Positive and Negative Gamma

It is very important for Traders and Investors to understand the difference between Positive and Negative Gamma when trading any asset, because these gamma conditions can significantly impact their investment strategies and risk exposure. Gamma is one of the Greeks used in options pricing and risk management, and it measures how the delta of an options position changes in response to movements in the underlying asset’s price.

Positive and Negative Gamma become more relevant if we look at how Market Makers need to hedge in different conditions. Within our Resources you can access different articles relevant for this topic:

Market Makers do not profit from directional move but rather from the bid ask spread of each trade. Therefore their delta hedging is different in positive and negative gamma.

Next let’s look at the difference between positive and negative gamma.

Positive Gamma

Positive gamma is typically associated with long options positions, for example long calls or long puts. The same can be said for multi-leg strategies. Long Straddles or Strangles and Long Options spreads are positive gamma.

- Positive gamma indicates that the delta of an option will become more positive as the price of the underlying asset moves. For calls it means that delta will move closer to 1, while for puts to -1. This means that if the underlying asset’s price increases, a positive gamma position will gain delta, and if the price decreases, it will lose delta.

- When your strategy is long gamma, you benefit from spot price moments. Gamma scalping is an example of a strategy that benefits from a positive gamma condition.

- Positive gamma positions are often associated with a directional outlook on the market. Traders who anticipate that the underlying asset will move in a specific direction can use positive gamma to their advantage by seeking strategies that align with their expectations.

Negative Gamma

Negative gamma is associated with short options positions, for example short calls and short puts. Credit Spreads, Iron Condors, Calendar Spreads are negative gamma strategies.

- Negative gamma implies that the delta of an option will become more negative as the price of the underlying asset moves. If spot price increases, our delta will decrease and vice versa.

- If we are short gamma, we want to make sure the market remains within ranges. Large price moves can lead to losses.

- Changes in implied volatility can affect the risk associated with negative gamma positions. Rising volatility can lead to higher risk and potential losses, which may require adjustments or portfolio rebalancing.

- Negative gamma positions can lead to wider bid-ask spreads. Market makers and traders may widen their spreads to account for the additional risk they are taking on, which can affect trading costs for market participants.

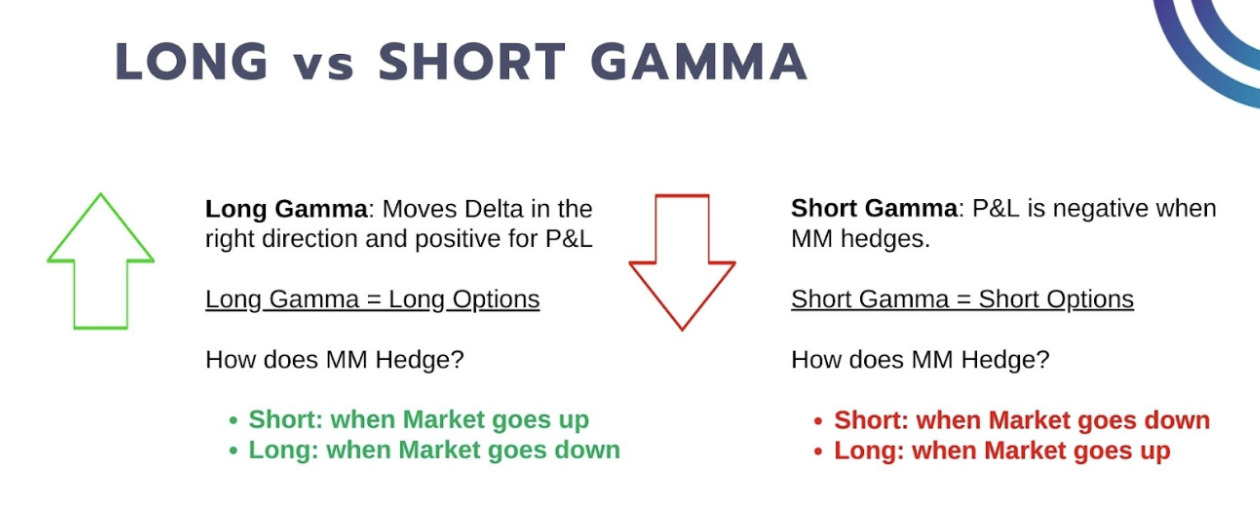

Here we can see how the Market Maker hedges in Positive and Negative Gamm.

How to know if we are in Positive or Negative Gamma?

We have developed a series of models to help investors quickly understand the market dynamics. Understanding when the market is in positive or negative gamma can be very important to define your trading strategy. You can access the models within our Premium Membership.

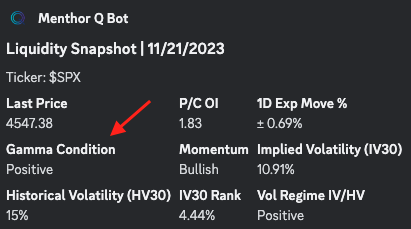

Here we can see a screenshot from our Bot. We can immediately see if the Gamma Condition is positive or negative and hence adjust our strategy for the day.

We have some additional resources to help understand the importance of Gamma and Options Greeks: