Delta Hedging Cheatsheet

In this guide we are going to show you our Delta Hedging Checklist, look at the Delta Hedging Mechanism and why Gamma Levels are key to better manage your trading plan.

For those who are used to our Q-Models, we look at the option chain and greeks to calculate GEX (Gamma), VEX (Vanna), DEX (Delta) exposures.This allows us to create Key Levels for the next day’s daily price action.

Let’s start with some important resources for you to better understand this topic:

These Key Levels allow you to filter a lot of the noise in the market. For example, knowing if we are in positive or negative gamma can help us understand intraday price volatility. Based on that we can then tailor our spread or directional strategies. More here on positive and negative gamma here.

Delta Hedging

We have created a dedicated guide on Delta Hedging.

We are interested in delta hedging, because by following how market makers hedge, we can get a sense of potential market movements. That can be helpful if you trade or risk manage.

What moves that Delta?

As the market moves throughout the day, the delta of the market maker’s portfolio will change. Since the market maker hedges with the underlying (mostly), knowing whether he is buying or selling can help us understand the liquidity in the market. This data can then be used with other Q-Models Indicators like the 1D Expected Move. You can read more about the indicator here.

The Delta of the market maker’s book is dynamic, and so are the greeks. It would be wrong to assume that changes in spot price is the only component that affects that delta movement. The option market is multi dimensional compared to the futures one.

As an option’s trader you have to also understand how time and volatility are playing a part. In this sense, we suggest checking out this article we wrote about Vanna. Vanna helps us understand how volatility affects delta. The other greek you want to focus on is Charm – effect on the passage of time on the delta.

Delta Hedging Mechanism

We are going look at how a market maker is hedging when an investor is:

- Short a Call

- Long a Put

- Long a Call

- Short a Put

We will look at the investor positioning and the market maker positioning at:

- At Market Open

- Re-Hedging after the stock price moves

- At Expiration

The exercise is mostly directed to shorter term time frames. The objective, and what we do in the Trading Rooms every morning is to understand current positioning and estimate next day moves. We will show you what key data you can use in the morning for your set up:

- Net GEX

- Open Interest & Volume Profile

- Open Interest * Implied Volatility Profile

- 1D Expected Move Indicator

You can also check a Case Study we wrote about how to manage short term momentum.

Delta Hedging Checklist

This checklist will help you think through how certain positioning by the investors (that you are estimating) may drive market makers’ delta hedging.

Let’s say, on a specific date, the market reaches a key level. The assumption is that most of that positioning around key levels are investors’ long calls. If we eliminate for a second volatility and charm, let’s think about what may happen to the market maker’s positioning if the price goes up or down. This is what these charts should help you out with.

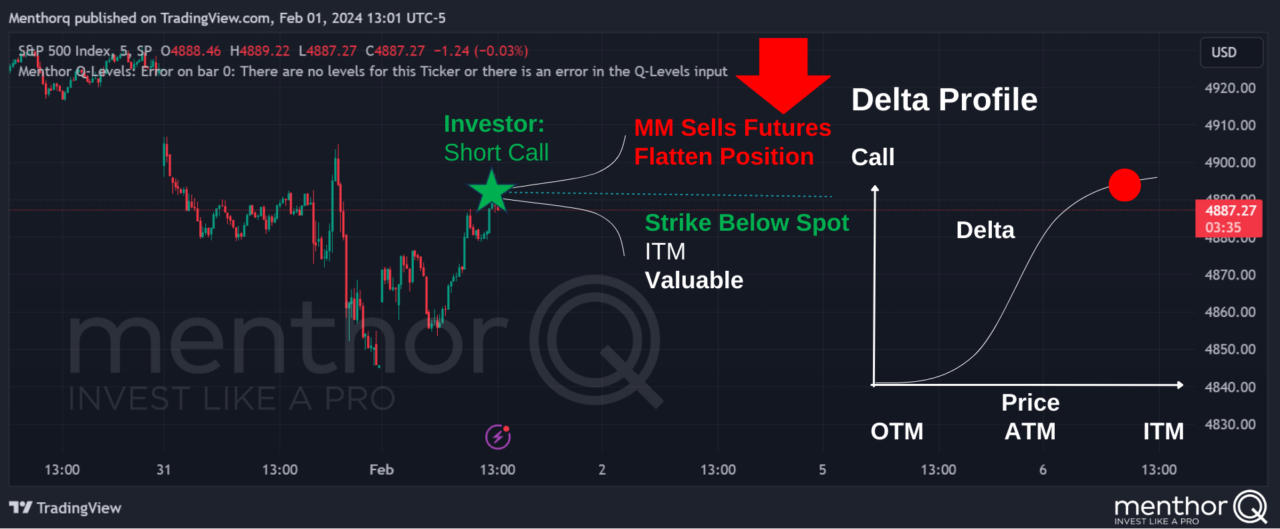

Short Call

Let’s start with the Delta Hedging Mechanism of a Short Call.

Positioning at Market Open

Re-Hedging after Stock move

Positioning at expiration – Strike above Spot

Positioning at expiration – Strike below Spot

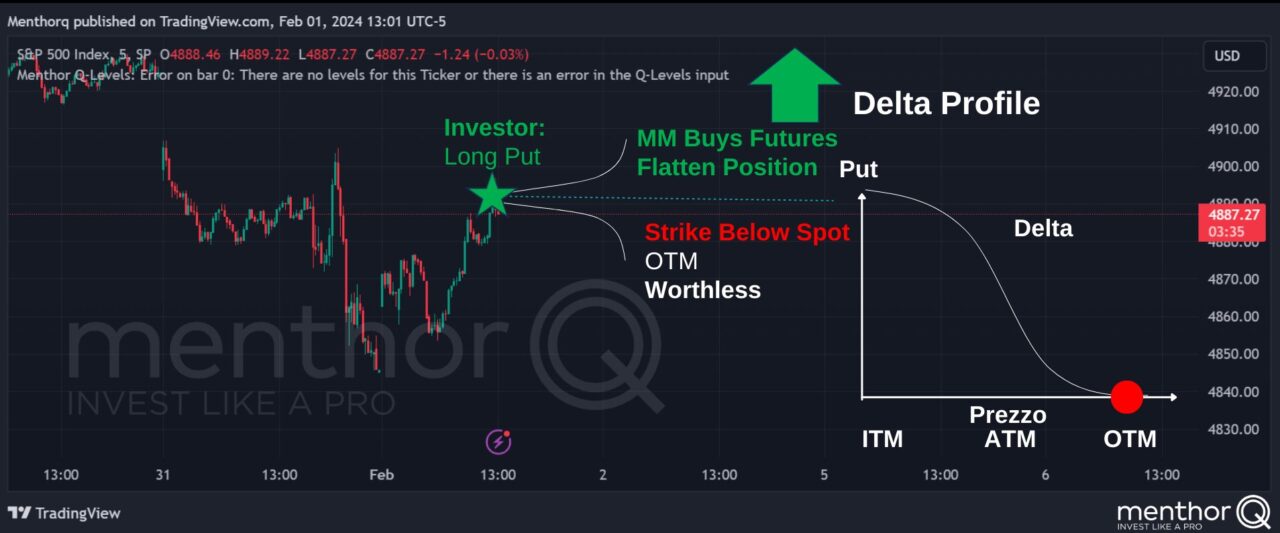

Long Put

Positioning at Market Open

Re-Hedging after Stock move

Positioning at expiration – Strike below Spot

Positioning at expiration – Strike above Spot

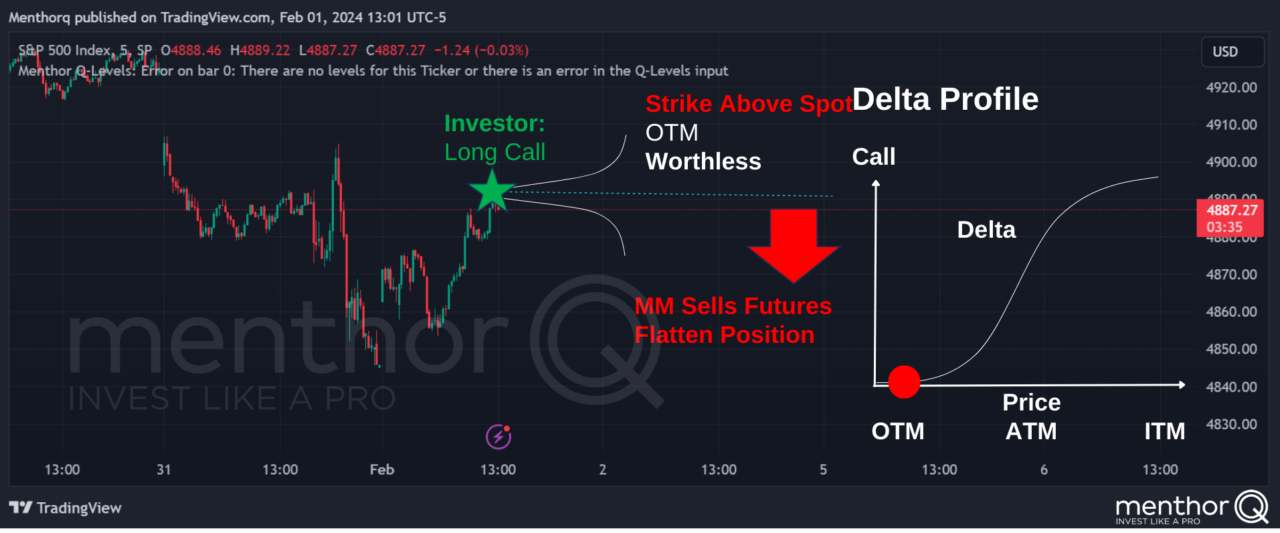

Long Call

Positioning at Market Open

Re-Hedging after Stock move

Positioning at expiration – Strike above Spot

Positioning at expiration – Strike below Spot

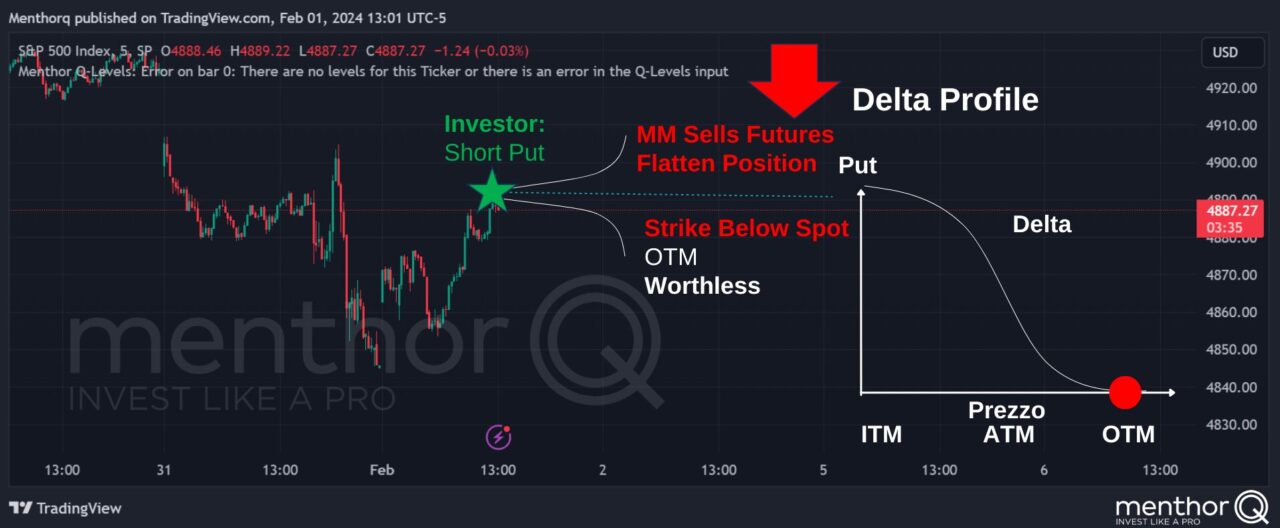

Short Put

Positioning at Market Open

Re-Hedging after Stock move

Positioning at expiration – Strike below Spot

Positioning at expiration – Strike above Spot

If you want to learn more about Delta Hedging and Greeks join our Academy. We created an advanced options and trading courses.