected by movement in the spot price, volatility (Vanna) and the passage of time (Charm).

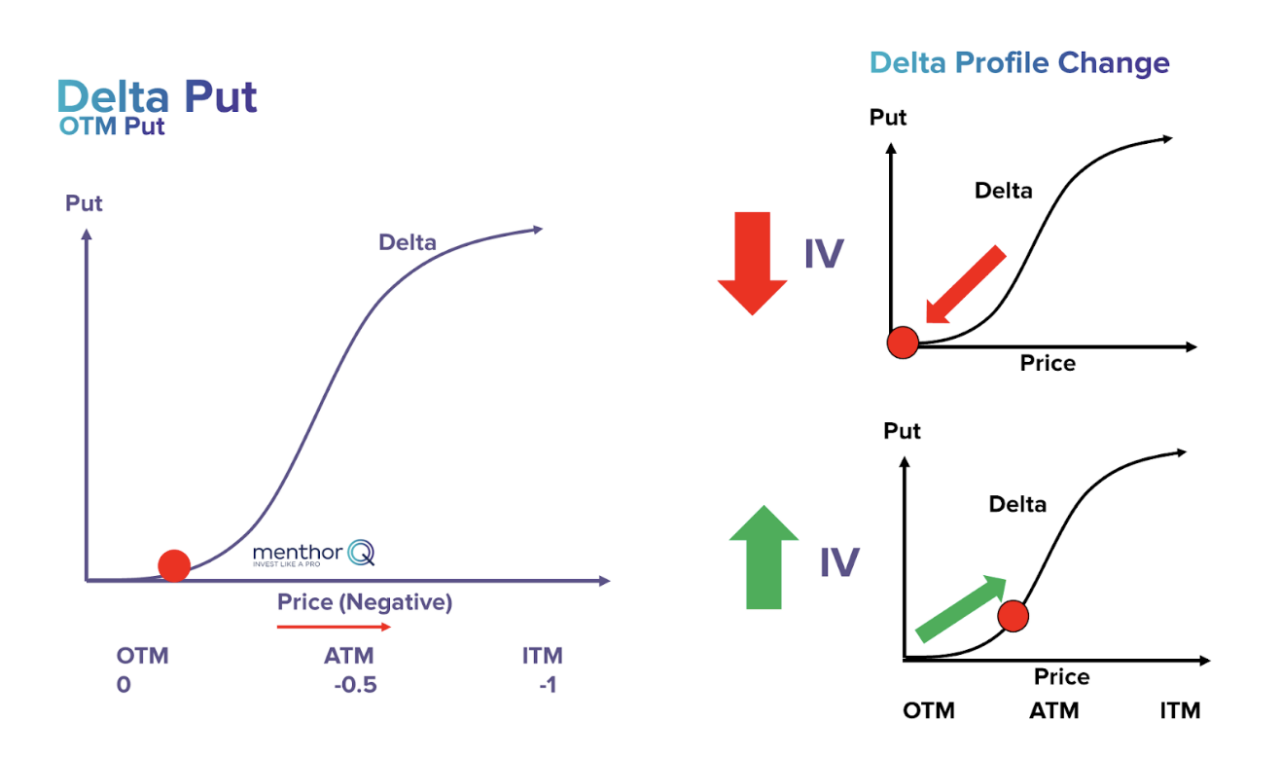

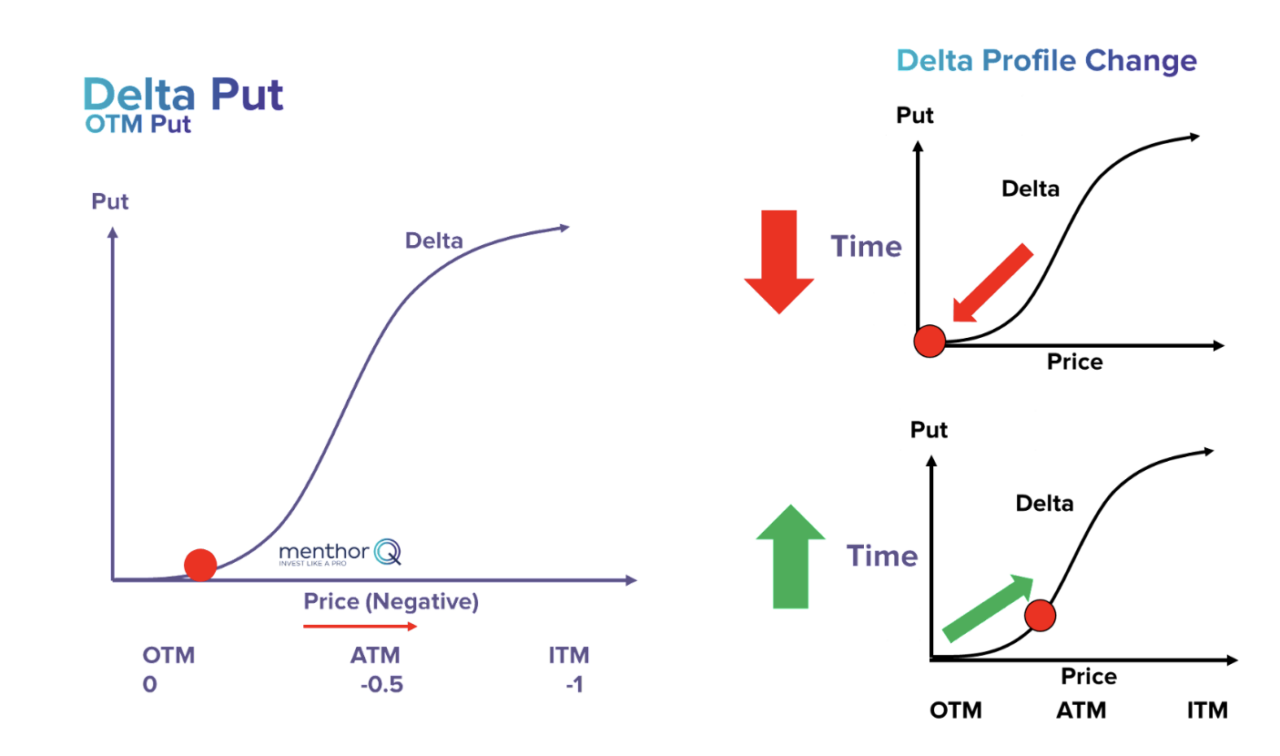

We know that the delta value will move towards 50 (ATM) as we increase volatility or time or away from ATM if we reduce them. Let’s take the example of a Put, and see what happens to its delta as volatility increases or decreases.

The left hand side in this chart is showing the Delta profile of an OTM Put. As volatility increases, the delta of that put option goes up. In case of a put it becomes more negative. This is the effect of Vanna.

The market maker will continue to short that position as the delta increases to stay delta hedged. Yet, if volatility decreases, that OTM Put moves further away from ATM and more and more out of the money eventually expiring worthless.

This time, the market marker will be reducing and eventually closing its shorts as the delta moves to 0, and that has a positive effect on price – the market maker delta hedging activity has a positive effect.

What about time?

Time and volatility in this context are very similar. Higher time to expiry just like higher volatility moves the delta in the same direction.

Less time to expiration will move the delta of an OTM put closer to 0. While more time to expiry has the opposite effect moving towards AMT, which is -0.5 for puts. This is the effect of charm.

When considering volatility and time, it’s essential to frame your understanding in terms of the likelihood of an event occurring. Higher volatility moves the Delta closer to ATM because, when there is high volatility, the probabilities that an option can move closer and further away from ATM are higher than when there is no volatility.

In a low volatility environment price does not move much. The same concept is applicable to time. If an option has more time, there are more probabilities that through time it can move closer to or further away from ATM.

In terms of how a market maker would hedge the passage of time, think about it in the same way as he does for volatility – as described above.

Back to NVDA

Now that we have a better understanding of how charm and vanna can affect the delta of an OTM put, and how a market maker will change its hedge, we can go back to the NVDA case study.

At the beginning of this article, we saw how the Net GEX profile was indicating a high amount of Put gamma before NVDA earnings. To hedge those OTM Puts market makers would have been short at close – before earnings.

Post market we saw NVDA beating estimates. That drove an increase in price with a reduction in volatility and time on those puts. As price continued to move higher, throughout the day those puts moved further away OTM eventually expiring worthless.

Once the market maker started unwinding its hedges (shorts), it became a supportive force to the market, eventually pushing prices close to the Call Resistance Level.

If you want to join our Trading Rooms where we discuss more practical examples sign up for Premium.