Long Put

Among the bearish strategies, we find the Long Put Strategy.

One of the simplest strategies with Options is the purchase of a put, or Long Put. Along with the Long Call Strategy, they are the building blocks for more complex options strategies.

Purchasing a Put gives the buyer the right, but not the obligation, to sell a security (known as the underlying) at expiration (or by expiration) at a certain price (strike). Each option contract gives us exposure to 100 shares of the underlying.

Why Purchase a Put Option?

With options, we can use financial leverage and employ less capital to have the same exposure to the underlying. We buy a Put option if we have a bearish view on the underlying.

To go short on a stock, it is possible to do short selling, but depending on the broker and the market, there are sometimes limitations. Going short on the underlying has potentially unlimited risk, while buying a put has a defined risk as we see below. At expiration or before expiration, we can exercise the contract and sell 100 shares of the underlying at a price higher than the market value if the price has fallen or resell the option contract at any time.

It is possible to purchase the put option directly from the broker. Through the option chain, we have the opportunity to choose the expiration of the option and the strike price. The price of options is called the premium, and it is the cost we must bear for its purchase.

The value of options depends on several variables called the Greeks.

Long Put Strategy Payoff Diagram

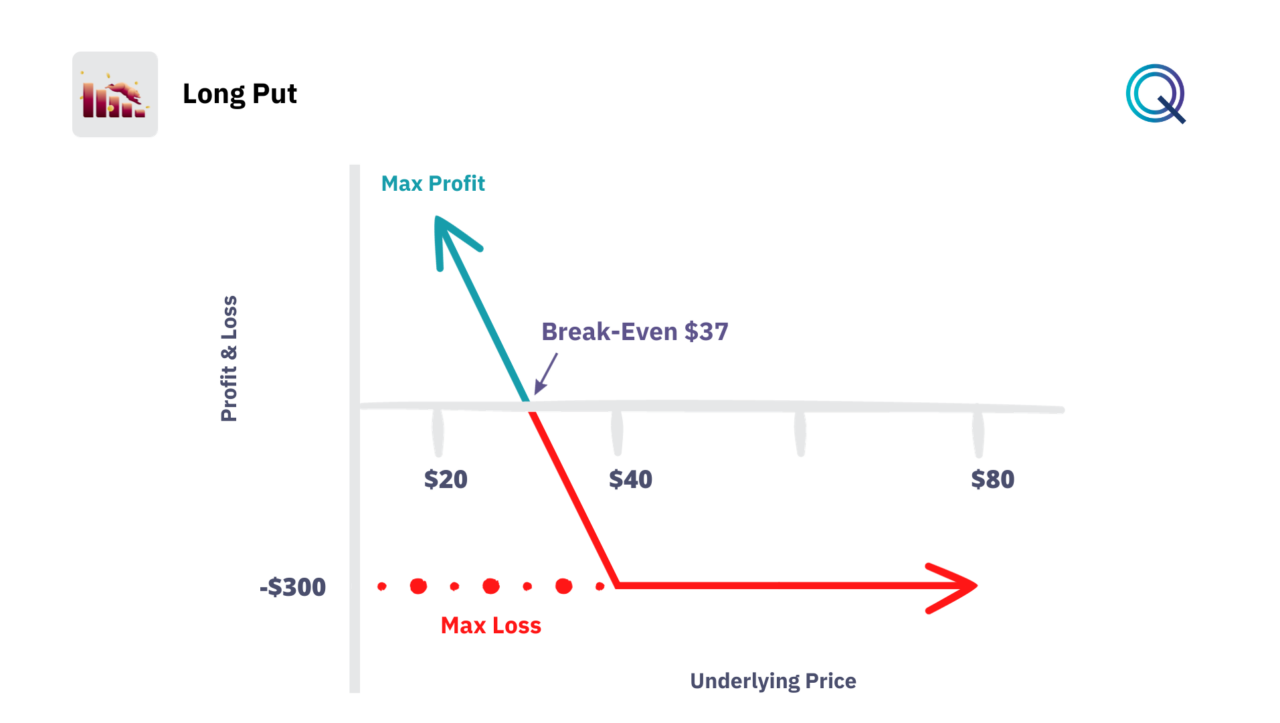

Each option strategy has a potential return and a maximum potential loss. These two values can be displayed through the payoff chart.

The graph shows on the X-axis the price of the underlying at expiration and on the Y-axis the profit and loss of the strategy. The payoff of a Long Put is slightly different compared to that of a Long Call. We have a bearish view of the underlying, and the put increases in value the more the price of the underlying approaches zero.

In this example, we purchased a put option contract with a strike price of $40 for a premium of $3. The cost of our option is $300, which is $3 x 100 (number of shares).

- Our maximum loss will be $300 in the case where, at expiration, the price of the underlying is higher than our breakeven.

- The breakeven point is $37 (strike price – cost of the premium). If at expiration the price of the underlying is less than $37, our strategy profits.

The maximum profit for this strategy is in this case limited to the value of the difference between the Breakeven price and zero, multiplied by the quantity of the underlying. Indeed, while for the strategy of buying a call the price of the underlying has no limits to growth, in the case of puts the price of a share can fall to zero and cannot go below.

Variables to Consider When Purchasing a Put

The Long Put strategy stands as a defensive strategy, particularly appealing during bearish market conditions or when downside protection for an existing portfolio is sought. There are many factors to consider:

- Strategic Applications of Long Puts. Investors often deploy the Long Put when they anticipate a downturn in either the broad market or a particular stock. It serves not just as a speculative tool betting on declines but also as a hedge against long positions in the underlying asset.

- Risk Management. The maximum risk is confined to the premium paid for the put option, which contrasts starkly with the unlimited risk profile of short selling the underlying asset directly.

- Premiums and Breakeven Points. The premium paid upfront for the put option defines both the total risk and the breakeven point for the strategy. This breakeven point is calculated by subtracting the premium from the strike price. Only if the underlying asset’s price falls below this threshold can the Long Put position turn profitable.

- Maximizing Profit Potential. While the Long Put strategy caps the maximum loss at the premium paid, its profit potential is substantial, stretching all the way down to the underlying asset hitting zero. This asymmetric payoff structure is what makes Long Puts a particularly attractive option during times of expected volatility or bearish market sentiment.

- Implied Volatility. Implied Volatility (IV) plays a crucial role in the pricing of options, and an increase in IV can lead to higher premiums. This can be advantageous post-purchase of a Long Put, as the rise in IV can inflate the value of the put option, potentially leading to profitable exit opportunities before expiration.

- Time Decay. Time decay, quantified by the Greek letter Theta, is a critical consideration for Long Put holders. As expiration approaches, the option’s extrinsic value diminishes, which necessitates a more substantial move in the underlying asset’s price for the strategy to remain profitable. This makes timing a factor for consideration.

- Adapting to Market Movements. The flexibility of options allows for strategic adjustments mid-trade. If market conditions change or the underlying asset’s price moves unexpectedly, the Long Put position can be modified, either by rolling to a different expiration date or adjusting strike prices.

- Integration with Complex Strategies. For those looking to leverage the foundational aspects of Long Puts, these can be incorporated into more intricate strategies such as Vertical Spreads, Straddles, or Strangles, allowing for nuanced market plays that can benefit from various price movements and volatility levels.

Conclusion

The Long Put strategy offers investors an approach to benefiting from downturns while keeping risks in check. As with all options strategies, understanding the correlation between market conditions, implied volatility, and time decay is important.

To recap:

- The Long Put Strategy is a bearish strategy

- Our position is Long Options

- It is a debit structure

- Our View is bearish on the underlying

- The strategy benefits from an increase in volatility

- Time is a negative factor for this strategy

Other Bearish Strategies

Here are other bearish strategies with Options: