Short Call

Among the bearish strategies, we find the Short Call Strategy. Options can be bought as in the case of Long Call or Long Put strategies, or sold.

In this article, we discuss the strategy of selling a call or Short Call. Selling a “naked” call, that is, without owning the underlying asset, has the same exposure as going short a stock or short selling. Each sold call option contract gives exposure to 100 shares of the underlying. Selling a call is equivalent to selling 100 shares.

Why Sell a Call Option?

Options are dynamic instruments that allow us to profit from any market condition. Buying calls or puts allows us to benefit from directional price movements, but selling options has its advantages for the trader:

- Income Generation. Selling options can generate additional income through the premiums paid by buyers who purchase the options. The option seller collects the premium.

- Portfolio Protection. Selling options can be used to protect one’s portfolio from future losses. For example, by selling call options on a security that one owns in the portfolio. A protection strategy is represented by the Covered Call.

- Non-directional movement returns. Selling options can generate profits if it is believed that the price of the underlying will move within a range or will not reach our strike price. When we sell options, we collect the premium. At expiration, if the option expires “Out of the money,” the option’s value is zero, and as sellers, we have fully earned the received premium.

We sell a Call option if we have a bearish view on the underlying.

As sellers of a call, we have the obligation to sell a quantity of the underlying at the strike price to the buyer at expiration. If the option at expiration becomes “In the money,” the seller will have to deliver 100 shares of the underlying at the strike price of the option.

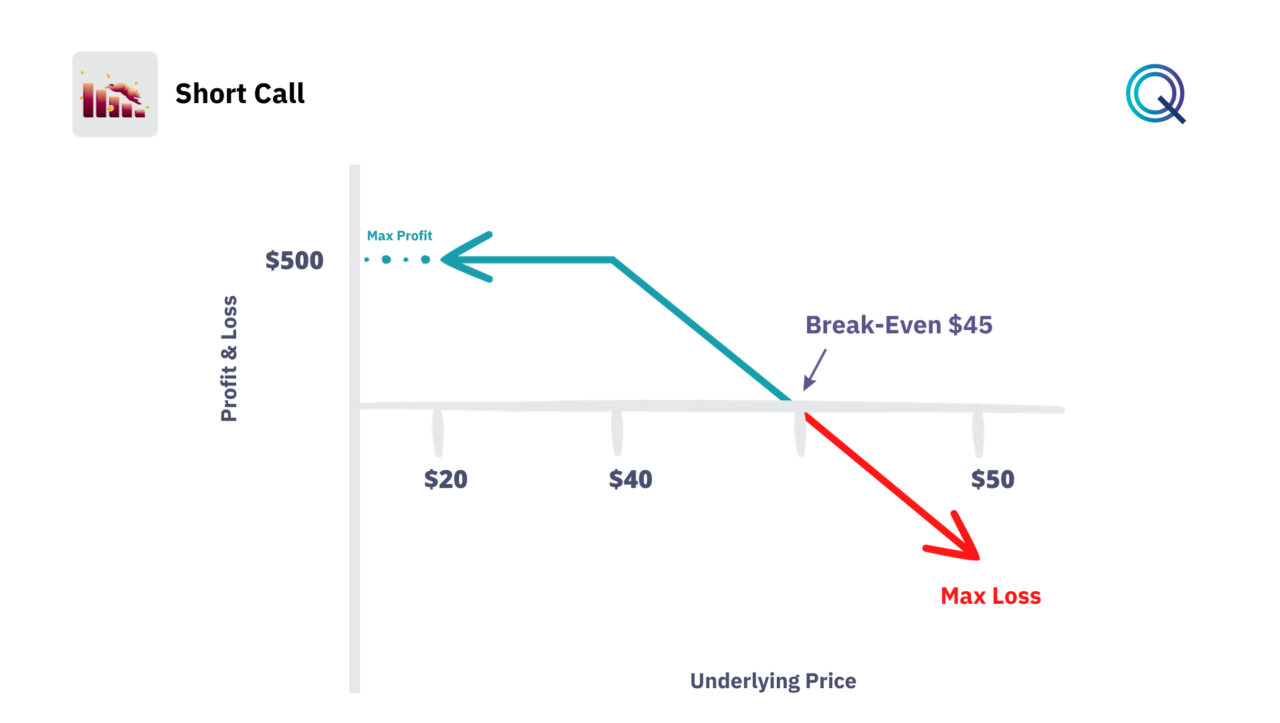

Short Call Strategy Payoff Diagram

Each option strategy has a potential return and a maximum potential loss. These two values can be displayed through the payoff chart. Selling options involves risks. Let’s see the payoff of this strategy. When we sell options, we have a limited profit represented by the received premium.

In the case of selling naked calls (selling without owning the underlying), the risk is unlimited. In this example, we sold a call option contract with a strike price of $40 for a premium of $5. The received premium is $500, which is $5 x 100 (number of shares).

- The premium represents our maximum profit. If the price of the underlying at expiration is lower than the strike price, the option expires without value, and we fully collect the premium.

- The break-even price is $45, calculated as the strike + the option’s premium. If at expiration the price of the underlying is higher than the break-even, our strategy incurs a loss.

- Our maximum loss in this case is unlimited. The price of the underlying can potentially rise to infinity. If this happens, as sellers, we have the obligation to deliver 100 shares to the buyer at the strike price. If we do not own these shares in the portfolio, we must purchase them on the market at a higher price.

Variables to Consider When Selling a Call

The Short Call strategy is an advanced options strategy that capitalizes on bearish market sentiments, enabling traders to profit from a plateauing or declining stock price while also bringing in premium income. There are various factors to consider:

- Market Expectations. Traders employ the Short Call when they anticipate that a stock will not exceed a certain price by expiration. This strategy is particularly effective in a stagnant or bearish market, where the likelihood of the call option expiring worthless is high, allowing the seller to keep the entire premium.

- Risk. The primary risk associated with a Short Call is the potential for unlimited losses, as the stock price can theoretically rise indefinitely. This contrasts with the limited profit potential, which is capped at the premium received for selling the call.

- Premium Collection. The premium collected provides immediate income and represents the maximum potential gain for the trade. It’s a strategy that’s not just about anticipating market moves but also about capitalizing on time decay and declining volatility.

- Covered vs. Naked Short Calls. While a Naked Short Call exposes the trader to significant risk due to the lack of underlying shares, a Covered Call is a conservative alternative that involves selling calls on stock already owned, thus capping the risk to the difference between the stock purchase price and the strike price, minus the premium received.

- Breakeven and Potential Loss. The breakeven point for a Short Call is the strike price plus the premium received. Any stock price below this level at expiration will be profitable. However, if the stock price exceeds this breakeven point, the trade starts to incur losses.

- Implied Volatility. A decrease in IV after the Short Call has been sold benefits the trader as it reduces the option’s value, making it cheaper to close the position if necessary.

- Time Decay. Time Decay, or Theta, works in favor of the Short Call seller. As the option approaches expiration, its extrinsic value diminishes if the stock price remains below the strike price, increasing the likelihood of the option expiring worthless.

- Managing Position with Rolling. Rolling positions is a technique used to manage and potentially extend the life of an options position. If market conditions change, the Short Call position can be rolled to a different expiration date or strike price, sometimes for an additional credit, which can help manage losses or lock in profits.

- Advanced Strategy Integration. For investors looking for greater market exposure or risk management tools, the Short Call can be combined with other options strategies, such as spreads or straddles, to create more complex positions tailored to specific market outlooks or risk profiles.

We talk about this in detail in our Academy.

Conclusion

The Short Call option strategy is a testament to the strategic and speculative nature of options trading. With a comprehensive understanding of market dynamics, implied volatility, and time decay, traders can effectively employ Short Calls to enhance their investment approach during bearish market phases.

To recap:

- The Short Call Strategy is a bearish strategy

- Our position is Short Options

- It is a credit structure

- Our View is bearish on the underlying

- The strategy benefits from a decrease in volatility

- Time is a positive factor for this strategy

Other Bearish Strategies

Here are other bearish strategies with Options: