GEX Levels 0 to 10

GEX Levels , or Gamma Exposure, is an important concept in options trading because it provides insights into how market participants’ positions in options can impact market dynamics and price movements.

GEX represents the aggregate gamma exposure of options market participants and can have significant implications for market behavior and stability. GEX can influence market movements and price dynamics.

- When GEX is significantly positive, it means that market participants have a collective bullish bias, and as the underlying asset’s price rises, they may need to buy more of the asset (delta hedging), potentially fueling further upward price momentum.

- When GEX is significantly negative, it suggests a bearish bias, and price declines can be significant as market participants sell to hedge their positions.

GEX can influence the “pinning” of options to certain strike prices near expiration. Market makers may use GEX data to manage their positions to maximize their profits, potentially leading to options prices gravitating toward specific strike prices.

This is why with Menthor Q Models you can follow GEX and together with the analysis of Positive and Negative Gamma you can better define your trading strategy and trading range.

When looking at GEX and Gamma Levels it’s important to consider how the collective gamma exposure (GEX) of market participants impacts the gamma (sensitivity) of their options positions.

- High GEX may result in more pronounced changes in the delta (higher gamma levels) for those with options positions. High gamma levels indicate positions that are sensitive to price changes and, therefore, may require more frequent adjustments.

- Low GEX could lead to less sensitivity in delta (lower gamma levels) for the options positions held by market participants. Low gamma levels imply positions that are less sensitive and may require fewer adjustments.

Primary vs Secondary Levels

In our Premium Membership you can access our Models and data. Our levels falls into two categories: Primary and Secondary.

Primary Levels

Those are represented by:

The primary levels are the ones we pay close attention to. They represent the levels with the highest Gamma Exposure.

They can be used within a directional strategy or a spread trading strategy. The strike of these levels tend to be less dynamic than the secondary levels.

Secondary Levels

The secondary levels are more dynamic and can be used for intraday trading and price discovery. These levels are taken out of our Net GEX Chart, and are the stickiest gamma levels after the primary levels.

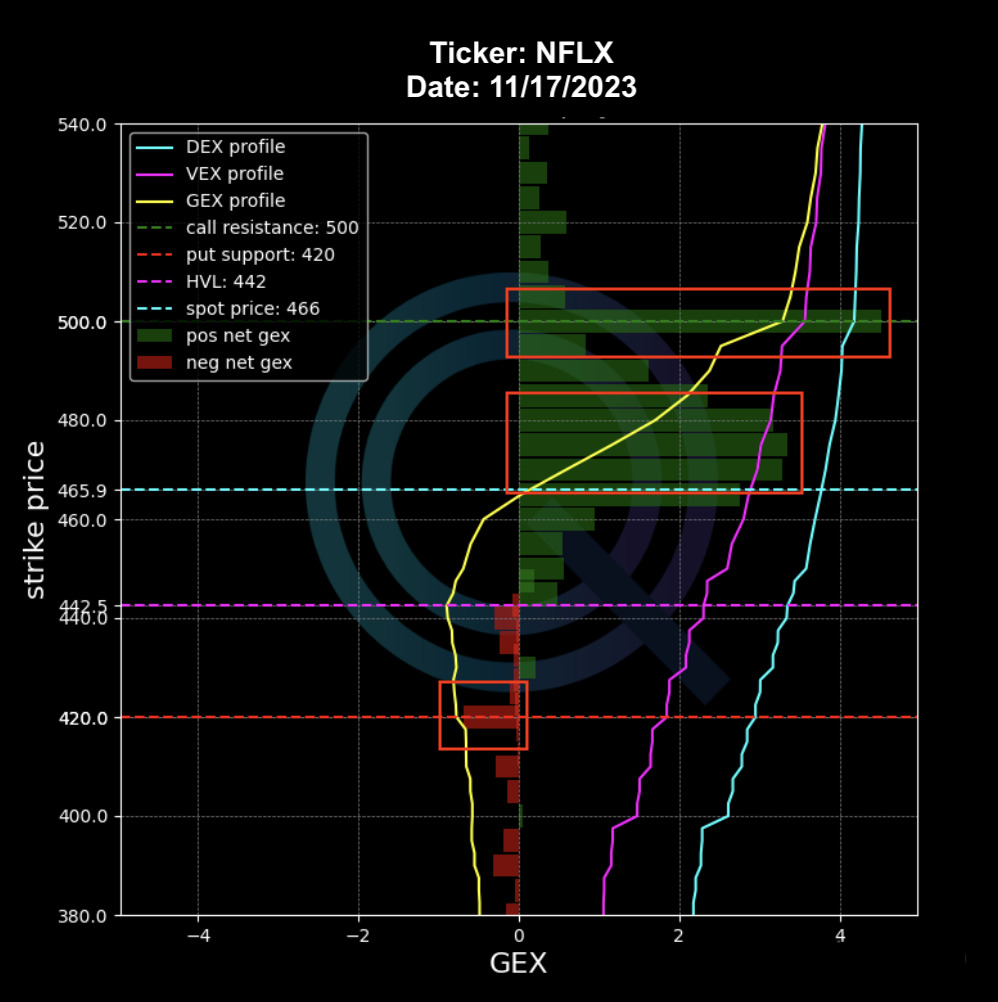

If you look at the Net GEX Chart, you can see that there are different levels that have the potential of being hit due to the size of the positive or negative gamma they carry. Here we see the Net GEX Chart of Netflix.

GEX Levels 0 to 10

The Secondary Levels are ranked from 0 to 10. They represent the 10 levels with the highest Net GEX within the 1D Exp Move range.

- GEX Level 0 is the secondary level with the highest Net GEX.

- GEX Levels 1 to 10 exhibit descending GEX values, with Level 1 having the second highest GEX and Level 10 having the lowest.

GEX Levels on TradingView

With the Menthor Q Levels Indicator in TradingView you will get access to our daily Key Levels that you can upload to the chart and monitor price action in real time.

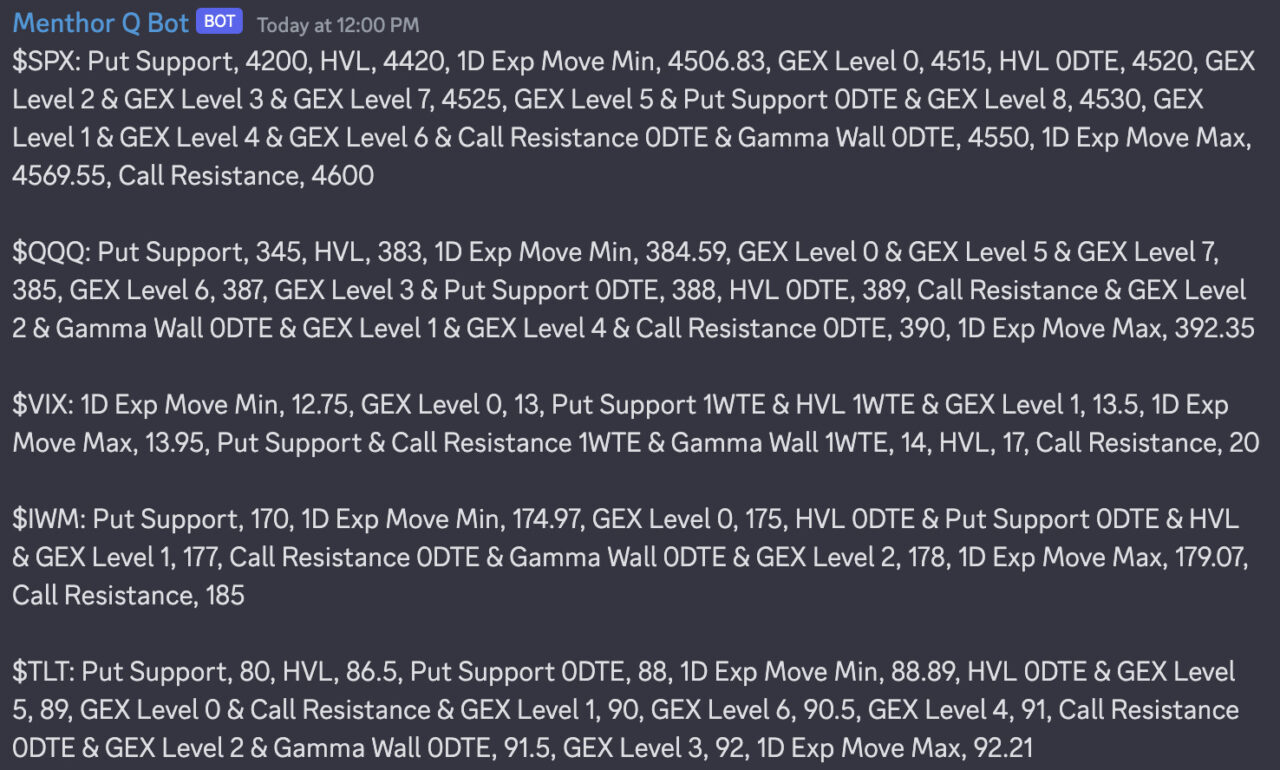

You can find the input for the Levels within our Free Daily Report or within the Premium Discord Server.

You can request levels for multiple tickers and add them to TradingView.

This is how they will appear in the chart using the Menthor Q Levels Indicator.

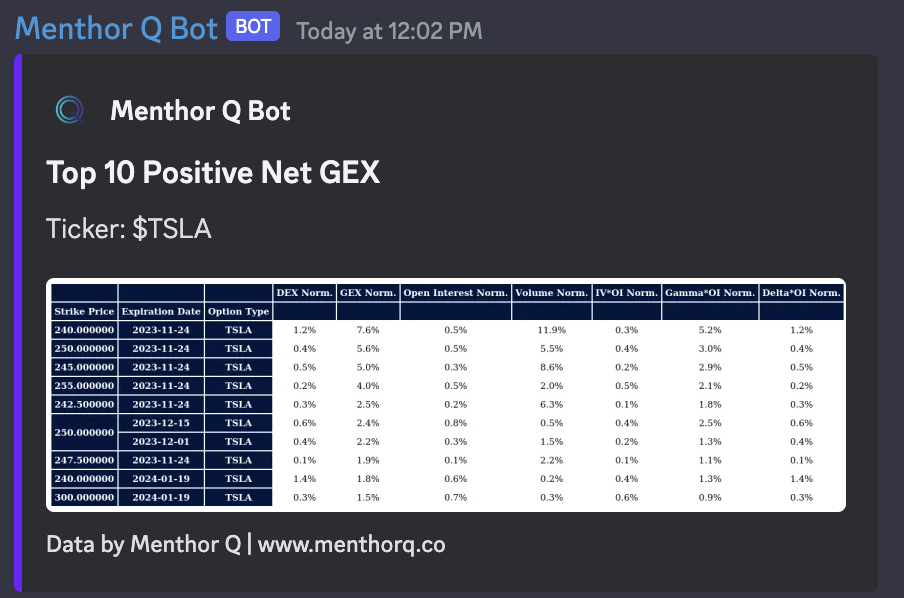

Top 10 Positive and Negative Net GEX

The GEX Levels 0 to 10 can also be seen in the Top 10 Positive and Negative GEX Commands within the Table. These levels represent the top 10 levels with Positive Net GEX (/posgex) and the top 10 levels with Negative Net GEX (/neggex). Here you can access the full list of Bot Commands.

You can access this Levels within the Premium Membership.