Gamma Levels

In the last few years, Gamma and Gamma Exposures have become increasingly important for traders and risk managers. Post COVID-19 option volumes have increased exponentially, becoming an important flow in markets. These new flows, as you will discover following us, are an “hidden” force in the market.

By understanding how Market Makers manage this new risk a trader can get reliable and actionable data that can give you a market edge. This is also what we are looking to track by using our Q-Models.

Why is this important?

Because of this market shift now the options market has become increasingly important for different reasons:

- The increase in option volumes can increase or reduce liquidity in the market.

- Being able to track that liquidity can give us an edge and increase our profitability.

- Increase of option volumes creates technical moves in the market because of how market makers have to hedge their book. These technical moves can be determined by looking at the options greeks. Let’s start from gamma.

What are Gamma Levels?

Gamma Levels are Key Price Levels where there is more Negative or Positive Gamma based on market positioning and open interest. By looking at the options data we can define sticky price levels that can help us define our trading plan.

You can access Menthor Q Gamma levels via the Free Report or our Premium Membership.

We have also created the Menthor Q Levels Indicator for TradingView that can help you leverage these levels in real time.

What is Gamma?

Gamma is the first derivative of delta with respect to underlying price. Gamma measures the rate of the change in delta as the underlying spot moves.

Gamma is a numerical value that indicates the sensitivity of an option’s delta to small price movements in the underlying asset. It measures how much the delta will change for a one-point (or one-unit) change in the underlying asset’s price.

So you can think of Delta as speed while Gamma as acceleration. Gamma is ultimately the rate of change in an option’s Delta per $1 change in the price of the underlying stock.

- Long options have Positive Gamma

- Short options have Negative Gamma

Why are Market Makers exposed to Gamma?

Market Makers are exposed to gamma because they take the opposite side of that gamma profile you saw in the previous tweet. If we are able to follow that gamma, we have a better understanding of how market makers will have to delta hedge.

Delta Hedging increases or decreases liquidity in the market.

In the derivatives markets, transactions operate on a zero-sum principle. This means that for every trade there’s a corresponding buyer and seller.

In a typical options trade, one party is engaged in either the purchase or sale of an option with the intention of holding that position. On the other side the counterparty, often a market maker, engages in the trade without a specific economic necessity for the option.

As long as the market maker maintains this position, their goal is to minimize any market-related risk associated with it. This is typically achieved by limiting their exposure to the underlying market. with the strategy known as delta-hedging. This involves a continuous process of trading in stocks or futures, strategically balancing their positions to maintain a net exposure of zero to the underlying asset.

For a trader, having a sense of what a market maker is doing to the market liquidity can increase profitability.

Gamma Levels and Delta Hedging

Options price is affected not only by the directional movement of the underlying price but also by other Option Greeks. Market makers are not in the business of directional bets.

On a daily basis, a market maker would want to be market neutral. He is engaged in what is known as delta hedging. Throughout the day, the market maker will be forced to buy or sell the underlying to stay delta hedged and maintain a delta neutral position.

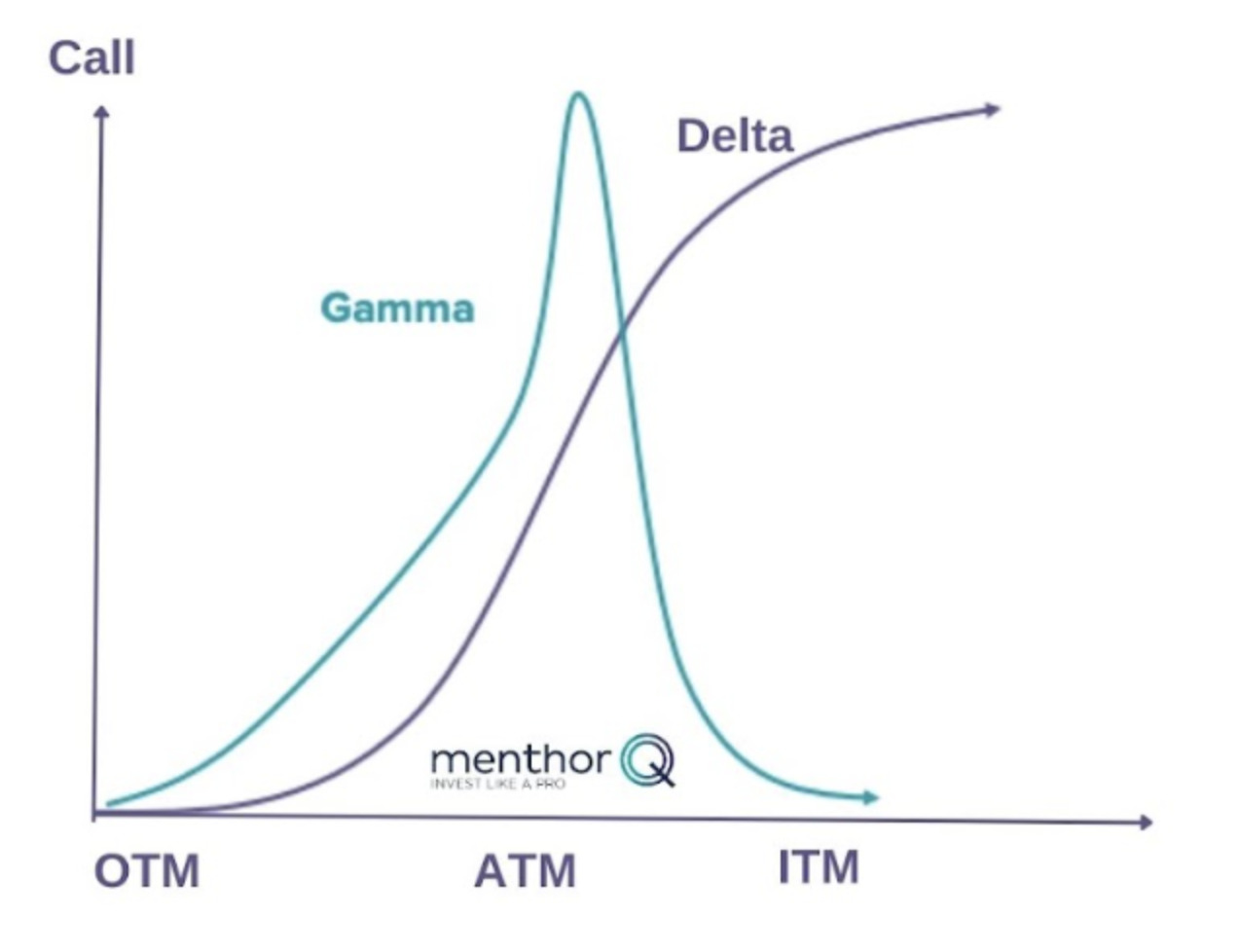

The relationship between Delta and Gamma

While GEX is the Gamma Exposure, the DEX is the Delta Exposure. The first one is better directed to gauge market volatility. The second one is liquidity and direction. Gamma and Delta however do have a relationship. Let’s take a look at the chart below.

From this chart, we can clearly see the relationship between delta and gamma.

- It is immediately clear that gamma increases as it moves away from out of the money and peaks close to at the money.

- The market maker has to hedge that delta curve as it moves between out of the money and in the money.

- Hedging that gamma helps him stay delta hedged (remember gamma is the change in delta).

Gamma Exposure

Market makers’ gamma exposure fluctuates constantly, and can be long or short depending on how the market participants are positioned. One important note, while there are many conspiracies out there accusing market makers of driving the market, the reality is that market makers are reactive.

That means, even if they move large volumes and are responsible for the liquidity shifts in the market, their role is reactionary, they react to traders placing bets.

How does the market maker hedge?

The market positioning changes daily. The market can be more bullish or more bearish. That positioning will affect the market maker’s positioning. There are two possible market scenarios, one in positive and one in negative gamma.

There are different ways that you can see whether the market is in positive or negative gamma by looking at our Q-Models.

You can access Gamma Levels on Stocks, ETFs and Indices within the Premium Membership.

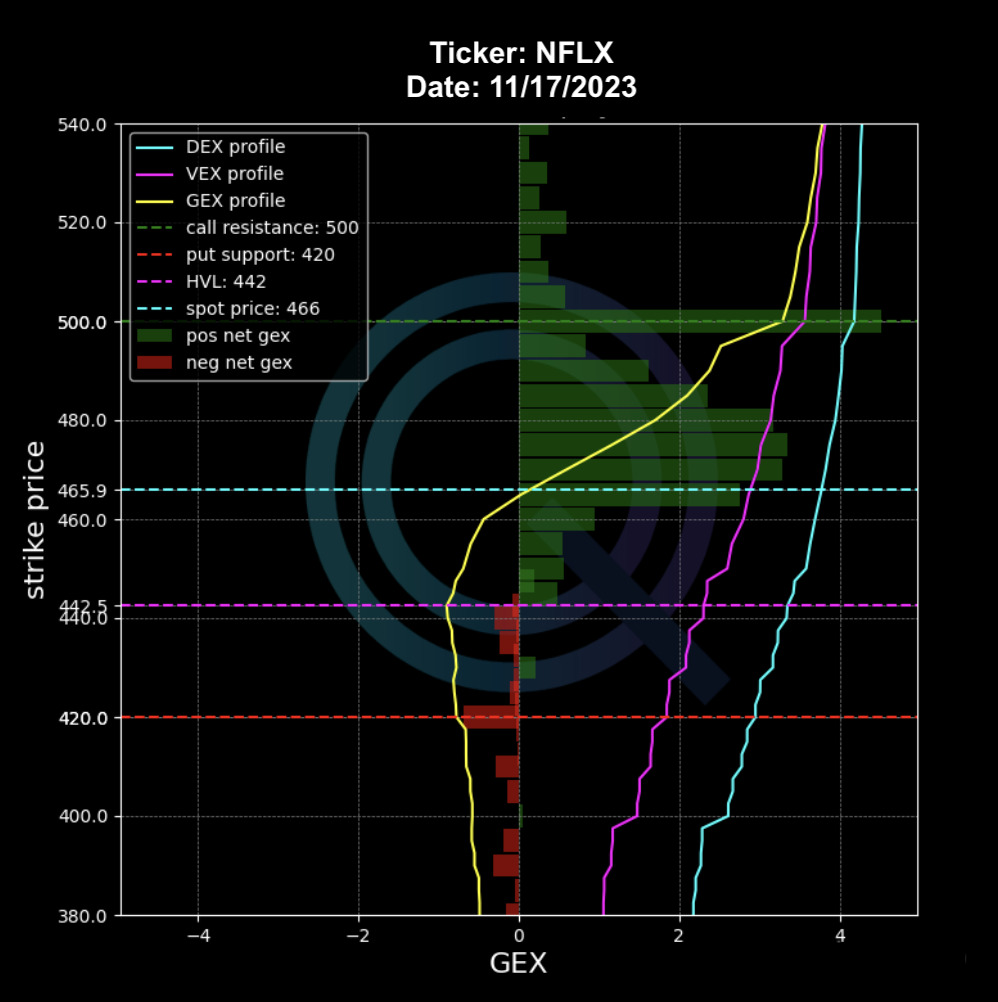

First the Net GEX Chart. The yellow line is the GEX Profile, when that yellow line is negative, that means the market is in negative gamma.

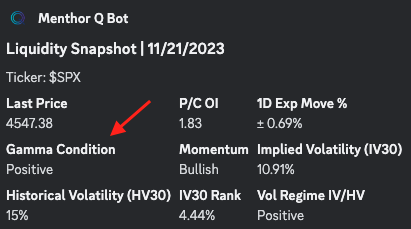

You can also look at an asset Gamma Condition via the Liquidity Snapshot within our Premium Membership.

How do Market Makers hedge in Positive or Negative Gamma

We have a separate article that describe Delta Hedging and how Market Makers Hedge in Positive and Negative Gamma. You can access the articles using the links below:

Let’s look at the difference in Hedging between the two regimes:

- In Positive Gamma the market maker buys when the underlying falls, and goes short when the underlying goes up. This suppresses volatility and keeps the market in ranges. In these cases we often witness slow rising markets or sideway moves.

- In Negative Gamma market makers hedge by selling the underlying when the price falls and going long when the market moves up. This naturally increases volatility as it accentuates market moves. This is when you see large directional moves.