Option Expiration Week (OPEX)

Option Expiration Week refers to the week in which options contracts expire. Options contracts have a predetermined expiration date, and they become worthless after that date.

Unlike stocks, options have an expiration date. Therefore, an options contract has a duration, and after the expiration, it can no longer be exercised and has no value. At expiration, we can exercise the contract or close the contract and resell it on the market. OPEX brings volatility to the market and it can affect price movements.

In most financial markets, options contracts have standardized expiration cycles. These cycles can be categorized into different time frames, including weekly, monthly and quarterly. Option expiration week typically occurs at the end of the options cycle that corresponds to the specific expiration date.

Types of Options

There are two main types of option contracts: American and European. The main difference is that American options allow us to exercise them at any time even before expiry. In practice this typically does not happen, but they offer this possibility. European ones, on the other hand, can only be exercised on the day of expiration.

There are some key points about option expiration week:

- Weekly Options: Some markets, particularly stock and index options, offer weekly options with relatively short expiration periods. These options expire on a weekly basis, typically on Fridays. Traders can use these shorter-term options for more tactical, short-term trading strategies. Due to time decay, weekly options typically lose value very quickly if the underlying moves in the opposite direction. It is difficult to recover the loss and this makes them more risky. Also many weekly options have less liquidity and typically a wider bid/ask spread. They are available on stocks/ETFs and indices.

- Monthly Options: The most common expiration cycle for stock and index options is monthly. These options typically expire on the third Friday of each month. This is often referred to as “standard expiration.” Option expiration week for monthly options is the week that leads up to the third Friday of the month.

- Quarterly Options: In addition to weekly and monthly options, some markets offer options with quarterly expiration cycles. These options expire on the last trading day of the quarter, which is typically in March, June, September, and December.

Investors should be aware of option expiration dates and plan their strategies accordingly.

Why does OPEX have a link to Gamma?

The gamma of an option is the change of the delta relative to its price. That means, that if moneyness changes, then we can see a big market movement due to gamma.

If the option goes from OTM to ITM all of a sudden there is going to be a spike in gamma that will drive a movement in delta and to hedge that position the market maker is going to have to enter the market and that drives liquidity and price action.

Because of these gamma effects, the market can get pinned at a specific strike based on current positioning. As a trader you can take advantage of option expiration by either buying or selling options.

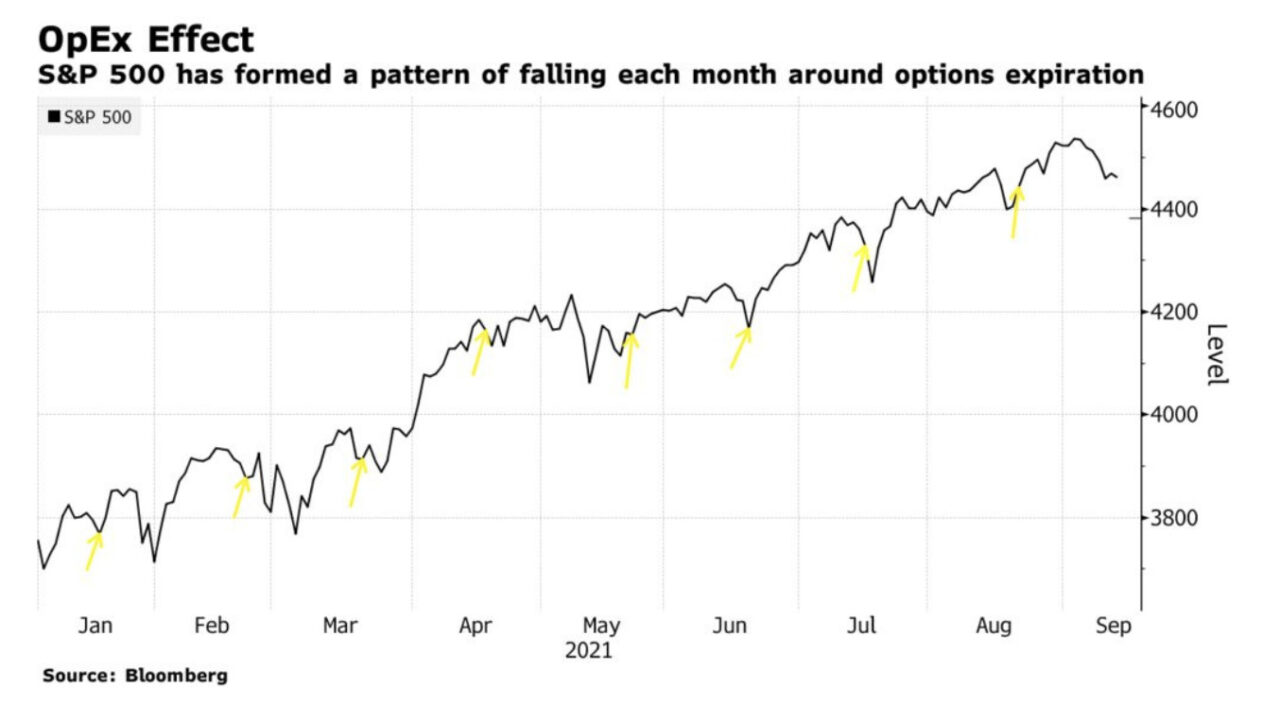

You must have seen this chart floating around before. But it really makes the point in showing how OPEX can alter gamma and market by pinning it.

Technical price movements after Option Expiration Week

OPEX is a key event that typically brings volatility where we tend to see technical movements in prices.

To understand this point, we need to go back to the concept of moneyness. Different moneyness have a different greek movement associated to it. Specifically for delta.

- If an option expires OTM, there will be no directional move as the delta will be zero.

- Instead ITM options will behave as if you were long the underlying, meaning that the delta for an ITM option is 100.

What does all of this have to do with Gamma?

As we explain in our Academy, the gamma of an option is the change of the delta relative to its price. That means, that if moneyness changes, then we can see a big market movement due to gamma.

- If the option goes from OTM to ITM all of a sudden there is going to be a spike in gamma that will drive a movement in delta

- To hedge that position the market maker is going to have to enter the market and that drives liquidity and price action.

Because of these gamma effects, the market can get pinned at a specific strike based on current positioning. As a trader you can take advantage of option expiration by either buying or selling options.

Option Exercise, Assignment and Delta Hedging

The reason why the Option Expiration Week is so important is because a few things could happen:

- Options Exercising, When options expire, holders may choose to execute the underlying transactions if their options are profitable or ITM. This can increase buying or selling activity in the underlying asset.

- Options Assignment. Option writers can be assigned and exercise notice if their options are profitable and holders decide to exercise them. This creates an obligation for writers to buy or sell the underlying asset, affecting its price.

- Hedging Activities. Traders and market makers engage in hedging to manage their options positions. As expiration approaches, they adjust their hedge by buying/selling the underlying asset, influencing market prices. They can also roll their positions in the future.

- Pinning Effect. This occurs when the underlying asset price tends to gravitate towards heavily traded option strike prices near expiration. Traders try to profit from options expiring at specific strike prices, leading to increased trading and price activity around those levels.

- Volatility Impact. Option Expiration can increase market volatility as traders adjust positions or implement trading strategies based on expiring options. This increased volatility can result in larger price swings and potentially impact overall market sentiment.

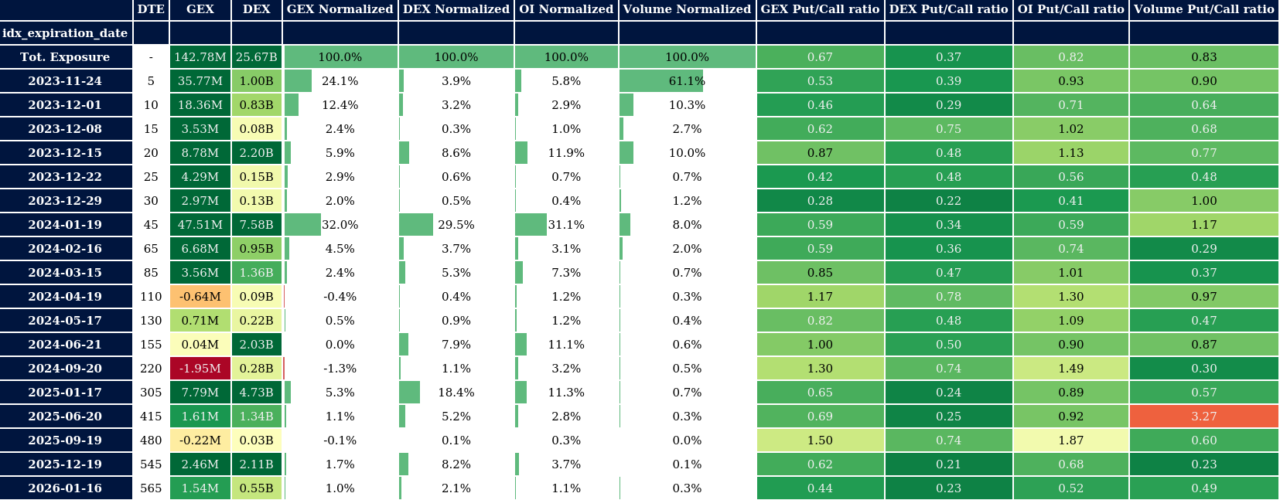

- Gamma. When there is an expiration, gamma is removed from the market. So knowing what positioning is prevalent in the market, can help us gauge potential moves. Using our Option Matrix, you can see the exact amount of GEX expiring.

Is Option Expiration Week positive or negative for market moves?

The best way to explain this concept is to take a specific example. Below you have a tweet from October 10th 2023. Let’s isolate everything that is geopolitical or that can have an impact on the market. For the purpose of this example let’s focus on positioning.

In the examples, the market price had been moving down for a few days. Spot price was reaching 4250 that was the level with most put activity, the Put Support level. In the Option Matrix below you can see how big that Put Support level was in terms of negative gamma. All that negative gamma was put gamma. This is what happens in these cases:

- Spot Price stays far from the Put Support. If the spot price does not reach the strike of those puts at the Put Support Level, then those Puts expire Out of the Money (OTM). If volatility does not increase, there is not much for the market maker to do, the impact on the market will not be too great. Charm will just adjust the hedges of the market maker as time passes and those OTM puts end out of the money.

- Spot Price moves closer to the level. Like it happened in this particular example spot started moving lower. Not only the market moved in negative gamma. That started accentuating Vanna. That has a direct impact on Delta. As market maker try to hedge, they short the market, that then brings spot closer to the Put Support Level.

- OPEX. As OpEx happens, those puts get monetized by investors that use those puts as hedges. That means that the market maker can now close the shorts. That has a technical reaction for the market, that then bounces back up. The important part following that technical move is really seeing where that Put Support is re-established. In a normal bullish market, that Put Support is moved up. While in a bearish market that is pushed down, puts are rolled down and then the same effect may restart.