Iron Butterfly

Among the “Market Neutral” strategies, we have the Iron Butterfly. The Iron Butterfly strategy is part of a series of advanced options strategies. It is a neutral or Market Neutral strategy.

This type of strategy aims to generate returns from the collapse of volatility and the passage of time. It is a strategy that allows us to define our risk and return.

- The Iron Butterfly strategy involves selling an at-the-money call and put with the same strike, and buying an out-of-the-money call and put with the same expiration date, resulting in four total contracts.

- The purchase of out-of-the-money calls and puts protects the trader from significant price movements up or down.

How to set up an Iron Butterfly

The Iron Butterfly strategy can be implemented by executing trades for selling at-the-money options and buying out-of-the-money options.

For instance, for a stock quoting at $50, we can create an Iron Butterfly in this way:

- Short Put with a $50 strike

- Short Call with a $50 strike

- Long Call with a $60 strike

- Long Put with a $40 strike

The idea behind this strategy is to sell two at-the-money options to collect the premium and buy two out-of-the-money options to cap potential losses.

- It is a credit strategy as we collect a premium, which is the difference between the premiums collected from selling options and those paid for buying.

- The trader has the flexibility to choose the distance of the strike prices from the current quote, and depending on the distance, they will have a different risk/reward profile. The wider the spread between the strike of the short positions and the long ones, the higher the premium collected.

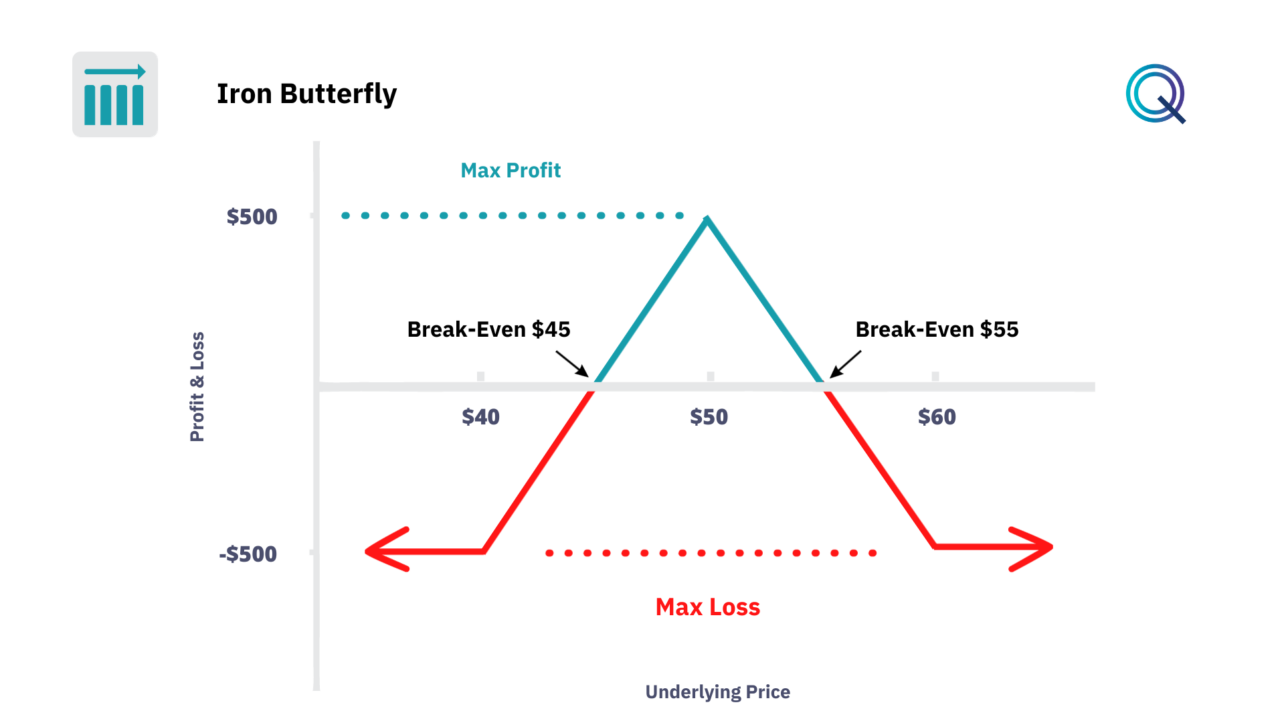

Payoff Diagram of the Iron Butterfly

Let’s look at the payoff of the Iron Butterfly Strategy. In this example, the stock is quoting at $50, and we execute four trades: we sell an at-the-money call and put with a $50 strike. Then we buy a call with a $60 strike and a put with a $40 strike.

This strategy is a credit strategy. Let’s assume our net credit (the difference between the premiums collected and those paid) is $5. We have a defined risk and return.

- The maximum profit is represented by the credit received. In this case, $500, which is $5 * 100 shares.

- The breakeven prices are calculated by adding and subtracting the credit received from the strikes of the short positions or sales. In this example, $45 and $55, which are $5 below the strike of the sold put and $5 above the strike of the sold call.

- The maximum loss is $500, which is the difference between the breakeven prices and the strikes of the purchased options.

Variables to evaluate on the Iron Butterfly Strategy

In this strategy, we are short options. When we are short options, we must therefore evaluate the impact of the following variables:

- Volatility. The Iron Butterfly is most profitable in environments where volatility is expected to decrease. Traders must forecast volatility accurately by analyzing historical data, current market sentiment, and upcoming events that could impact the underlying asset’s price.

- Premium. The key to profitability lies in the premiums. Traders need to navigate the balance between the premiums paid for the long positions and those received from the short positions to ensure a net credit that justifies the risk.

- Timely Adjustments. Active management of the Iron Butterfly may involve adjusting the strikes or widths of the wings in response to changes in the underlying asset’s price or volatility. This could mean moving the strikes of the short options to collect more premium or buying back the short options to reduce risk.

- Exit Strategies. Traders should establish clear rules for exiting the position, whether taking profits or stopping losses.

- Dynamic Delta Hedging. To face small adverse moves in the underlying asset, a trader might engage in delta hedging, adjusting the overall position to maintain delta neutrality.

- Leveraging the Greeks. Aside from Theta and Vega, understanding the impact of Delta and Gamma on the Iron Butterfly enables traders to make more informed decisions about position sizing and adjustments.

Conclusion

To recap:

- The Iron Butterfly Strategy is a Market Neutral strategy.

- Our position is Short Options.

- It is a Credit structure.

- The strategy benefits from the decrease in volatility.

- Time is a positive factor for this strategy.

Other Market Neutral Strategies

Here are other neutral strategies with Options: