Headline

Headline

Market Positioning

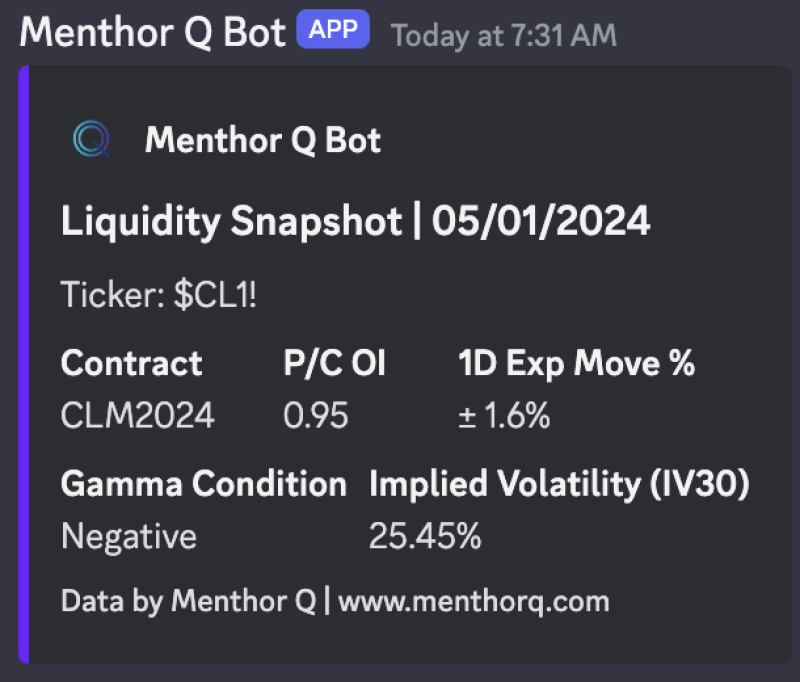

Volatility

Sentiment

Risk Management

TradingView

By accessing the Menthor Q Levels Indicator on TradingView we can leverage the power of real time data and set up our strategy before the market opens. We can then monitor, create alerts and speed up our decision-making process.

Positive and Negative Gamma

Understanding the Gamma Regime is key for our strategy. Market Makers hedge differently in Negative Gamma and this can have a direct impact on intraday price movements and trends.

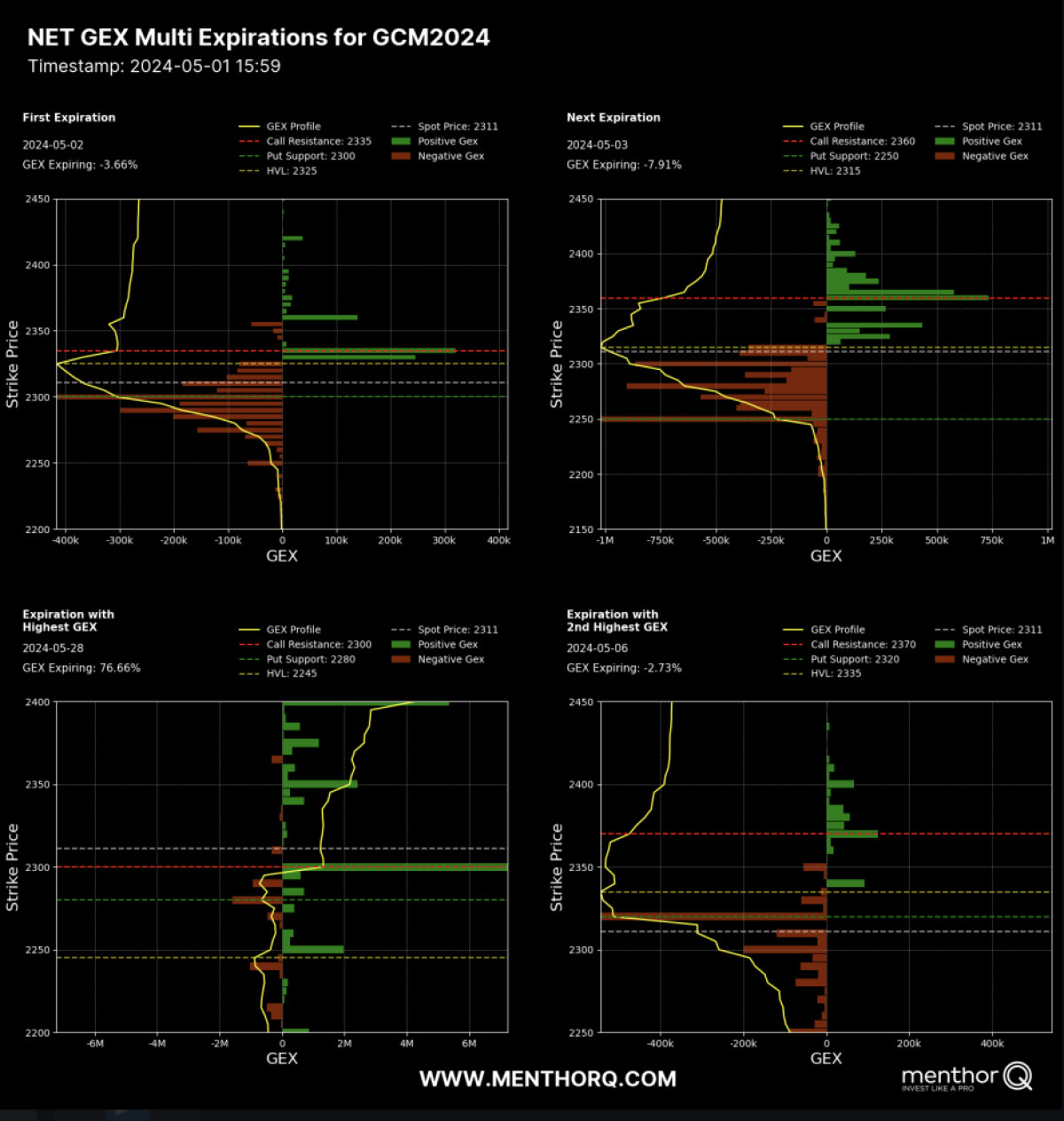

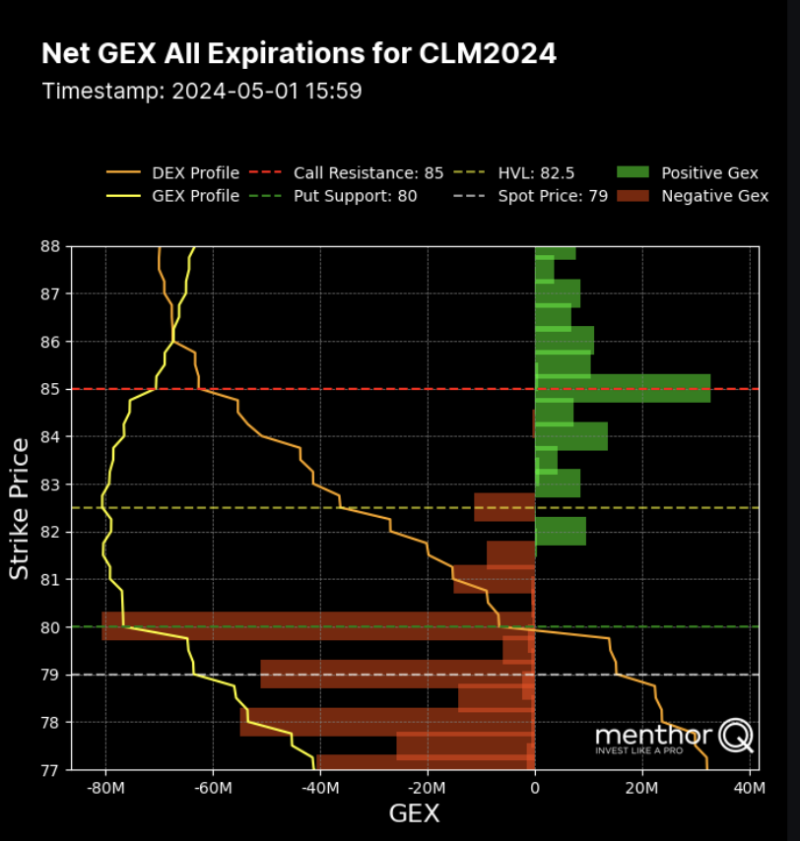

Net GEX Levels

Gamma Levels are Key Price Levels where there is more Negative or Positive Gamma based on market positioning and open interest. By looking at the options data we can define sticky price levels that can help us define our trading plan.

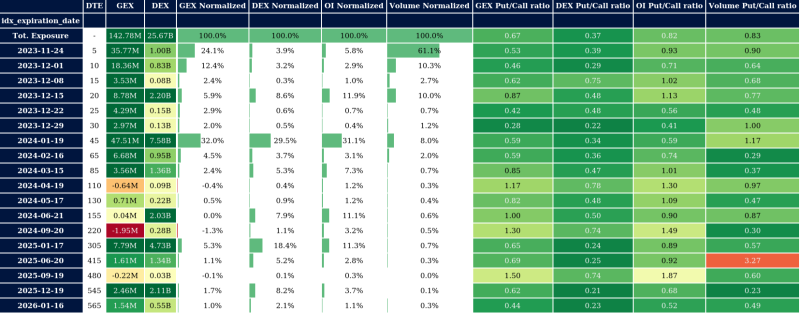

Options Greeks

Understanding the different Greeks is key to managing the risk of our position. The Option Matrix provides you access with relevant information across the option on Greeks, Open Interest and relevant ratios.

Your trading strategy?