Delta Hedging Effect of Volatility

As part of the Delta Hedging series we are now going to focus on the effects that Volatility has on Delta. Previously we wrote about the effects that the movement of spot has on the delta hedging activity of market makers.

We looked at the investor positioning and how that was mirrored by market makers. The exercise is useful as one tries to track liquidity in the market but also for risk management.

If you missed check out our Delta Hedging Cheatsheet.

The effects that an increase or a decrease in volatility have on positioning may be less counterintuitive than when we are simply looking at spot movements – and ignoring time and volatility. This is why before we look at how a market maker hedges, we really need to understand how the delta profile of an option changes as volatility changes.

For the purpose of this exercise we are going to look at an ITM and an OTM Call option. The assumption here is that everything is staying equal apart from changes in volatility. We will focus on puts in the next Delta Hedging series that will follow.

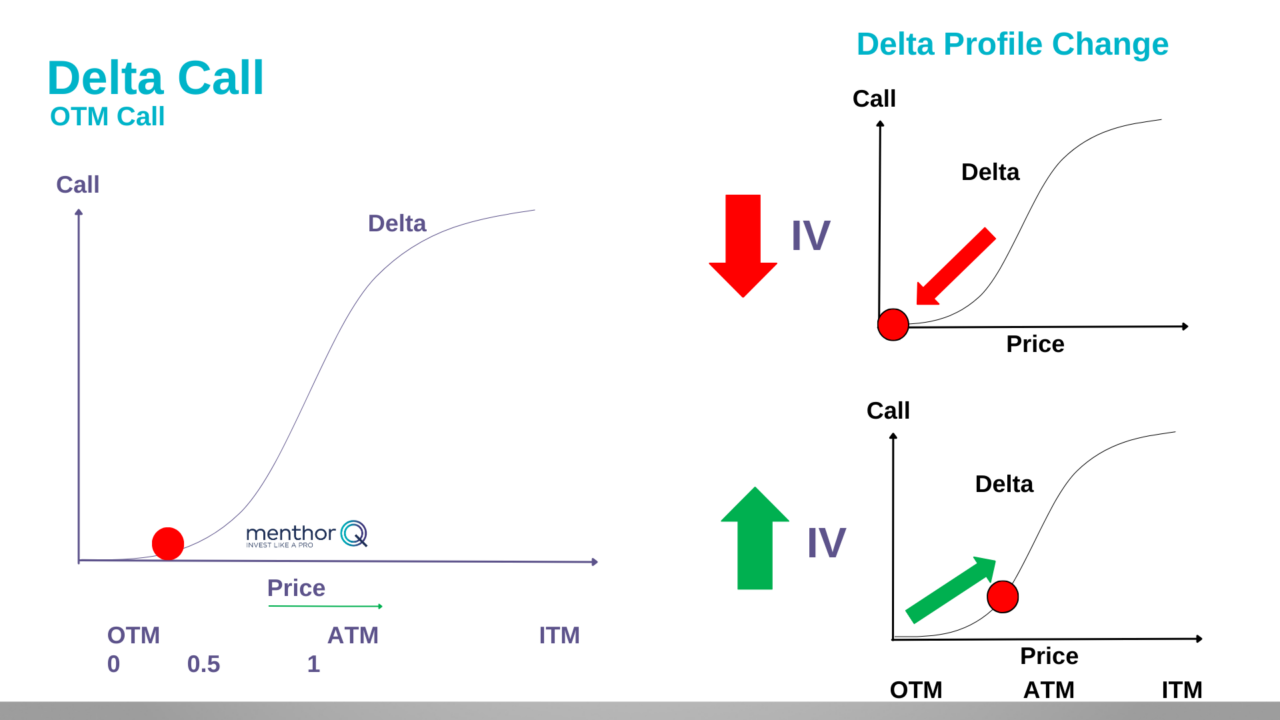

OTM Call

Let’s start from an OTM call. As you can see on the left hand side the red dot is the strike of our call, which in this example is Out of the Money (OTM).

- As volatility increases, the delta of that call option will change.

- In a low volatility environment, our OTM call will move deeper OTM.

- The opposite happens if volatility increases. All of a sudden the OTM call starts moving closer towards the at money. Why? Because higher volatility means that the probabilities of the call moving ATM are higher. Higher volatility means that there is more movement in the market, and more action. In a low volatility environment our OTM call has very low probabilities of being able to get to the ATM strike – there is no gas in the tank.

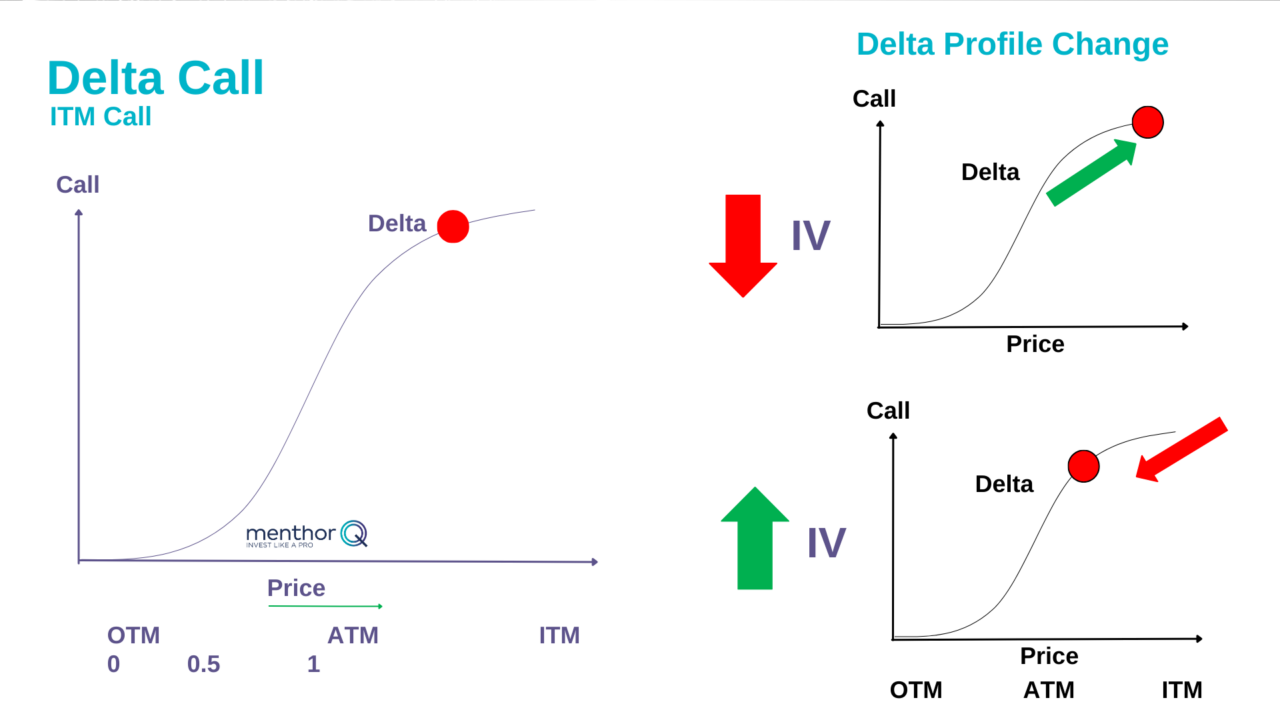

ITM Call

The concept is similar when we are looking at an ITM Call option. As volatility decreases, our call is more likely to stay ITM. The opposite is true if volatility increases. At that point, the ITM call shifts towards ATM, volatility is increasing the probabilities that the call may not end up ITM. We have not covered ATM because ATM calls tend to stay close to ATM with changes in volatility.

How is the Market Maker Hedging?

For the purpose of this guide, we will focus only on positions where the investor is long the derivative. Next week we will cover short positions as we continue to dig deeper on investor and marker maker’s positioning.

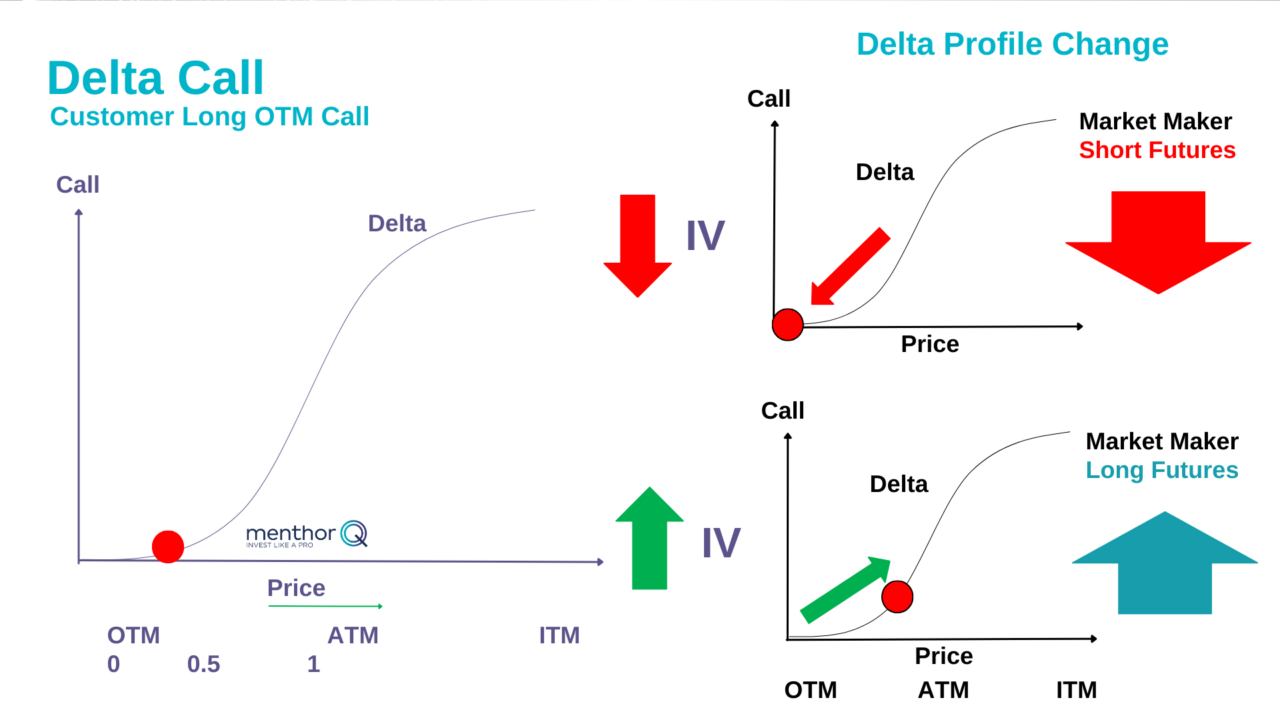

Investor Position: Long OTM Call

When an investor is long a call, the market maker is going to take the opposite position. As volatility decreases we can see from the delta profile that the OTM call moves deeper out of the money.

This means that the option delta is moving towards zero. In this case, the market maker is going to short the underlying as the delta decreases.

The opposite is true when volatility increases. In that case, the delta moves away from 0 and towards At the Money. That means the delta is increasing, in this case the market maker is going to have to go long the underlying to stay flat.

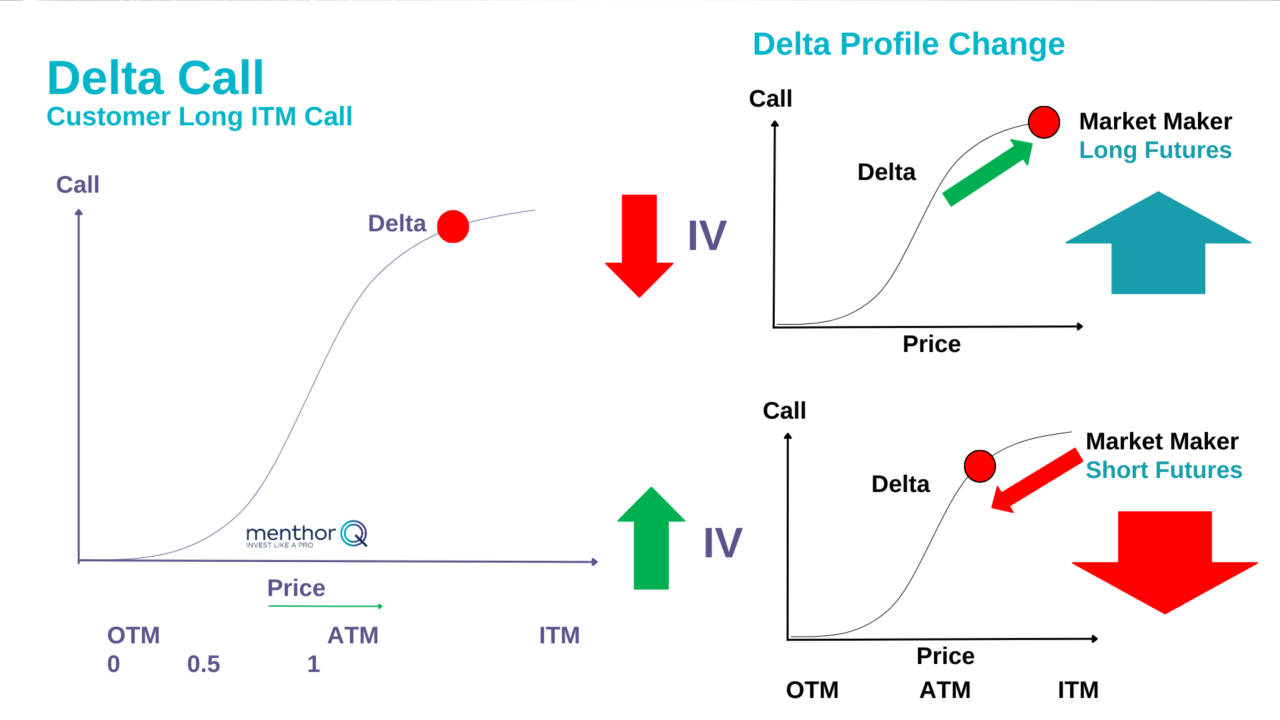

Investor Position: Long ITM Call

In this final scenario, the investor is long an ITM call. As volatility decreases, we know the Call has more probabilities of staying in the money and the delta will move closer towards 1. In this case as the delta increases the market maker is going to have to go long futures to stay flat.

The opposite is true as volatility increases. In that case, the ITM call will move along the delta curve towards at the money. This means that the delta of the investor’s call is reducing. In this case the market maker is going to have to short the underlying or future to stay delta hedged.

You can find more information about this within our Guides Section.

We have also created our Academy where you can access our Advanced Course on Options Trading.