Bear Call Spread

Among the bearish strategies, we find the Bear Call Spread Strategy. The Bear Call Spread is part of a series of multi-leg strategies that consist of the simultaneous selling and buying of options with the same expiration, but different strike prices.

The Bear Call Spread is a bearish strategy that has a limited maximum profit. The strategy benefits from a decline in the price of the underlying asset. The trader’s view is bearish.

- It is a strategy that involves selling a call option and buying a call with a strike price higher than the sold call. The expiration of the option is the same. In this case, we sell a call and collect the premium, and we buy a call with a higher strike to limit the risk in case the price of the underlying should rise.

- This is a credit strategy as we receive the difference between the two premiums. Unlike the “Naked” call sale or Short Call, our premium is reduced because we have a buying leg of a call in which we pay for this option.

- The wider the spread between the sold call and the bought call, the greater the premium or credit collected.

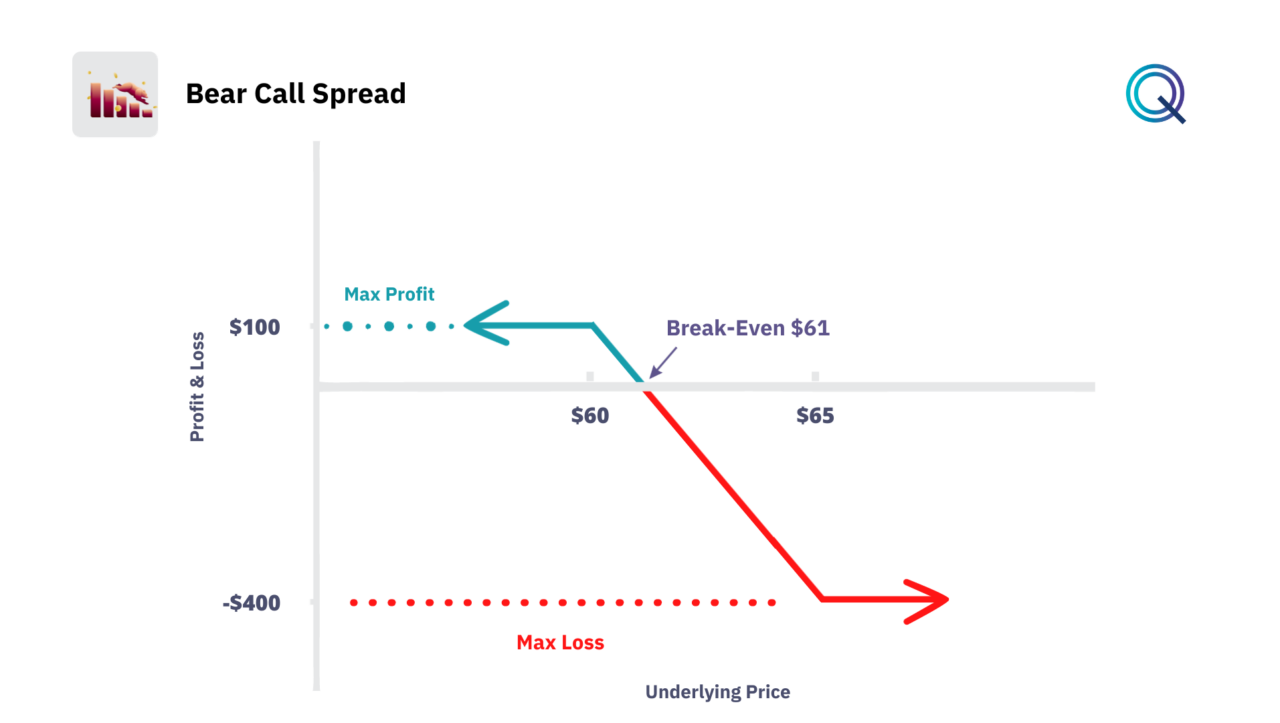

Bear Call Spread Payoff Diagram

The Bear Call Spread strategy is a credit spread. The trader receives a premium when entering this structure. The Bear Call Spread has a payoff diagram with a risk and return defined from the time of purchase. Let’s look at this example.

We sell a call option with a strike at $60 and buy a call option with a strike at $65 for a net credit of $1. We receive a credit for the sale of the call and pay a premium for the purchase of the call with a higher strike.

- Our maximum profit is represented by the received credit of $100 ($1 * 100 shares).

- Our breakeven price is represented by the strike of the sold call + the received premium ($61).

- Unlike the Short Call sale, our maximum risk is limited and is represented by the difference between the strike of the bought call and the breakeven: ($65-$61) * 100 shares. The maximum loss of this strategy is therefore $400.

The Bear Call Spread is used to take exposure to the underlying through leverage but reducing the risk compared to the simple sale of a naked call. The Short Call strategy, in fact, has an unlimited potential risk.

Variables to Evaluate on the Bear Call Spread Strategy

The Bear Call Spread is an advanced options strategy for investors with a bearish outlook, offering a conservative approach to profit from anticipated market downturns or stagnations. We need to consider different factors:

- Strategic Implementation. When using a Bear Call Spread, a trader sells an Out-of-the-money (OTM) call option while simultaneously buying a further OTM call option on the same underlying security with the same expiration date. The goal is to capitalize on the expected stagnation or decrease in the underlying asset’s price while mitigating the risk associated with a potential rally.

- Premium Collection and Maximum Profit. The initial net credit received by selling the call option represents the maximum potential profit for the trade. This credit is retained by the trader if both calls expire worthless, which will happen if the stock remains below the strike price of the sold call option.

- Risk Management. The Bear Call Spread is particularly favored for its defined risk. The maximum risk is the difference between the strike prices minus the credit received, and this is only realized if the underlying asset’s price rises above the strike price of the call option bought. The breakeven point for the trade is the strike price of the sold call plus the net premium received.

- Implied Volatility. A decrease in implied volatility after the spread is initiated can benefit the trader, as it can lead to a reduction in the price of the call options, potentially allowing the trader to buy back the spread for less than the credit received, thus locking in profits before expiration.

- Time Decay. The Bear Call Spread benefits from time decay (Theta), especially as the options approach expiration. Since the trader wants the options to expire worthless, the erosion of the options’ extrinsic value as expiration nears works in the trader’s favor.

- Position Management and Adjustments. Traders have the ability to manage and adjust their positions dynamically. If the market moves against the spread, it can be rolled up (to higher strikes) or out (to a further expiration) to manage risk or improve the position’s potential profitability.

- Comparative Advantage Over Naked Calls. Compared to selling naked calls, the Bear Call Spread presents a more risk-averse strategy due to its capped loss potential. It is an appealing strategy for traders who want to take a bearish position without the unlimited risk exposure of naked call writing.

- Integration with Other Strategies. The Bear Call Spread can be combined with a Bear Put Spread to create an Iron Condor, aiming to profit from a stock trading in a range. It’s part of a broader, more sophisticated trading approach, where multiple positions are managed to capitalize on different market conditions.

How to structure a Bear Call Spread

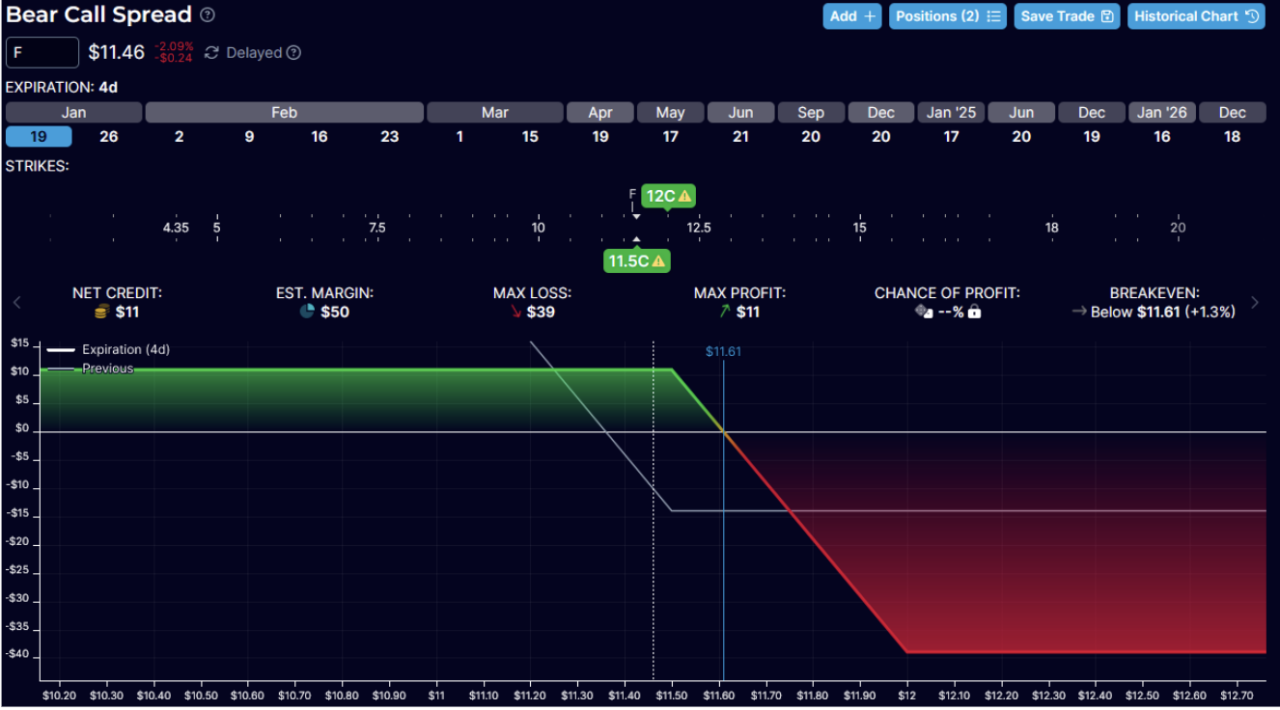

The Call Credit Spread (CCS), or Bear Call Spread, uses Call options to establish a short position. We sell a call, and buy a call at a higher strike with the same expiration.

- In this example, we sell the $11.5 Call strike and buy the $12 Call strike. We receive an initial credit of $11 for our position on margin. Our maximum profit is $11 and our maximum loss is $39. We breakeven as long as Ford stays below $11.61.

- We keep the entire $11 credit if Ford closes below $11.50.

- Maximum return would be a 28% return on a risk of $39.

Just like the other positions, the expectation would be to close the position before expiration so you don’t have to deal with assignment if Ford is between $11.50 and $12; but it is not mandatory.

Conclusion

The Bear Call Spread serves as a strategic choice for traders looking to benefit from bearish trends while maintaining strict control over potential losses. It’s a testament to the versatility of options trading strategies, providing traders with tools to navigate bearish market conditions with confidence.

To recap:

- The Bear Call Spread Strategy is a bearish strategy

- Our position is Short Options

- It is a credit structure

- Our View is bearish on the underlying

- The strategy benefits from a decrease in volatility

- Time is a positive factor for this strategy

Other Bearish Strategies

Here are other bearish strategies with Options: