Option Matrix

The Menthor Q Option Matrix is a powerful tool that summarizes a lot of data including 0DTE data for a ticker. Every morning it becomes your key data feed where the majority of our data can be found.

The Option Matrix can be accessed via our Premium Membership for Stocks, EFT and Indices and soon Crypto and Futures. It will break down our data throughout the month by individual expiration dates.

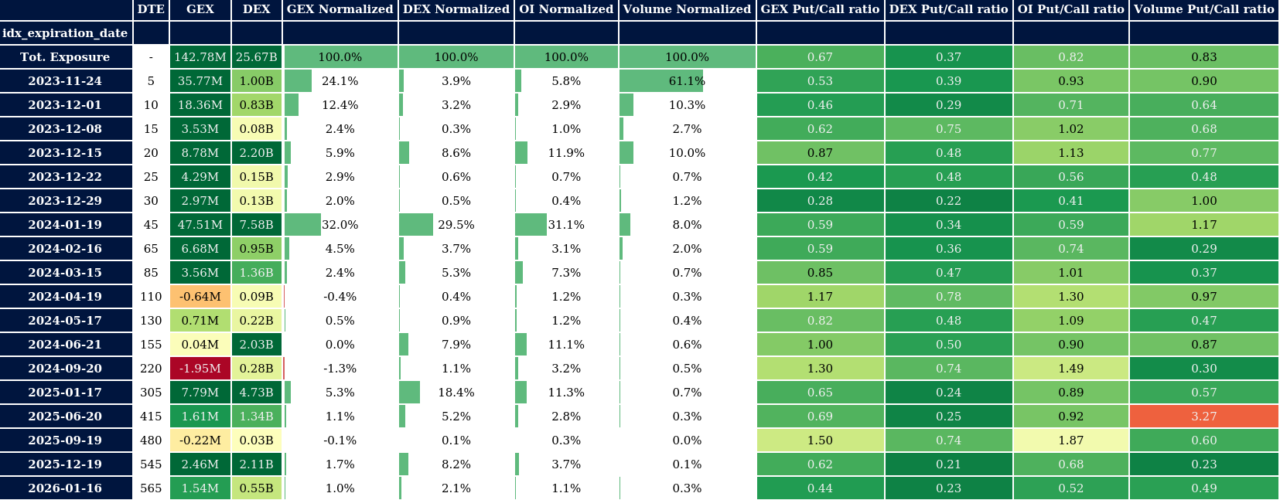

In the first row you will find the Total Exposure. In that row, that is the total exposure by each field for the entire month. For example, if we look at the GEX column by Total Exposure we see 52.87M. That is telling you that by looking at the entire option chain throughout the month, our total exposure is 52.87M. That also means the market is currently in positive gamma. You can do the same exercise for all of the other columns.

Option Matrix Columns

Now let’s breakdown what each of the columns represents:

- Expiration date: The first column represents the entire exposure for the month as of the date of issuance of the Option Matrix.

- DTE: this is the time to expiry. For example if you take 1, that would represent the 0DTE row or 1 day to expiration.

- GEX & DEX: those are your GEX and DEX, similar to what you can find on the main screen. We aggregate those levels by splitting it by maturity.

- GEX and DEX Normalized: what we are doing here is simply taking the total amounts of GEX and DEX for the month and dividing it by the GEX & DEX of the specific date. This allows us to see how much GEX & DEX there is in a specific expiration date.

- OI Normalized: we take the total Open Interest for the month and divide by the Open Interest of the specific expiry. Obviously dates with big OI are of interest for traders.

- Volume Normalized: same exercise of normalization we have done before. We take the entire volumes for the month (as of the date of issuance of the Option Matrix) and divide by the volume on the specific date. We want to see the dates with the highest volumes. Again those become of interest for traders.

- GEX and DEX Put Call Ratio: these two columns are telling us if there is more GEX and DEX on puts or calls. This can be integrated with your GEX & DEX indicators to confirm if volatility is becoming stronger or weaker.

- OI Put / Call: again, where is the most open interest? On puts or calls? A bearish market would see a spike of OI towards puts. This helps us track it.

- Volume Put / Call: here we look at how the volumes are building between calls and puts. We like to use this indicator for confirmation of what is happening with the Open Interest.

- In the next columns you will find our gamma levels. This is interesting because we create the levels throughout the entire month for a specific date. This can give you a good sense of how the market is positioned at the specific time when the Option Matrix has been ran. You can access High Vol Level, Gamma OI Level, Call Resistance, Put Support for each expiry date.

- Expected Move: finally we have our proprietary indicator the Expected Move. This gives us the range of movement of price at the expiration.

To access the Option Matrix you can use the Query Bot on our Premium Discord Membership.

You can access the Full List of Bots Commands here.

You can also find more information on the Key Levels below: