What are 0DTE Options?

0DTE options refers to options contracts with a zero days-to-expiration (DTE). In other words, these options have reached their expiration date and are set to expire at the end of the trading day.

0DTE options are very short-term in nature and are typically used for day trading or very short-term trading strategies. These options have a limited lifespan, often just a matter of hours, and they are typically associated with higher levels of risk and volatility. Here are some key points to consider regarding 0DTE options:

- Intraday Trading: Traders use 0DTE options for intraday trading, meaning they open and close positions within the same trading session. These options are not held overnight.

- Limited Time: 0DTE options are useful for capturing short-term price movements or taking advantage of specific intraday events, such as earnings announcements or economic data releases.

- High Risk: Due to their very short lifespan, 0DTE options can be extremely risky. Price movements in the underlying asset or the options themselves can be rapid and unpredictable.

- Theta Decay: The time decay, or theta, of 0DTE options is very high. As they approach expiration, their time value erodes rapidly, which can make them sensitive to price fluctuations in the underlying asset.

- Gamma Play. 0DTE options are often considered a “gamma play” because they have a high gamma compared to options with longer time to expiration. Gamma is higher for options that are close to at-the-money (ATM) and have a shorter time to expiration, such as 0DTE options. This means that the option’s delta can change more quickly in response to small changes in the underlying asset price.

- Volatility. 0DTE options can be considered a realized volatility play because they are highly sensitive to changes in the underlying asset price and can provide the opportunity to profit from short-term price movements. 0DTE options are highly sensitive to realized volatility because they have a short time to expiration, and any significant price movement in the underlying asset can result in large gains or losses for the option holder.

It’s essential for traders interested in 0DTE options to have a clear strategy, risk management plan, and a good understanding of how options work. Options Expiration Day is a factor to understand when trading options.

Trading 0DTE Options on the SPX Index

Not all assets provide 0DTE Options. For example Stocks only have Weekly and Monthly options while indices provide 0DTE. Traders that leverage this type of strategy use 0DTE options on the SPX Index. There are a few things to consider when looking to apply this strategy.

The most important is Settlement.

SPX vs SPXW Options

SPX options are divided into two groups: Weeklys (including Daily) and Monthlies.

- Monthly options expire on the third Friday of the month at market close (4 pm New York time).

- Weekly or daily options expire at the market close on the expiration day. They expire either at the end of the week or at the end of the day.

Here we see a screenshot of the Interactive Brokers’ TWS platform Option Chain.

As we can see, there are different expiration dates and two tickers: SPX and SPXW. For both, the underlying reference is the S&P 500 index.

Trading Hours: Options with the underlying S&P 500 trade from 9:30 am to 4 pm (New York time).

Settlement of SPX 0DTE Options

Both options with the SPX ticker and those with the SPXW ticker are European type. This means that they are cash-settled at expiration. They cannot be exercised before expiration.

At expiration, you do not receive the underlying asset, but you will be paid or charged the difference between the option’s strike price and the index price at the closing of the expiration day.

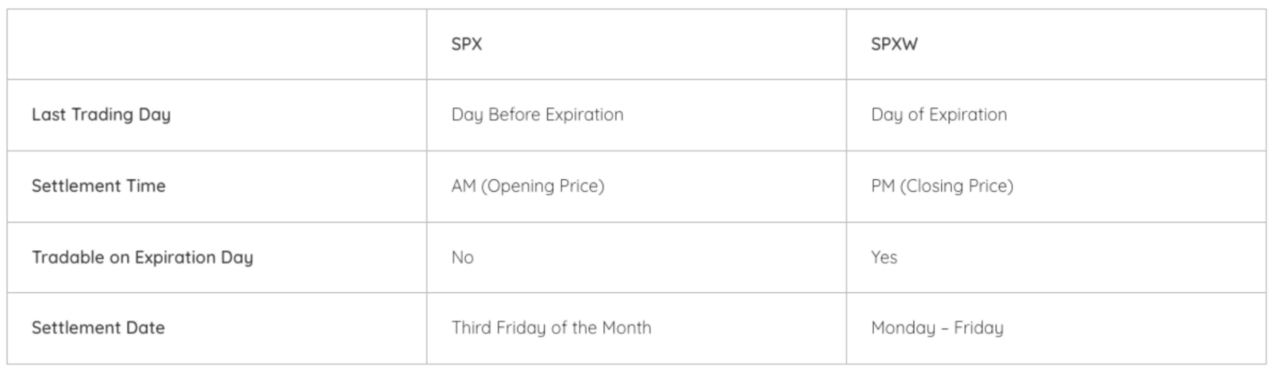

There are important differences to note, which we can see in this table. The main differences are as follows:

- SPX: The last trading day is the day before expiration, but the settlement price is based on the Friday’s closing price. This can create confusion for those using complex strategies such as spreads or condors.

- SPXW: Weekly and daily options, on the other hand, behave differently. The last trading day is the expiration day.

The settlement also has different timings:

- SPX: The settlement is done on the following morning after the opening.

- SPXW: The settlement is done on the same day at the closing.

To check all this data, you can use the right-click on the option chain of the desired expiration and click on “Description.”

Here we can then see more details about the individual contract. We see the description of a contract with the SPX ticker. As we can see, the expiration is on March 17th, but the last trading day is on March 16th.

Let’s instead look at the difference with a contract with the SPXW ticker. We can see that the expiration and the last trading day are the same.