Menthor Q Setup Guide

Welcome to Menthor Q! This is our Setup Guide that will allow you to get familiar with our products, our content and help you leverage our data to become a more profitable trader. We are going to break it down in steps and share the relevant documentation that will help you understand our models.

Menthor Q Documentation. We have a dedicated section with Guides, Tutorial Videos, Articles and more.

What Data do we Provide?

We build Quantitative Models and Data that we provide to our users daily. Within our Free and Premium Membership you will be able to access:

- Gamma Levels on Stocks, ETFs, Indices, Futures and Crypto

- Advanced Quantitative Liquidity Models (CTAs, Vol Control Models and Momentum)

- Community and Trading Rooms

You can access these models within our Premium Membership. On top of that we have also created an Academy to allow you to learn the theory and how to use our models. You can Join our Academy here.

Why do you need to understand the importance of Options and advanced Quant Models?

Weather you are a Stock, Futures or Options Trader you cannot ignore the importance of Options and the impact they can bring to the price action of your asset.

Options are becoming more important for investors. Even if you don’t trade options you need to be aware of how options can affect the underlying price.

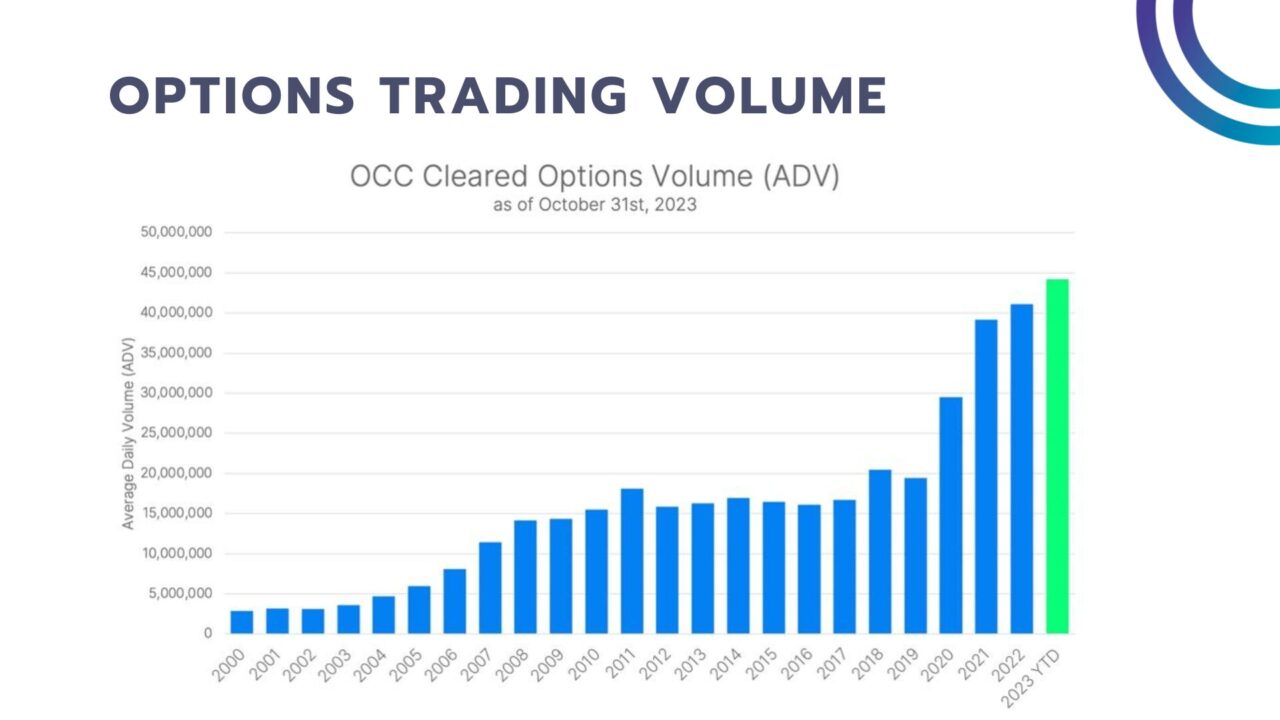

In 2021 Options volumes surpassed Equity Volumes for the first time. Options are becoming more important and this trend is here to stay. Because of the increased volume of options and leverage that comes with it, a trader cannot afford to ignore these flows like before. Options volumes have become one if not the key flow that is responsible for certain price action. Understanding it will make you a better risk manager and a more successful trader.

In this Podcast together with Anthony Crudele we go over Gamma Levels and how Stock, Options and Futures Traders can leverage them to their advantage.

Step 1. Menthor Q Discord Server

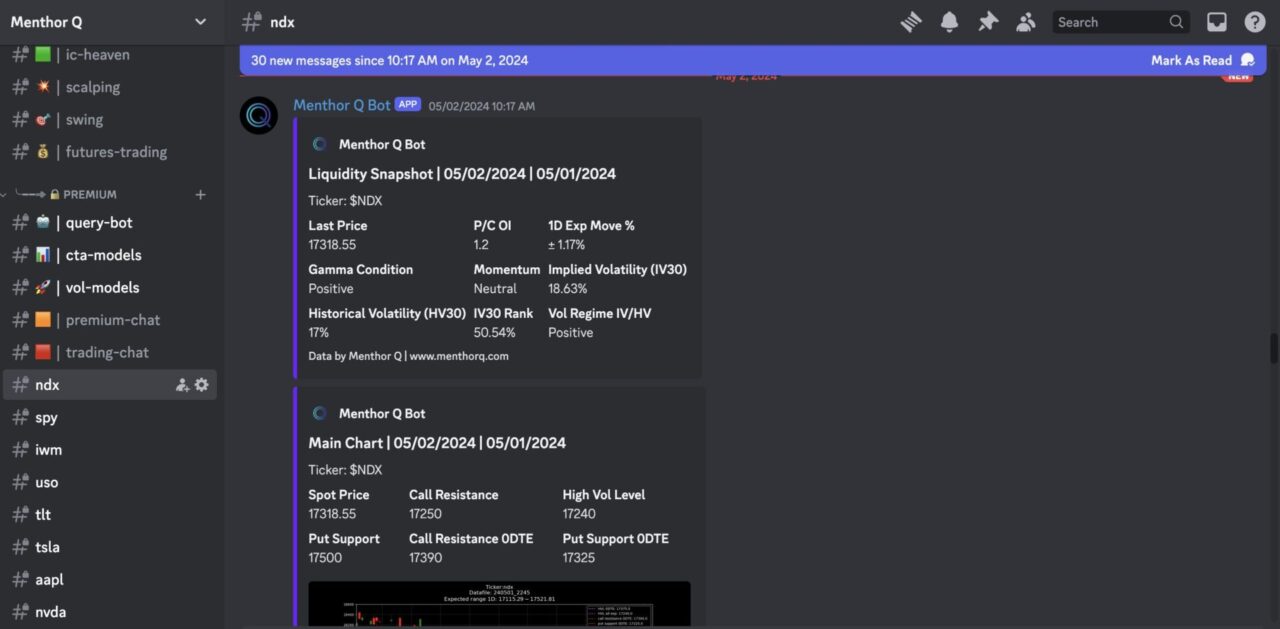

You can access our Free and Premium Membership directly via Discord. Here you can access our Community and Data on a daily basis. Join Menthor Q Discord.

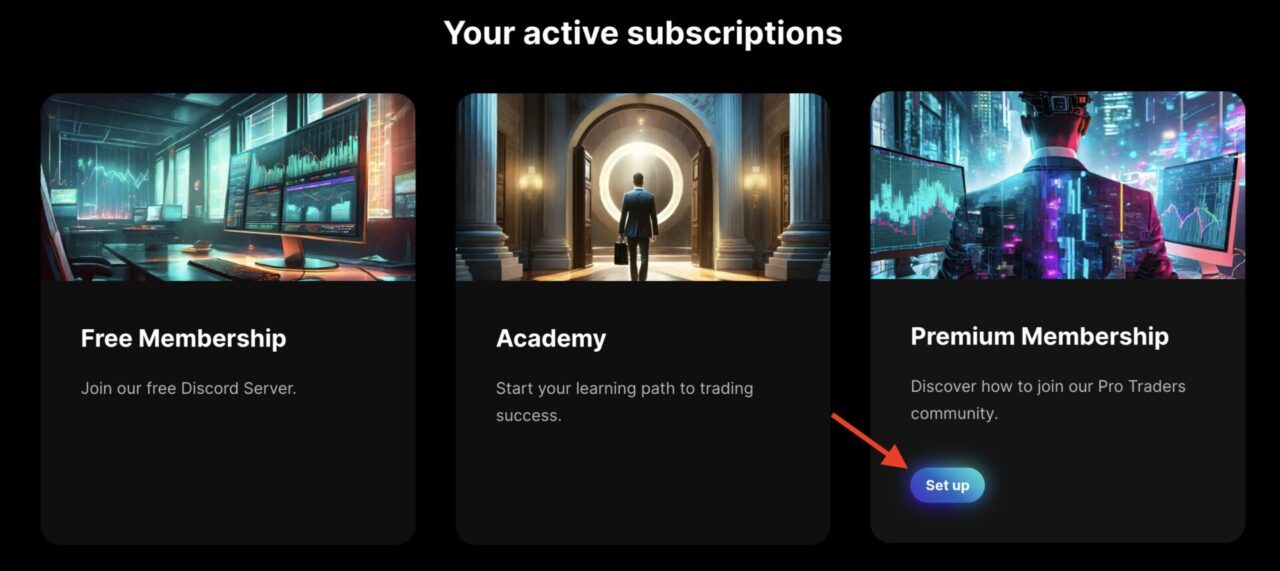

Step 2. Activate your Premium Membership

If you signed up for the Premium Membership and you don’t have access to the Premium Channels you will need to activate the membership. You can do so by logging in the “My Account” section of our website. Then click on the Set Up button and follow the instructions.

Step 3. How to use the Premium Membership

Within Discord you can access our Discord Bots and our data. Here are some links that will help you get started.

- First we want to understand how to use the Bots and what is available within the Premium Membership. You can access a product demo using this Guide.

- Then we want to check all the available commands within our Bots. Check out our Bots Commands here.

Step 4. Learn about the Menthor Q Data

Within our Membership we provide daily Charts, Tables and Models on Stocks, ETFs, Indices, Futures and Crypto.

To better understand our data you can use the following Guides:

- How to read the Menthor Q Data and Daily Report

- How to get set up with Menthor Q in less than 5 minutes

Step 5. TradingView Integration

We now provide access to our Premium Subscribers to two indicators:

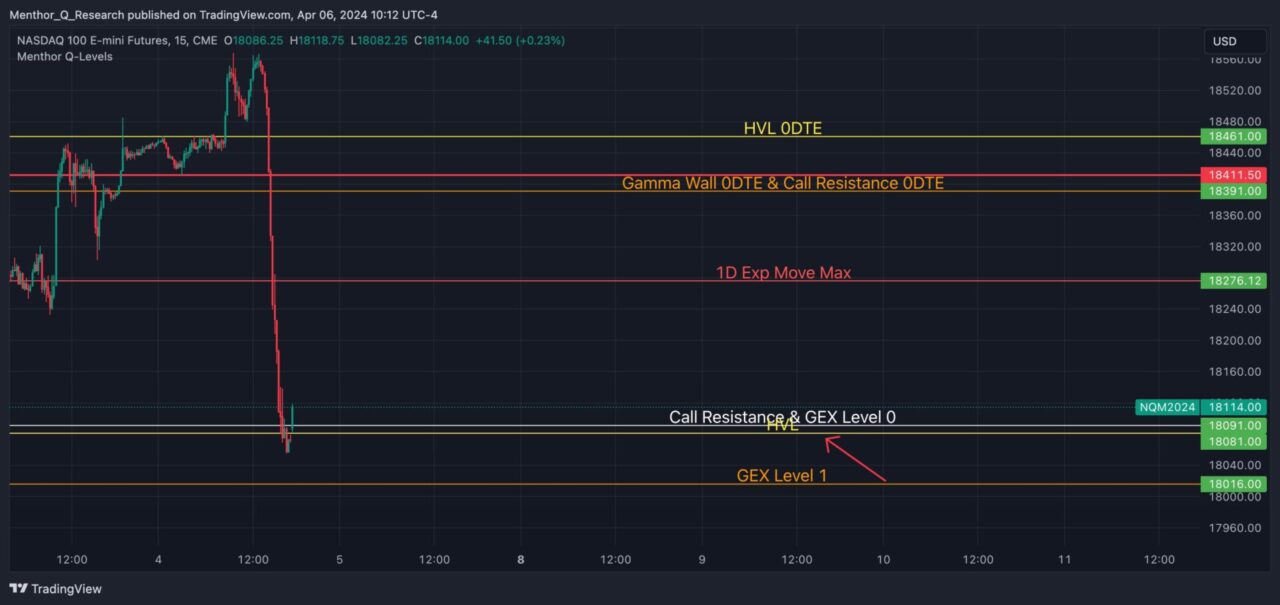

- Menthor Q Levels indicator. You can now plot Gamma Levels on Stocks, ETFs, Indices, Crypto and Futures directly into TradingView. Check out our Tutorial Video.

- Menthor Q Momentum Indicator. Premium Members can now access our Momentum Indicator. You can now access 3 indicators in one: Support and Resistance, Fibonacci Retracements and Volume Profile. They will dynamically update in the chart. Check out the indicator.

Step 6. Understanding the importance of Market Makers Flow

Then we need to understand the importance of Market Makers and how their flow can impact the price action of any asset.

The Market Maker is a key player to ensure liquidity in the market. They provide bids and ask prices that we can use to buy or sell our options. By providing Liquidity they take on a risk. The first step is to understand how Market Makers make money. They do not make money from the direction of the trade. They make money by charging a spread on volumes executed.

To protect themselves from losing money, Market Makers use a strategy called Delta Hedging. It is a complicated concept that involves the understanding of how Options Greeks works and today we are not going to go into the details of it. In the simplest form, that means that the market maker is always hedging its portfolio making trades that offset their risk. They buy or sell the underlying asset based on the change of the price, volatility and time to expiration. This activity is like their own protection. It helps them not lose money when the market falls.

Because the Market Makers are buying and selling the underlying, this affects liquidity of the asset and can affect the price action. You can learn more about Delta Hedging using the link below:

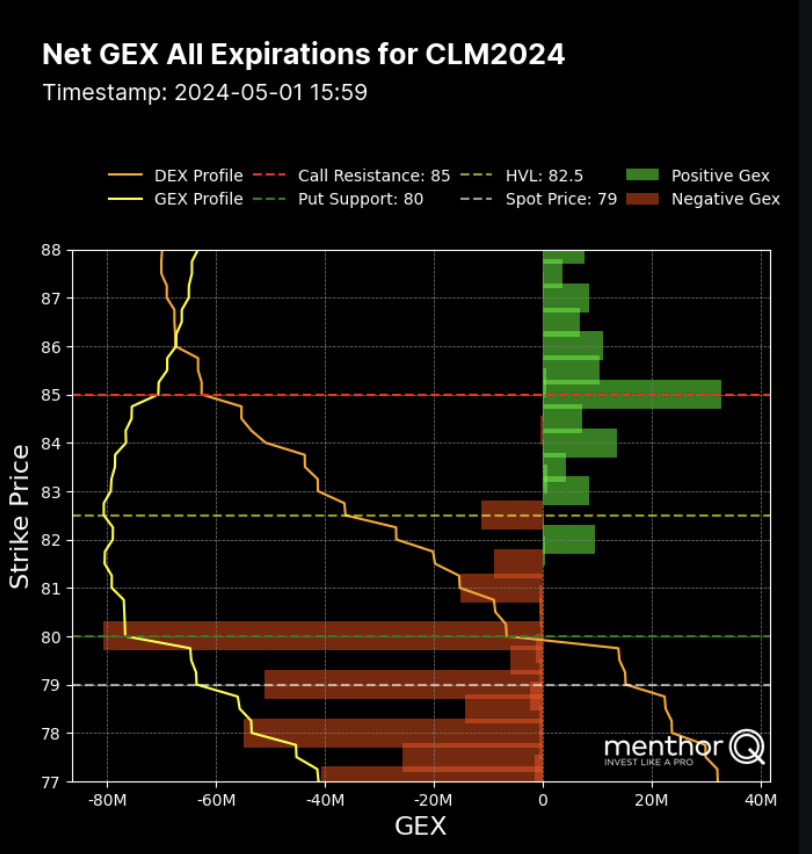

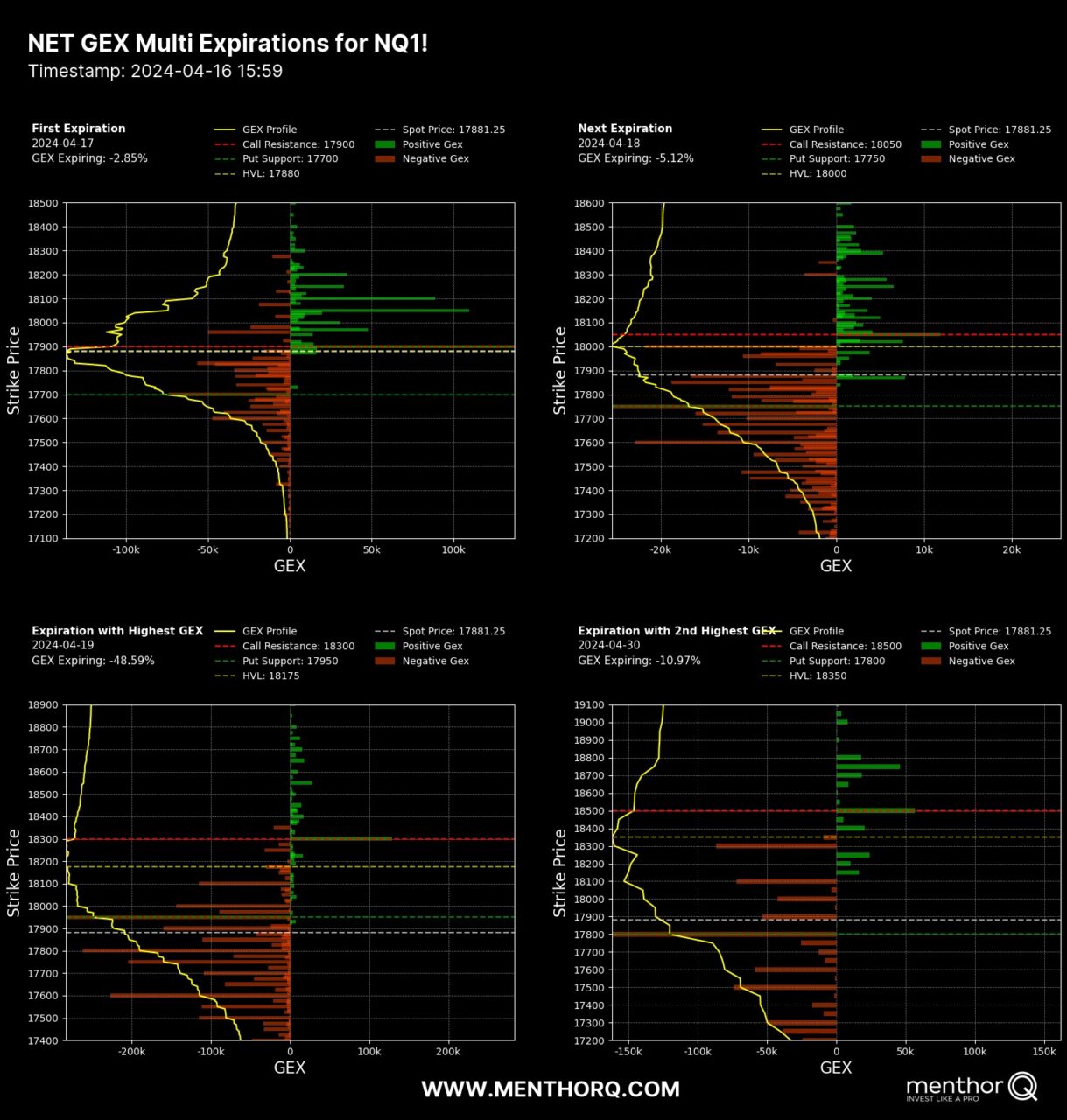

Step 7. Menthor Q Gamma Levels

Now we can move to the exciting part which is use the Menthor Q Gamma Levels. They can be integrated directly into TradingView.

The gamma levels can be divided into two types:

Primary Levels

Here we have dedicated guides that show you what they mean and how to use them for your trading:

We also have developed some backtesting results on the Success of the 1D Exp Move Indicator. Check our Backtesting Results here.

Secondary Levels

Then we have our Secondary Levels.

Step 8. Menthor Q Quant Models

We have also developed a series of advanced Quantitative Models to help you better understand Liquidity and Momentum:

- Menthor Q CTAs Model

- Menthor Q Volatility Control Fund Model

- Menthor Q Momentum Models

- Menthor Q Liquidity Barometer

Step 9. Case Studies

We have also a series of success stories and case studies that you can find within our Resources section:

Step 10. Menthor Q Academy

We have also created an actionable course where we cover Options Greeks, Technical Analysis, and how to read the Menthor Q Models. Check out our Free Lesson here. Join our Academy.

If you have not yet signed up for our Premium Membership you can try it here.