Call Resistance Level

The Call Resistance level, like the Put Support level, is one of the key levels in our models. This is the price level where there is more Call GEX.

This is the level that our model projects as a potential level for:

- A resistance where the price bounces back down. Just like in the case of the Put Support level where prices find support, in the case of the Call Resistance the price find a resistance that has the potential to slow down price breakout.

- An inflection point for an accelerated upside.

You can find the Call Resistance level in our model in the main chart.

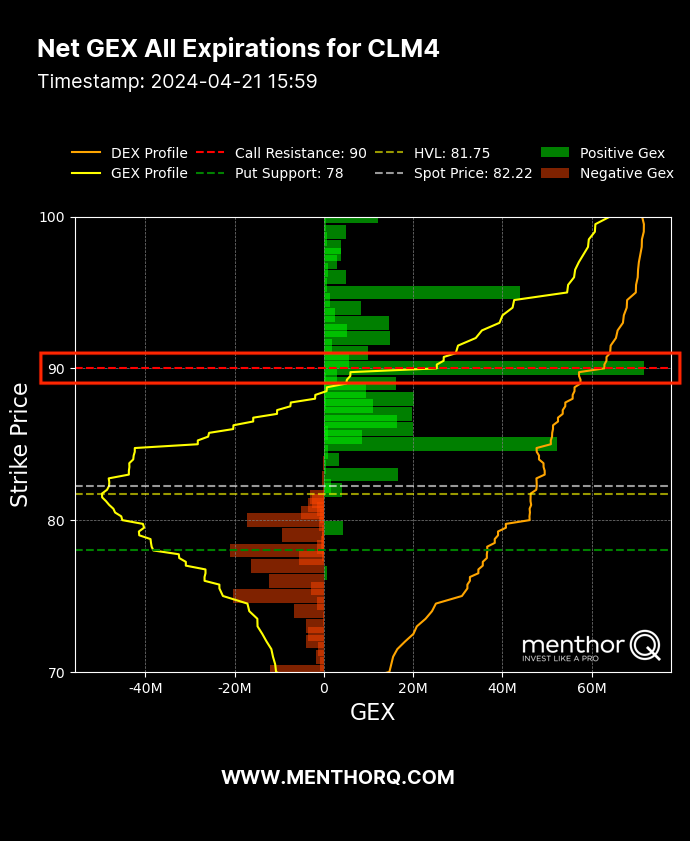

You can also find the Call Resistance in the Menthor Q Net Gamma Exposure Chart to better understand why this level can become a reaction zone. The Call Resistance Level is the Strike Price with the highest net call gamma. This is represented by the wider Green Bar.

This also means that it is the level where there is more call open interest and call gamma. Investors and hedgers have been buying out of the money call options at that strike price.

You can find the Call Resistance Level within our Premium Membership.

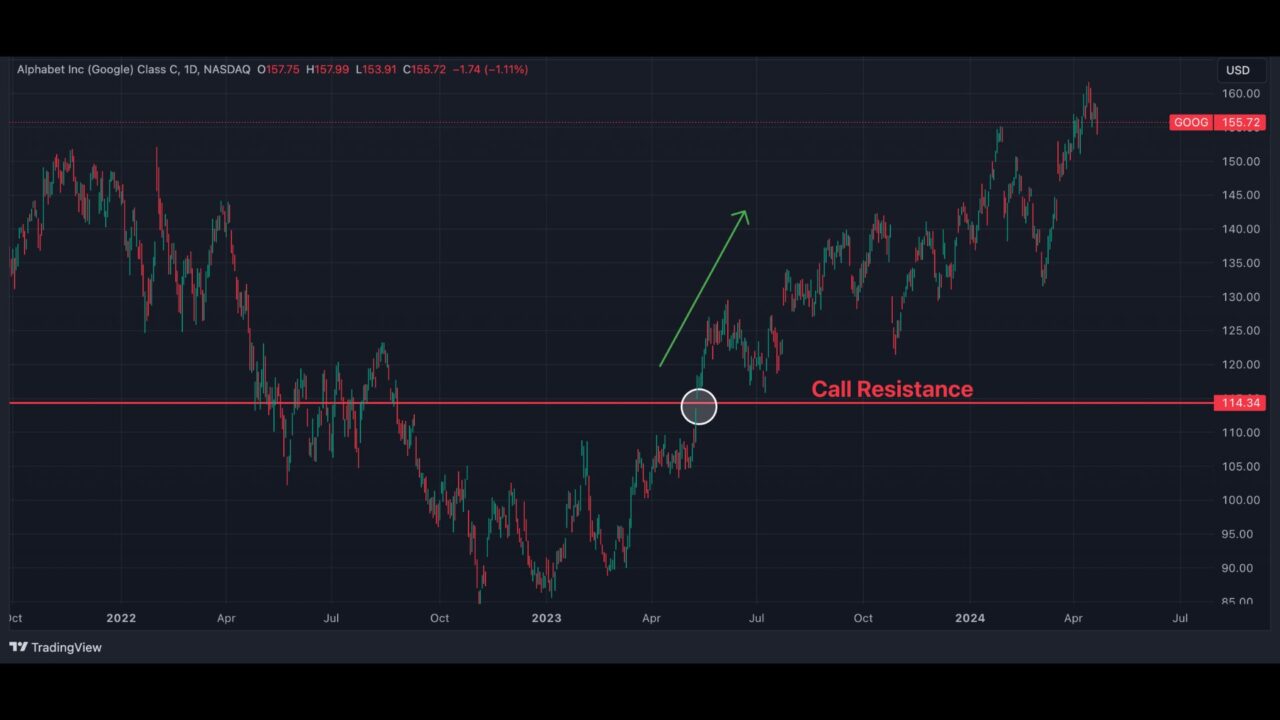

Call Resistance Level on TradingView

You can leverage the Menthor Q Levels Indicator in TradingView to add the levels to the chart.

What happens when the price hits the Call Resistance Level?

Generally when the spot price approaches the Call Resistance Level there are two possible technical scenarios for the market:

- Bounce to the downside. The Call Resistance level is also structurally the level where most investors are positioned. Like the Put Support level it makes this level very sticky. When a price level is sticky, the price can be attracted to it, but it may be difficult to break above it. The price will usually break off as the market maker will start shorting at those levels. The market maker will be in long gamma condition, and in those cases when its delta increases it shorts to stay delta hedged. This activity will become a technical short term bearish force. It is also fair to say, that as we reach that Call Resistance level, calls will be monetized and closed. That once again will have an effect for the market maker that will close its long position to return to delta neutral.

- Roll Position. When we reach this level, the bulls will want to see investors repositioning those calls higher. That would roll the Call Resistance level higher. Market markets would then be pushing the market higher if the spot price moves incrementally towards the new Call Resistance strike.

Why does the Level act as a Resistance

If we think about market mechanics, we know that the market maker is going long to hedge investors’ call options. As the spot price moves closer to that Call resistance level, the calls that were out of the money start moving in the money.

At that point investors that were long those out of the money calls start closing those positions. The reason is obvious if you are long an Out of the money call option, you will monetize it when it moves in the money whether you are a hedger or a speculator.

That is the main reason that the call resistance level becomes a resistance. As investors close those call options, market makers will also adjust their delta hedges. Remember, marker makers were going long to hedge those calls. As the calls are closed, the market makers close the long exposure. That stops the market from moving higher above that level.

Now can the spot price move above this level?

It can indeed, but it requires a further catalyst. You can take the example of GameStop in 2020, when investors were bidding hard calls higher forcing market makers to continue to go long to remain delta hedge. That was a bullish force on the market that kept forcing the market higher.

How to trade using the Call Resistance Level

Similar to how you would use resistance in Technical Analysis our Call Resistance can be used in the same way but it encompasses the power of options data.

We can use this level as a resistance or reaction zone where the price slows down its uptrend and can bounce to the downside.

If you are in a Long Trade you can use this level as a profit target area and if you are looking for a reversal trade this can be an efficient level of entry.

Let’s look at this chart. This is the chart of NVDA at the end of March 2024. We are in a strong uptrend and on March 26th the price is approaching the $1000 dollar mark.

Here we see the Net GEX or Net Gamma Exposure chart from our models and we can identify 2 key levels: the Call Resistance and the Call Resistance 0DTE which looks at the market positioning at the next weekly expiration.

The $1000 level and the $950 level are the one with the highest exposure. As we can see from the chart the price reaches this level and then retracts. It fails to break above.

The Call Resistance though can also be an inflection point for an accelerated upside similar to the GameStop example. If there is bullish sentiment in the market a break above the Call Resistance Level can bring upside momentum.

Within the Menthor Q Models we also have other Key Levels you should consider:

You can access these levels within our Premium Membership.