Menthor Q Trading Rooms

Today we want to spend time talking about our Trading Rooms and the value they bring to our customers.

The key success for every trader is access to actionable information and being able to manage risk with the goal of creating a successful strategy. Menthor Q not only provides you with actionable data but we have created a community of professional traders that can help you learn. The best way to improve is to learn from the experience of professionals.

Now you can do this with Menthor Q. We provide access to some of the best traders in the market. Each of them have their own view and strategy and this is what we will discuss today.

You can access the Trading Rooms within the Premium Membership.

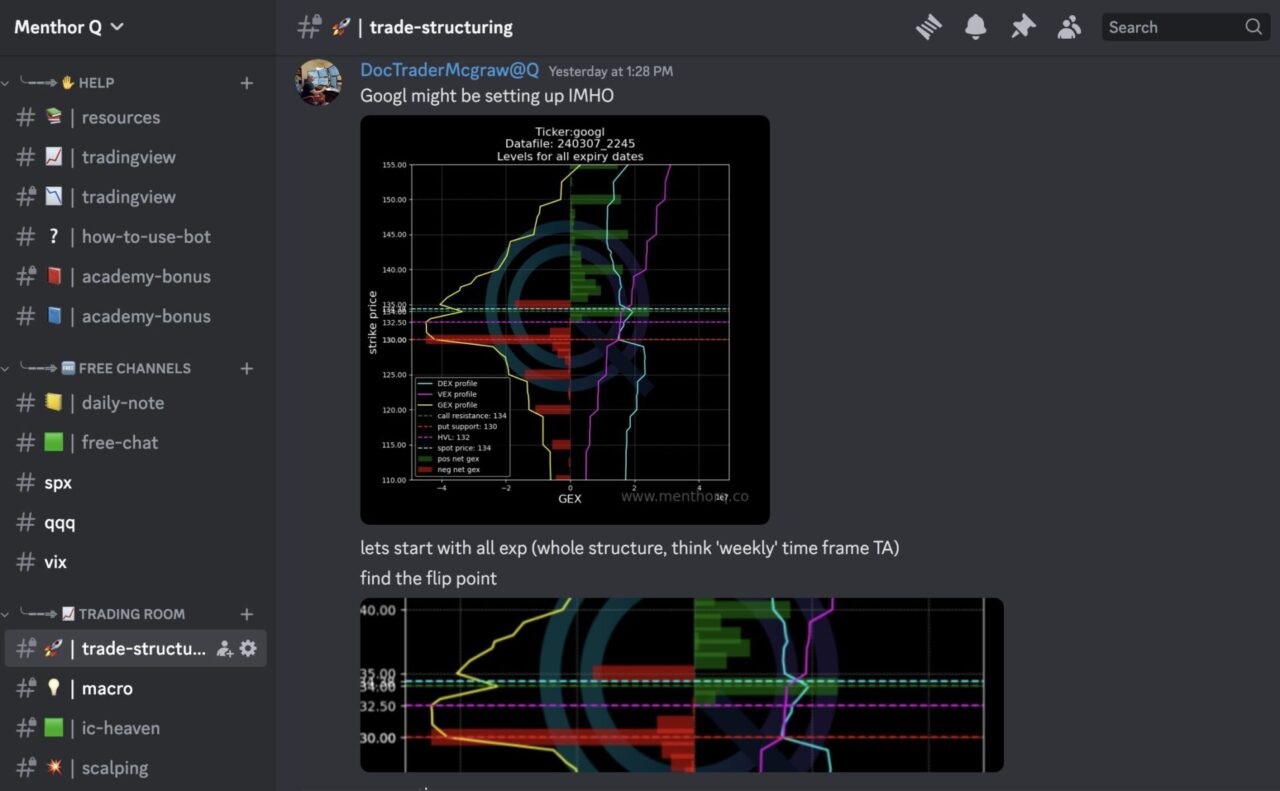

Trade Structuring Channel

The first room we started is the Trade Structuring Channel. The goal of this channel is to show you how to read our data, our Q-Models that you can access via the Premium Membership. Our traders are active usually as early as 5 am EST in the morning.

The goal is very simple, is to teach you how to turn our data into actionable trades. We noticed from your feedback that this was one of the biggest gaps, turning the data into your trading.

In this room we also try to understand what the secondary effects of hitting a key level are. We look at positioning and then try to understand how the movement of spot, volatility and time can affect the price action. We put intro practice what we wrote in these article about Delta Hedging:

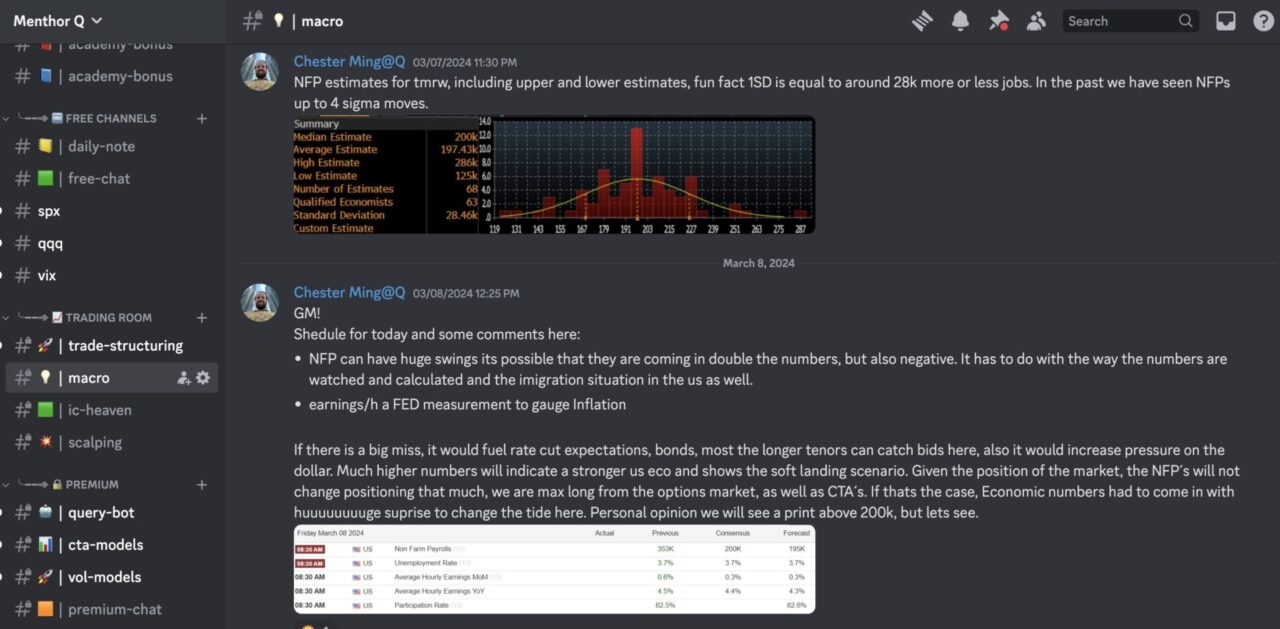

Macro Channel

In the Macro channel we follow the same format as in the structuring channel:

- Data

- Pre-market analysis

- Set Up / Execution

- Risk Management

The only difference is that here, our traders scout the market as a whole to find actionable ideas. Our Option Screeners became a key starting data point. From there we try to link option data with across assets to find an actionable idea.

The assets covered go from Bonds all the way to Bitcoin. This channel can be used for short term ideas or to understand how asset classes are rotating long term.

Scalping Room

The scalping room is the latest of the rooms to be added. Here we use momentum data to place trades or support what you are seeing in the option chain. To describe this channel we can just use the words of Bart, the trader driving the room.

“Scalping is not an easy business, but can be very profitable if you know what you are doing. I like scalping because you get in and out fast (make or lose money and then move on). I will outline the general approach.

The market moves in a stair step manner in opposite directions. We have days of consolidation and chop. Days of strong direction and days of meandering around all over the place. Understanding Gamma levels and the rest of the Greeks helps us “predict” the type of day we might have. With that said, let me describe my approach. Price oscillates and there are extremes in all time frames, the trick is finding them.

So, apply your favourite oscillator to a short time frame chart. I use:30 seconds, 1minute, 5 minutes and 15 minute charts. If you see an extreme overbought or oversold situation there is a good chance that the move will reverse, at least for a minute or two. This represents an opportunities”

These are some of the indicators we use in the channel every day.

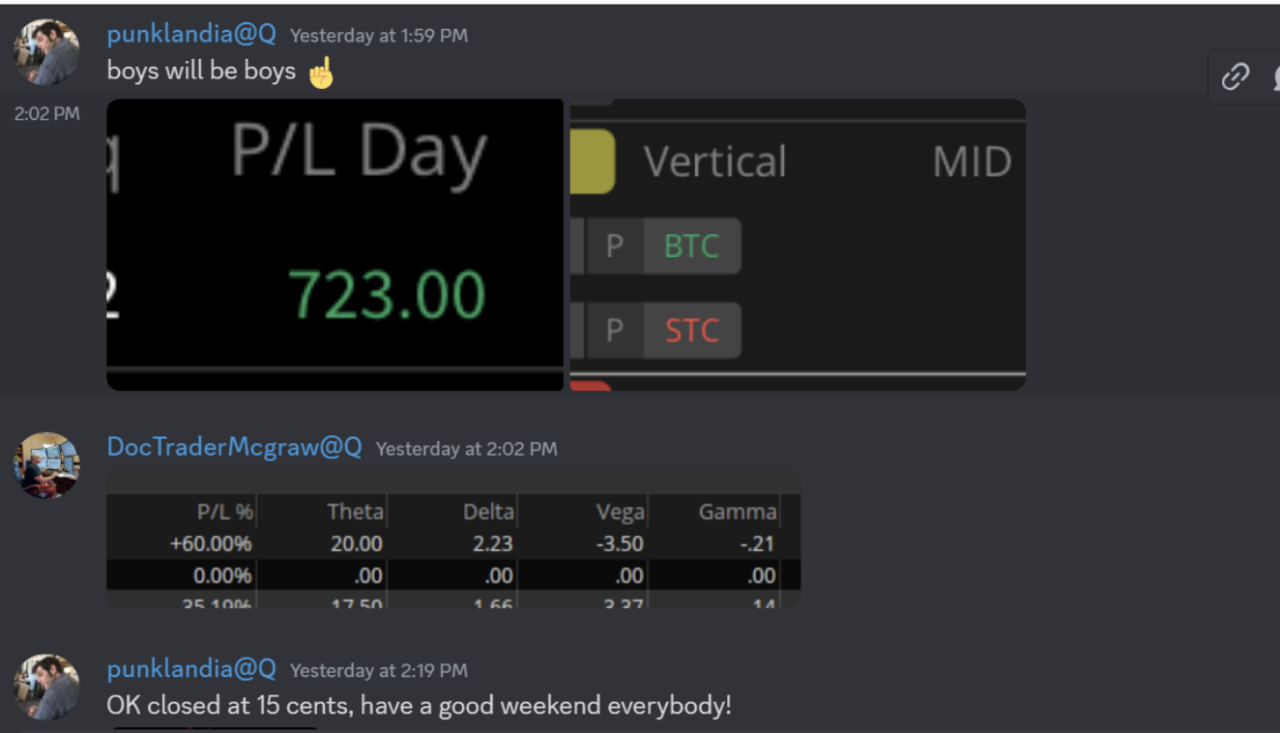

Iron Condor Room

Finally the Iron Condor room. In this one we just do that, help you structure an Iron Condor Strategy.

What is an Iron Condor?

An Iron Condor is an options trading strategy designed to profit from a stock or market index trading within a specific price range over a certain period of time. This strategy is particularly favoured by traders who expect low volatility in the market and wish to capitalize on the relative stability of the underlying asset. It involves four different options contracts, making it a combination of a bull put spread and a bear call spread.

- Sell 1 OTM Put

- Buy 1 OTM put with a lower strike

- Sell 1 OTM Call

- Buy 1 OTM Call with a higher strike

It is a neutral or Market Neutral Strategy. This type of strategy aims to generate returns from the collapse of volatility and the passage of time. It is a strategy that allows us to define our risk and return. It reaches maximum profit if the price of the underlying stays within the strikes, and the structure expires worthless at expiration.

Every day our Traders look at Key Levels, Volumes and Open Interest to select the strikes for this strategy. If you want to learn more about Iron Condor you can follow the Iron Condor Room.

We also wrote a Guide on How to Trade 0DTE Options and our process.

If you want to access the Trading Rooms join our Premium Membership.