Dividend Strategy with Options

Many stocks pay dividends to attract investors. These stocks are often referred to as “Dividend Aristocrats”. Stocks that pay dividends are often considered attractive investment options, especially for those looking for a steady income stream in addition to potential stock price appreciation.

Dividend-paying stocks are typically shares of companies that distribute a portion of their earnings to shareholders on a regular basis, which can be quarterly, semi-annually, or annually.

In this guide we are going to share a strategy that allows you to capitalize on dividends by leveraging options to generate additional income for your portfolio.

Why Investors Like Dividend-Paying Stocks

There are several reasons why investors like dividends stocks:

- Income Generation: Dividends provide a source of regular income, which can be particularly appealing for investors.

- Indication of Stability: Companies that regularly pay dividends are often perceived as financially stable and less volatile, as they are usually established businesses with predictable earnings.

- Reinvestment Opportunities: Investors can reinvest dividends to purchase more shares, compounding their investment over time.

- Hedge Against Market Volatility: Dividends can offer a buffer against market downturns. Even when a stock’s price falls, the dividend payments can provide a partial offset against capital losses.

How are Dividends Paid Out?

When a company decides to give out dividends, there are four main steps to follow:

- Declaration Date: This is when the company announces it will pay dividends in the future.

- Record Date: The company checks its list of shareholders on this date to decide who will get dividends. Only those listed as shareholders on this date will receive them.

- Ex-Dividend Date: This date is usually two business days before the Record Date.

- Payable Date: The last step, also known as the payment date, is when the dividends are actually given to the shareholders who are eligible.

How to trade dividend stocks using options?

Now let’s look at an example strategy to benefit from dividends payouts and options premium.

Who is the strategy for?

- An investor who is looking to generate additional income

- An investor willing to hold the stock in case of assignment. You should use this strategy on stocks that you would potentially want to hold in your portfolio

- An investor with a short term horizon. This strategy should not take more than 30 days holding positions

Assumptions

- The idea of this strategy is that right after the ex-dividend date, the symbols typically drop by the dollar amount of the dividend.

- Good companies typically recover from that drop.

Trade Structuring

- The plan is to sell aggressive puts, with an intention to be assigned. If an earnings date is in the picture, we also get the advantage of the Higher Implied Volatility.

- If the earnings date is before the record date, then you can aim for the right expiration with earnings related to high Implied Volatility. Earnings can bring additional risk to the picture.

- The expiration will be just before the ex-dividend date. So if you are assigned, you become eligible for the dividend payment.

- Immediately sell covered calls at an aggressive strike with an intention to be called away. If the short call does not expire In the Money, sell further aggressive calls for the next expiration. Your cost basis will be coming down with each round of covered calls.

Dividend Income Strategy

Let’s review the multiple sources on income in this trade:

- Put premium from selling puts

- Call premium from selling calls

- Dividend income

- Capital gains from buying low and selling high

The goal is to seek assignment and we can use the higher Implied Volatility to our advantage.

When selling the covered calls, you need to take precaution as to the strike and the expiration. You don’t want your shares called away before the record date. Premium collected needs to be addressed in such a way that there is enough time value left in the sold calls that it makes it unreasonable to seek early option exercising.

How to scan for Dividends Stocks

This is a good strategy if you can spend some time scanning the upcoming dividends. To start working on this strategy, identify how much of your portfolio you can keep aside for this strategy.

Most dividends are quarterly. You can short list a few symbols from the Dividends Aristocrat list. We will pick symbols in such a way that their ex-div date is scattered over the Jan/Feb/March cycles.

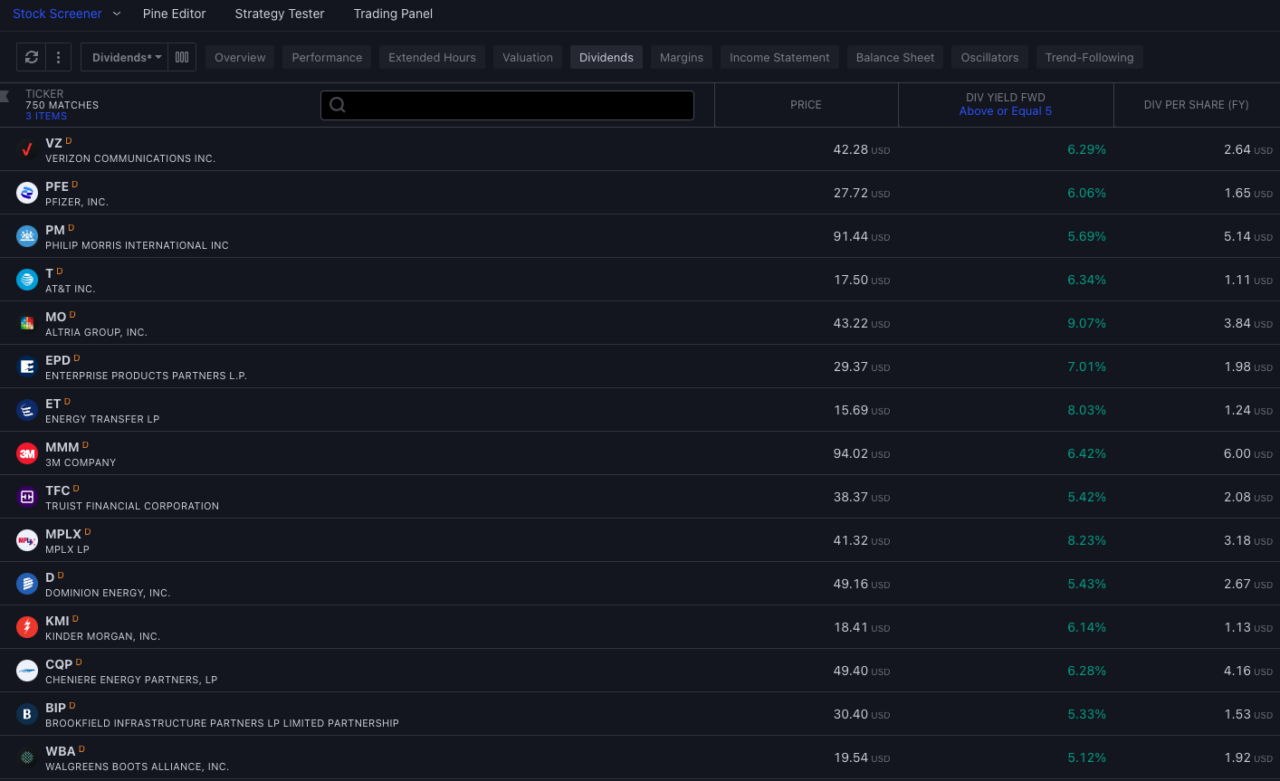

You can use Stock Scanners to identify stocks that are paying dividends. This is an example with TradingView. You can also use the holdings company of the Dividend Aristocrats ETFs.

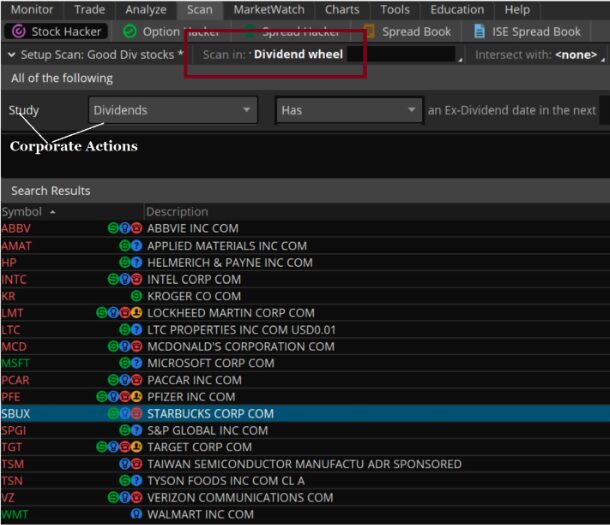

Each Broker platform will have some kind of scan for upcoming Dividends. This is an example from ToS (Think or Swim).

If you want to learn from our Traders and other strategies with Options join our Premium Membership.