Headline

Headline

Volatility

Time

Risk Management

Strategic Positioning

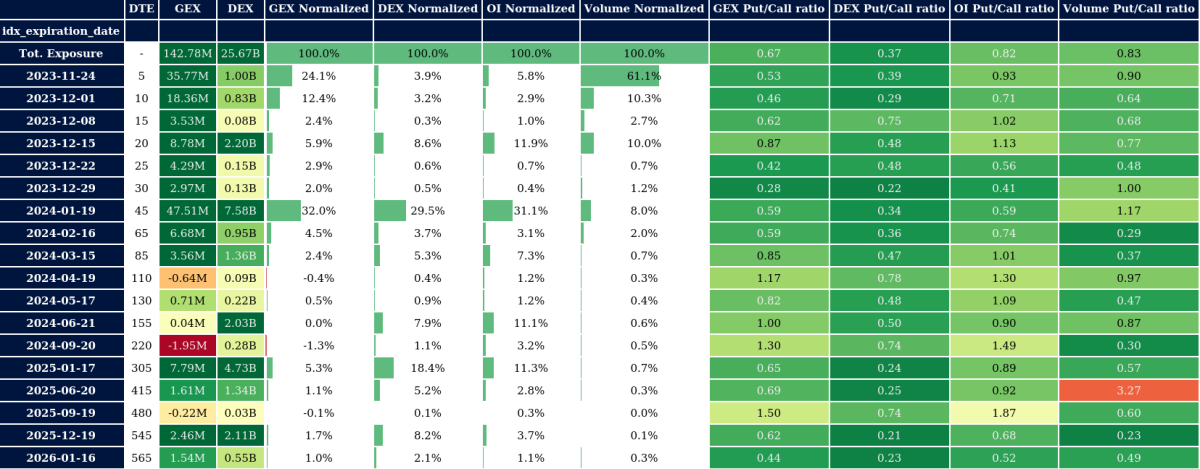

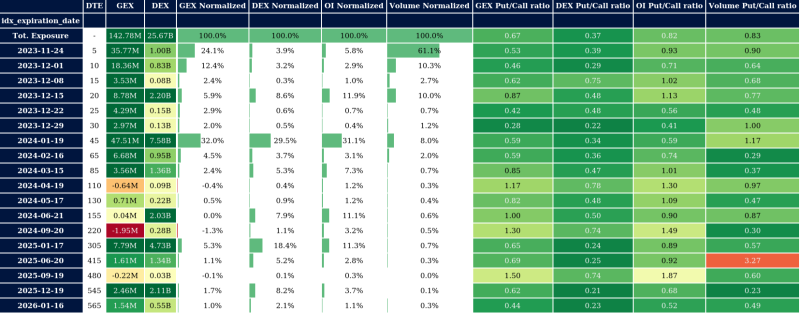

Option Matrix

The Matrix provides access to the entire monthly option chain, including Key Levels, Greeks Exposure, Open Interest, Volumes by Strike, and more. The Option Matrix simplifies the complex option chain data. It helps visualize positioning throughout the month, access Greeks exposure and identify key expirations with potential market volatility.

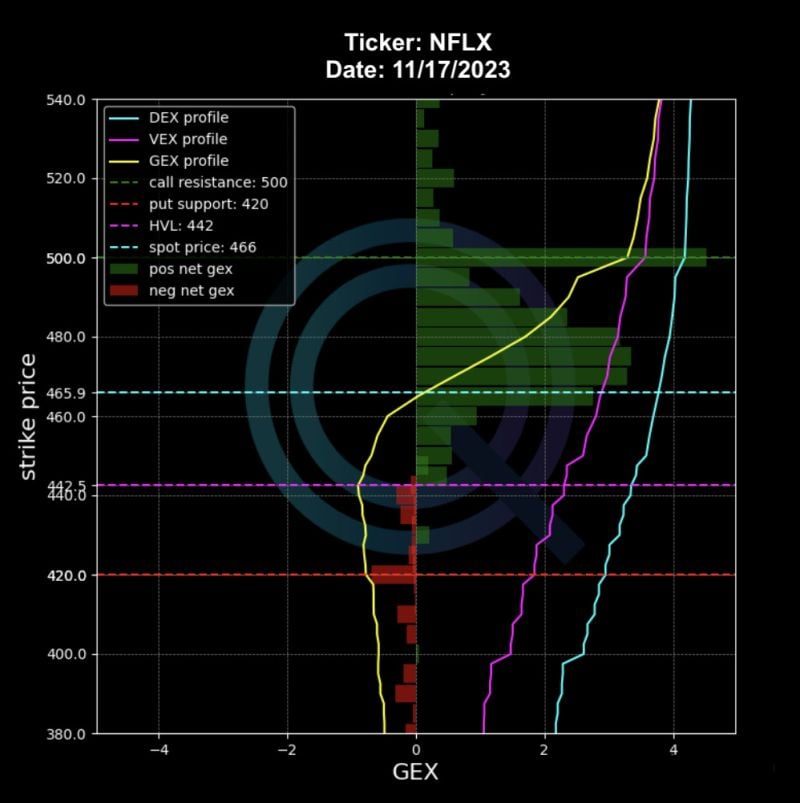

Gamma and Delta Exposure

Our model allows you to see the greeks profiles, including the absolute and net gamma per strike, with call gamma represented in green and put gamma in red. Gamma and Delta Exposure can help identify strikes with the most gamma, which can act as magnets and understand if the market is more bullish or bearish by observing the change in Gamma at different levels.

Simple Visualization

The Main Chart provides access to historical and forward looking Gamma and Delta exposure. By comparing them with volatility and spot price they can easily provide actionable insights into the underlying price action.

Your trading strategy?