Why Options Move Markets?

In today’s interconnected world, the option market has become increasingly important, especially after the pandemic. However, investors have been lacking the necessary tools to effectively analyze and navigate this market. This is where option data comes in.

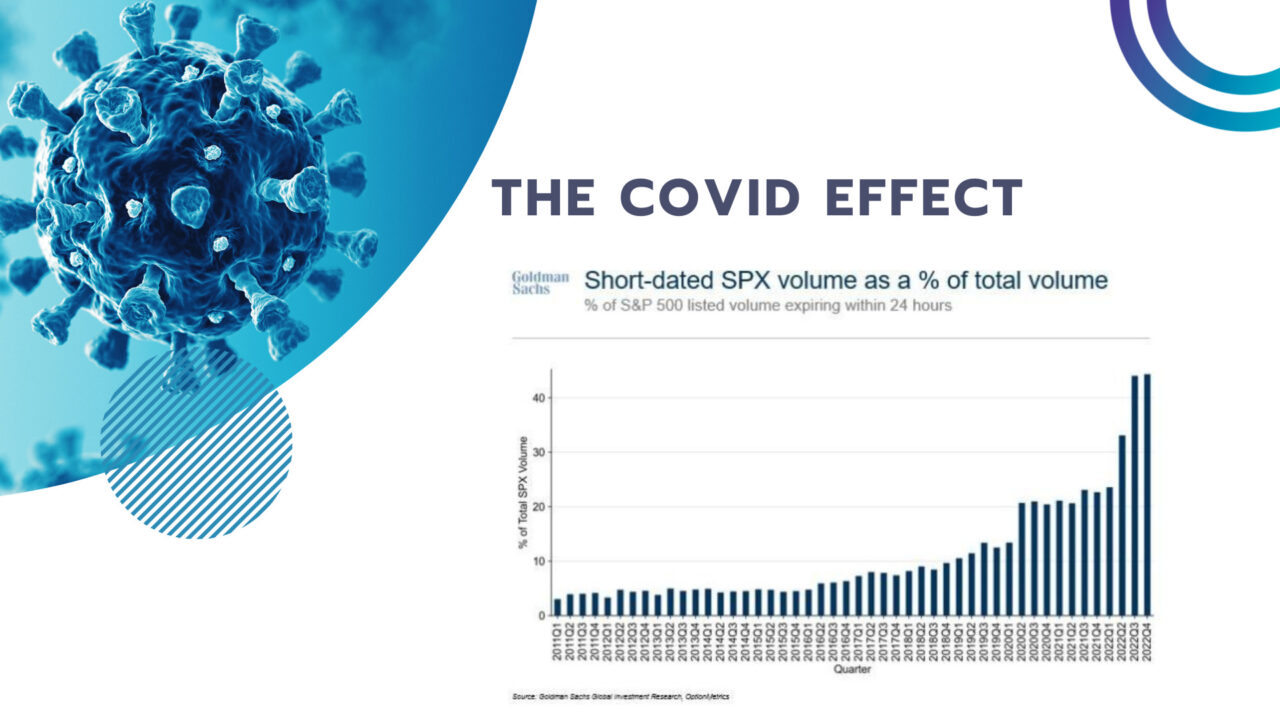

In the graph below we can see the change in options volumes in the last few years.

With Menthor Q we want to focus on the importance of analyzing the correlations between the different markets. The options one is particularly important because it has a direct effect on the stocks we hold in our portfolio, and also on the ETFs we use for our asset allocation.

Here are some interesting stats from Goldman’s research on option volumes during Covid. Option volumes surpass equity volumes in 2021 for the first time in history.

Why Options can affect Stocks and other Assets?

Options, like other financial instruments, can have an impact on underlying markets. There are several ways in which options trading can influence the movement of the underlying assets and broader financial markets:

- Hedging Activity: One of the primary reasons options can move markets is related to hedging activities. Investors and institutions use options to hedge their positions in the underlying assets. When they buy or sell options to protect against potential price movements, it can result in corresponding adjustments to their underlying asset positions. These hedging actions can lead to changes in supply and demand for the underlying asset, affecting its price.

- Price Discovery: Options markets contribute to price discovery in the underlying assets. Option prices reflect market expectations and sentiment about the future price movements of the underlying asset. As such, when there is significant trading activity in options, it can provide insights into market sentiment and influence traders’ decisions in the underlying asset market.

- Leverage and Speculation: Options offer leverage, allowing traders to control a larger position in the underlying asset with a smaller amount of capital. This leverage can attract speculative traders looking for significant profit potential. Large speculative options trades can move the underlying asset’s price.

- Expiration and Pin Risk: Around options expiration dates, market dynamics can change. Traders may adjust their positions to manage the risk of options contracts expiring in or out of the money. The so-called “pin risk” refers to the phenomenon where the underlying asset’s price is pushed toward a specific strike price to minimize losses for a large number of options traders. This pinning effect can influence short-term price movements.

- Volatility Expectations: The implied volatility of options (which is derived from option prices) can influence investors’ and traders’ expectations about future market volatility. This can, in turn, lead to changes in trading strategies and asset allocations, impacting market movements.

- Market Sentiment: Options market activity can be a reflection of market sentiment and expectations. When there’s a surge in options trading, it can be an indicator of increased interest or concern about the underlying asset, potentially leading to price moves.

- Options Expiry and Rollover: Near the expiration of options contracts, traders may need to roll over their positions by closing existing contracts and opening new ones. This activity can affect the demand for the underlying asset and contribute to short-term price fluctuations.

Why should investor look at Options data?

There are several reasons why investors should know how to use options:

1. Risk Management. Options provide traders with various strategies to manage and control risk effectively.

2. Increased Profit Potential. Options offer traders the opportunity to leverage their capital and potentially generate higher returns compared to traditional stock trading. With options, traders can benefit from price movements in the underlying asset at a fraction of the cost, amplifying their profit potential.

3. Flexibility and Versatility. Options provide traders with a wide range of strategies to suit different market conditions and investment goals. Whether it’s hedging, speculation, income generation, or capital preservation.

4. Capital Efficiency. Options can enable traders to diversify their portfolio and gain exposure to multiple assets while optimizing the use of their available capital.

5. Access to Additional Income Streams. Options strategies enable traders to generate additional income from their existing stock positions. These strategies can help enhance overall returns and potentially create a consistent income stream.

6. Following Liquidity and the activity of Market Makers can help you be better positioned for bullish or bearish market movements.