Long Call

Among the Bullish strategies, we find the Long Call Strategy. One of the simplest strategies with Options is buying a call, or Long Call.

Buying a Call grants the buyer the right, but not the obligation, to buy a security (referred to as the underlying) at expiration (or by expiration) at a given price (strike). Each option contract gives us exposure to 100 shares of the underlying asset.

Why Buy a Call Option?

- With options, we can use financial leverage and use less capital to have the same exposure to the underlying.

- We buy a Call option if we have a bullish view on the underlying.

- At expiration or before expiration, we can exercise the contract and purchase 100 shares of the underlying at a lower price than the market value if the price has risen or resell the option contract at any time.

It is possible to purchase the call option directly from the broker. Through the option chain, we have the opportunity to choose the option’s expiration and the strike price. The price of options is called the premium and is the cost we must bear for its purchase.

The value of options depends on several variables also called Greeks. We cover the Greeks within our Resources section and our Academy.

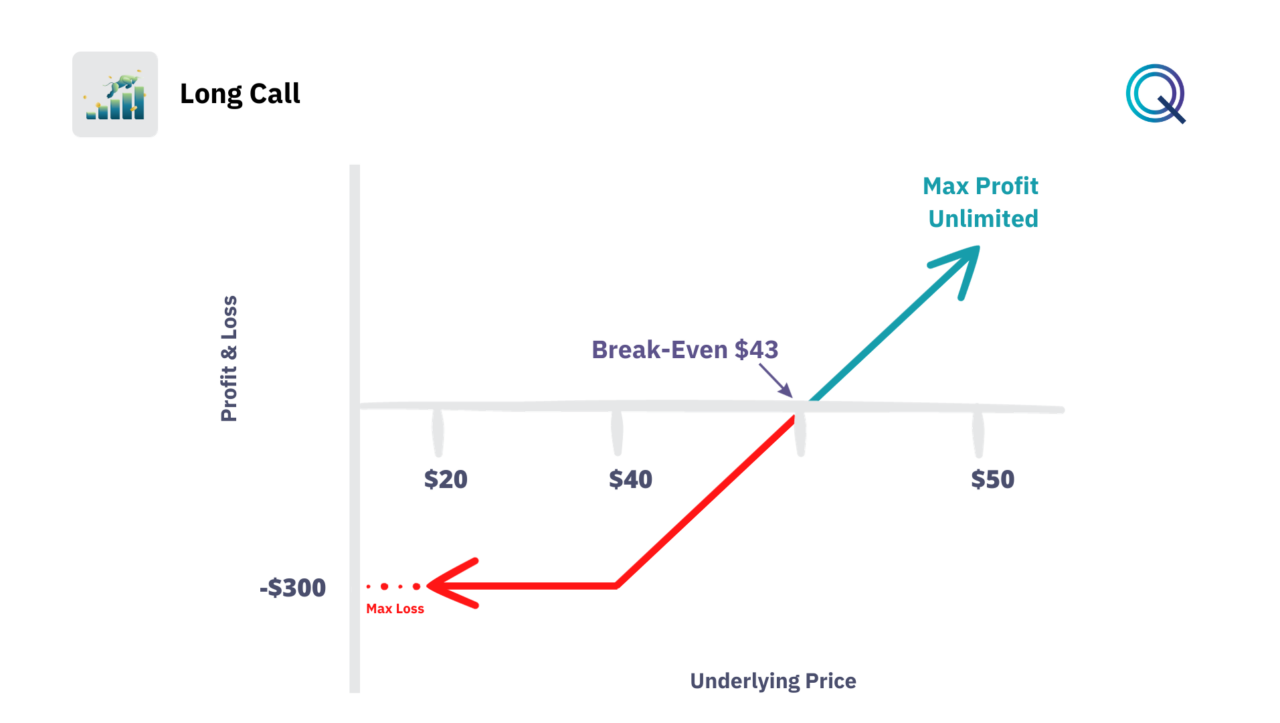

Long Call Strategy Payoff Diagram

Each option strategy has a potential return and a maximum potential loss. These two values can be displayed through the payoff chart. The graph shows the price of the underlying at expiration on the X-axis and the profit and loss of the strategy on the Y-axis.

The payoff of a Long Call can be calculated as the difference between the strike price and the underlying price at the time of exercise or expiration of the option, multiplied by the number of shares for each option contract (100 shares).

Here’s the formula:

Payoff = (Underlying Price – Strike Price) x 100 (Number of shares per option contract)

In this example, we purchased an option contract with a strike price of $40 for a premium of $3. The cost of our option is $300, that is $3 x 100 (number of shares).

- Our maximum loss will be $300 in the case where, at expiration, the price of the underlying is below our break-even point.

- The break-even point is $43 (strike price + cost of the premium). If at expiration the price of the underlying is higher than $43, our strategy makes a profit.

- The maximum profit for this strategy is potentially infinite as theoretically, the price of the underlying could increase indefinitely, although this does not happen due to the time to expiration.

Strategic considerations in Long Call Options

The Long Call strategy is often favored by investors for its simplicity and potential for high returns. Here’s a deeper look into this strategy.

- Selecting the Right Strike Price and Expiration. The selection of strike price and expiration date is crucial. Investors typically choose in-the-money (ITM) calls for a higher delta and probability of profit or out-of-the-money (OTM) calls for a higher leverage effect. The expiration date should align with the investor’s forecast period and risk tolerance, balancing the cost of the premium with the potential for growth.

- Risk Management. The beauty of the Long Call lies in its defined risk. The maximum loss is limited to the premium paid, making it an attractive proposition for those looking to cap their potential downside while enjoying the benefits of leverage.

- Breakeven Analysis. Understanding the breakeven point is key. It’s not just about the underlying price exceeding the strike price; it must also surpass the total cost incurred by the premium paid. The breakeven formula is straightforward: Strike Price + Premium Paid.

- Volatility’s Impact. Implied Volatility (IV) plays a critical role in options pricing. A Long Call strategy may benefit from an increase in IV, as it can lead to an increase in the premium. Professional investors monitor the IV to enter a Long Call position when they anticipate a spike in volatility, potentially leading to higher profits if they sell the option back to the market. When you trade options a key rule is to be on the right side of volatility.

- Time Decay and Theta. Time decay, or theta, is the enemy of the Long Call investor. As the expiration date approaches, the value of the option can erode if other factors remain static. This decay accelerates as the expiration date gets closer. Investors often manage this by choosing a longer-term option to minimize the impact of time decay or by actively managing the position to take profits or cut losses before time decay significantly erodes the option’s value.

- Rolling. During the trade, it will always be possible to convert our Long Call into more complex strategies such as Vertical Spreads, Straddle, or Strangle. There is then the concept of Rolling positions. Rolling allows us to extend the time available to allow the strategy to become profitable. Rolling in many cases has a higher cost.

- Leverage and Capital Efficiency. Options provide the ability to control a larger amount of the underlying asset with a smaller upfront investment. This leverage can increase returns, but it also amplifies the percentage loss if the stock moves in the opposite direction. Capital efficiency must be balanced with risk exposure.

We talk about this in detail in our Academy.

Tips for Long Call Traders

- Monitor Earnings and News. Events can cause significant price swings, which can impact the value of the Long Call position.

- Set Profit Targets and Stop Losses. Given the time-sensitive nature of options, setting clear objectives can help secure profits and limit losses.

- Stay Informed on Market Trends. A bullish strategy works best in a rising market. Keeping an eye on market trends can help in making informed decisions.

Advanced Applications of the Long Call Strategy

While a Long Call is straightforward, it can also be used as a stepping stone to more complex strategies. Converting a Long Call into a Call Spread, for instance, can offset the cost of the premium and cap potential losses further.

Moreover, rolling allows investors to adjust their positions to changing market conditions, extending the expiration date or changing the strike price, to better align with the new market outlook.

Conclusion

The Long Call strategy is the simplest along with the Long Put and is the building block of advanced and multi-leg strategies. With its unlimited profit potential and clearly defined risks, it provides a straightforward yet powerful way to capitalize on bullish market sentiments.

However, the key to success lies in understanding the nuanced dynamics of option pricing, IV, and time decay, coupled with disciplined risk management and market analysis. By mastering these factors, traders can use Long Calls to potentially enhance their investment returns while managing downside risk.

To recap:

- The Long Call Strategy is a Bullish strategy

- Our position is Long Options

- It is a debit structure (we pay a premium for this strategy)

- Our View is bullish on the underlying

- The strategy has defined risk

- The strategy has unlimited profit

- The strategy benefits from an increase in volatility

- Time is a negative factor for this strategy

Other Bullish Strategies with Options

Here are other Bullish strategies with Options: