How to structure a Trade on OKTA

This week we are going to take some of the work that DocTraderMcgraw@Q did in our Trade Structuring Channel. For those that do not know Doc together with Chester Ming@Q and Punklandia@Q run our Structuring and Macro Trading Rooms everyday. You can access the rooms within our Premium Membership.

Since they started they have been doing an amazing work at simplifying the complexity of the markets while educating the ever growing Q Community. You can follow them by signing up for free for 7 days.

The best free 7 days of your trading life. Now let’s jump to this week’s note and dig into Doc’s work.

Case Study: Trade Structure on OKTA Inc.

Okta Inc. is an American identity and access management company based in San Francisco. It provides cloud software that helps companies manage and secure user authentication into applications, and for developers to build identity controls into applications, website web services and devices.

Goldman calls it a “conviction buy”. But we like data, so today we are going to dig deeper and see what our models are telling us about this company. This will be another great exercise to understand how you can use the Q-Models to analyse your assets in order to make data driven trading decisions.

First of all, we want to see if the asset is in positive or negative gamma. Positive and Negative Gamma become more relevant if we look at how Market Makers need to hedge in different conditions. If you are not clear about this point, please refer to this article.

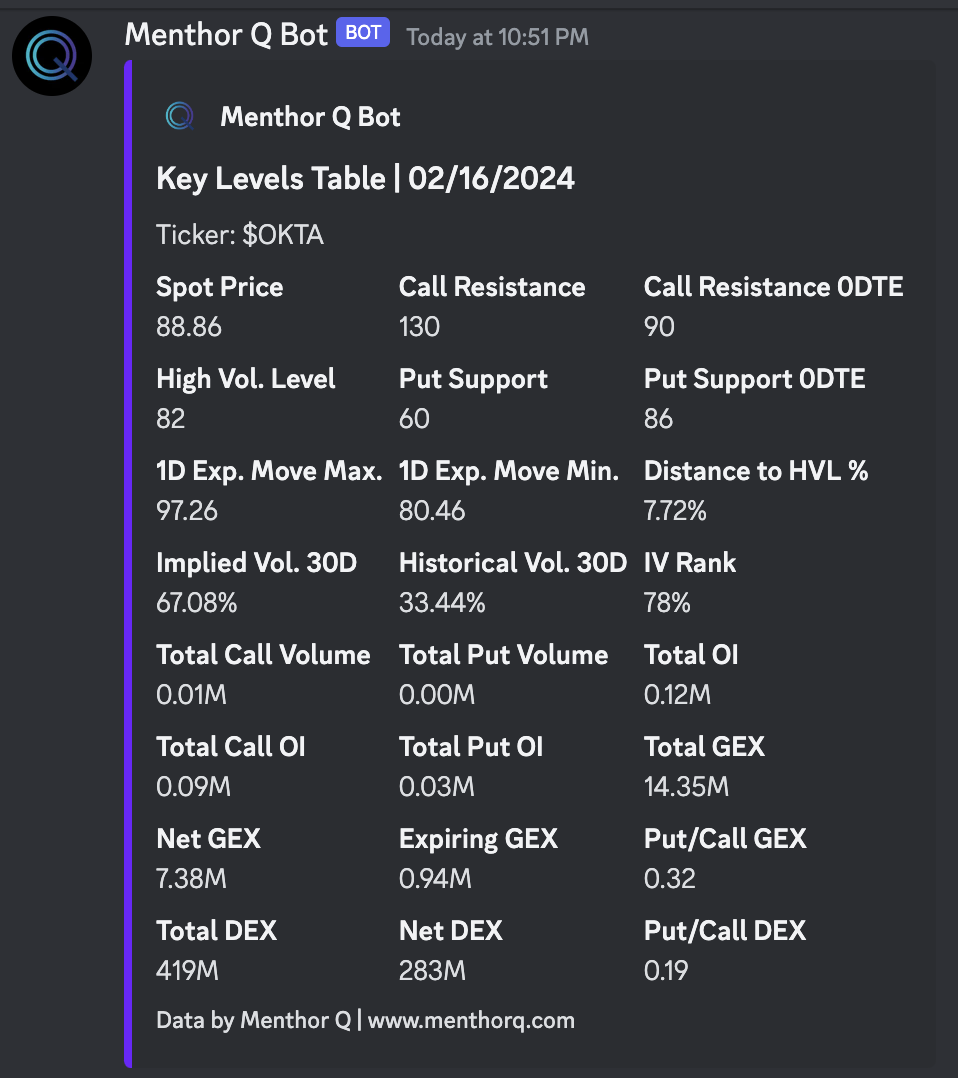

By accessing the Query Bot we can download the liquidity snapshot. This is a summary of the key data for gamma, volatility and momentum you want to be aware of. From the screenshot you can clearly see that the asset is in positive gamma. Momentum looks bullish. You can use this function by typing the short cut /liq_snapshot ticker:OKTA

Key Levels on OKTA

Next we can look at what the key levels are. We can do that in different ways, one of the easiest formats is by just downloading the Key Levels Table. These are also what many refer to as the gamma walls. These levels are important because at those strikes you have strong positioning, and as spot, volatility and charm are dynamic, so is the delta of the market makers.

That means that when the spot hits those levels that change in market maker’s delta can act as a support/resistance, attracting prices to it when the delta moves to the “at the money” strike. There are different considerations you want to make when looking at those levels. But the first thing is to understand Delta Hedging. You can use these links:

The Key Levels can also be visualized on TradingView, some find that more helpful. Either way, now this information helps our analysis by filtering the key strikes. These strikes can potentially be used for directional bet, or option spread strategies, depending on what type of trader you are.

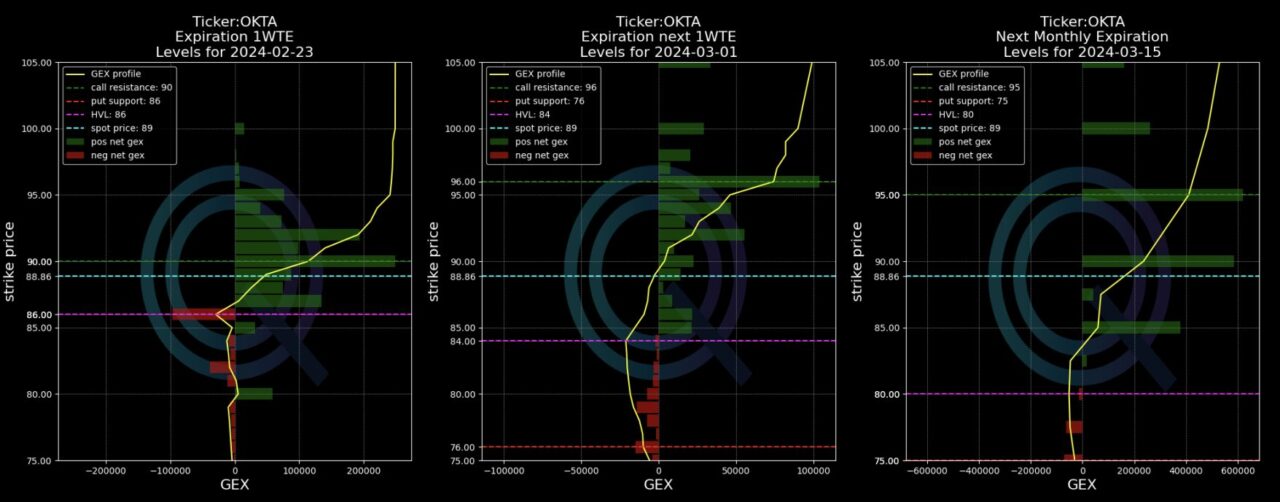

Net GEX Multi Expiration

Next we jump to the Multi Expiry Net GEX. On the left hand side you can see the short term expiries, on the right hand side the next monthly expiration. Learn more about the Net GEX here.

What we can see here is positioning throughout the chain is skewed towards calls. You can download this chart by typing /netgex_multiexpiry ticker:OKTA.

To further drill down and find those important strikes we can run two more charts. The Top 10 Negative and Positive Net GEX levels.

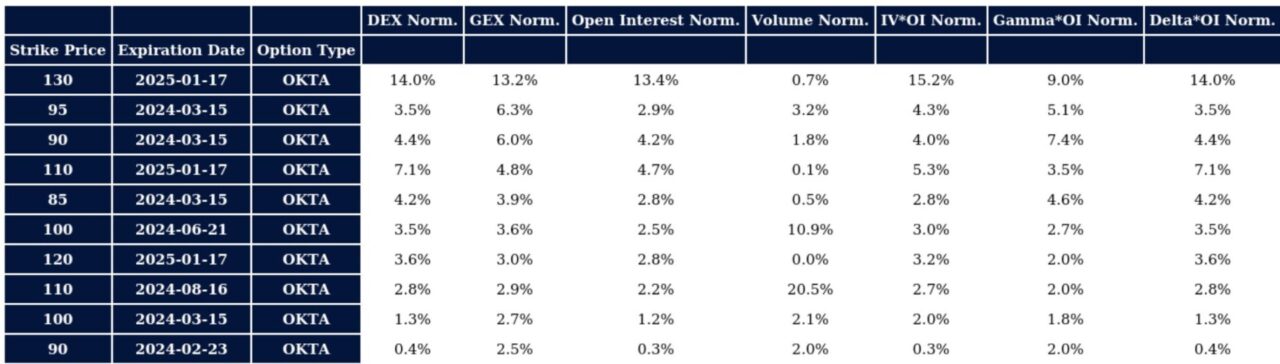

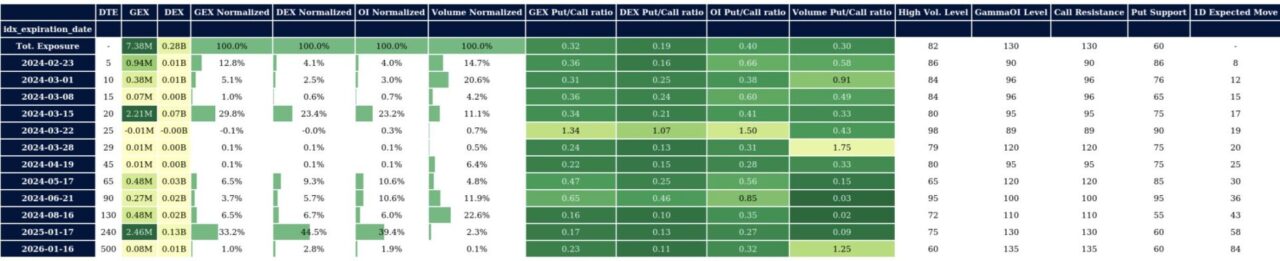

Option Matrix

Next Doc looked at the Option Matrix. While the Net GEX looks at GEX per strike, the Option Matrix looks at time. You want to see how gamma and delta is changing per expiry as well as the different ratio.

Again, if we focus in the middle of the table we see that the ratios are skewed towards calls, confirming what we have been seeing in the Net GEX chart. You can download the Option Matrix in the Bot by typing /matrix ticker: OKTA

If you want to learn more about the Option Matrix follow this link.

Trade Structuring – Buy Write Covered Call

Now that we have all this data, we can start thinking about potential structures. The first thing that Doc does is to look at Earnings and High Implied Volatility. Based on this, he then comes up with some potential ideas.

In our Case Study we are Bullish the Stock. We want to get exposure but at the same time enhance our performance by using options. We can implement a Covered Call Strategy. For this strategy we own at least 100 shares of OKTA and sell a Call Option. You can find more details about the Covered Call Strategy here.

But questions you want to ask yourself are: What call to sell vs shares? What tenor?

If we go back to the Net GEX, we noticed that 85, 90 and 95 were all strikes with large call positioning. That call positioning was also confirmed by what we saw in the Option Matrix where all ratios were pointing to call bias. The strike that one chooses is really based on the type of risk you are willing to take.

Setting up the Covered Call

First of all by looking at the OKTA Option Matrix we see it clearly green. That then confirms that investors are call bias on this asset.

The next question then is where do we buy? For this we want to take out once again the Net GEX chart. We want to focus our attention on the monthly expiration chart to the right.

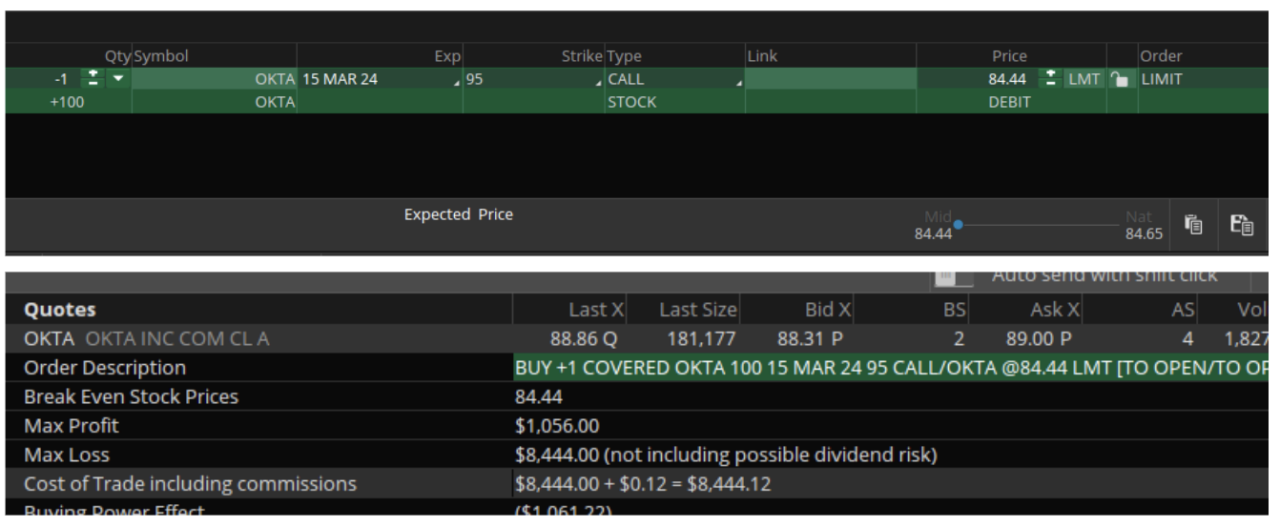

$95 Strike

The first strike we look for is the $95.

Looks like $95 is indeed the strike that we would want to focus on. We are looking at the $95 strike for the March 15th 2024 expiration. Here we can see a screenshot from the Thinkorswim platform.

Let’s now calculate our potential return. These are the inputs we want to look at:

Max Profit: $1,056

Max Loss: $8,444

$1056 / $8444 = 12.5% for the month

Now we can look at other strikes by looking at the Net GEX Chart. We see that $90 and $85 are also strikes where there is a good level of option activity.

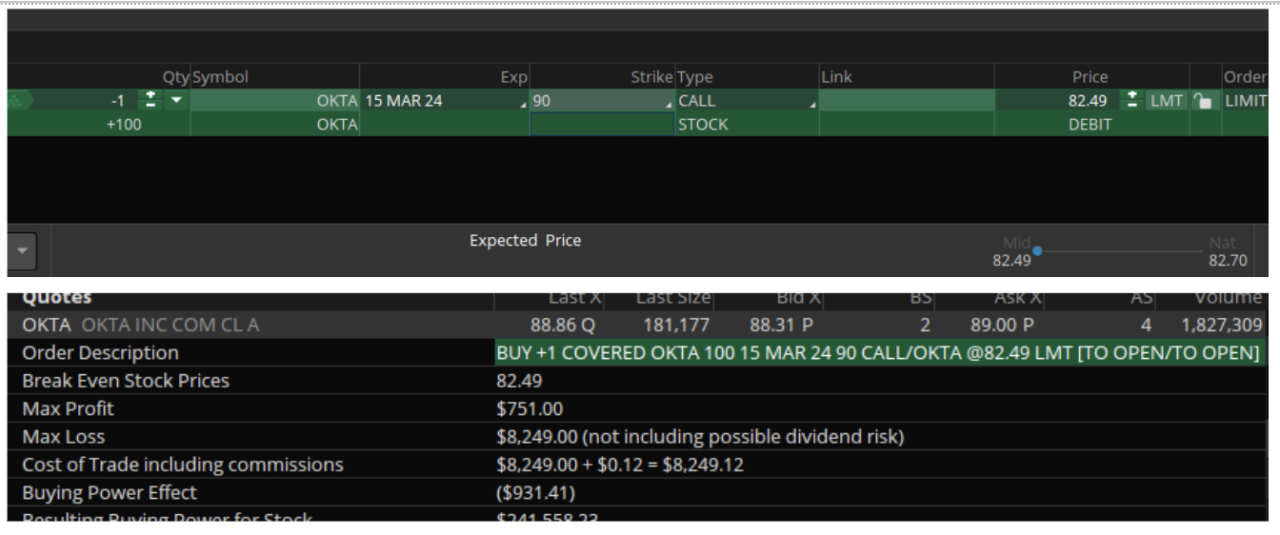

$90 Strike

We can start with the $90 strike.

We can do the same exercise we did earlier by taking Max Profit and Max Loss. This is what we get $750 / $8,250 = 8.7% in a month

By selling a call we can also lower our breakeven price which means we can own the stock at $82.5.

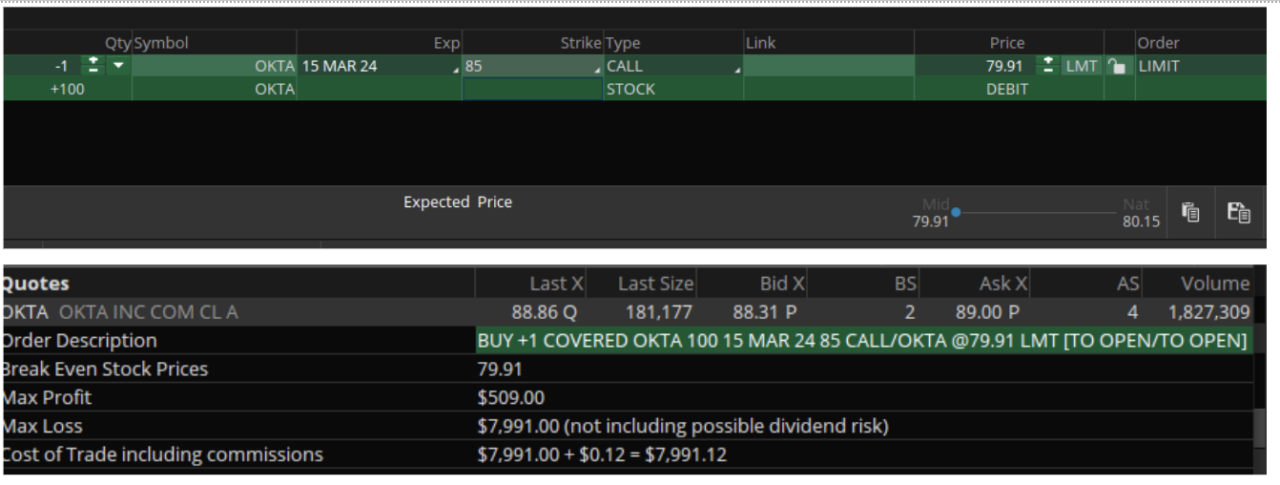

$85 Strike

Let’s now look at the $85 strike

In this case our Profit and Loss is calculated as follow:

$500 / $8000 = 6.25% return in a month or own the stock at $80.

The Covered Call Strategy also carries risks in case the price of the stock drops.

Recap

Finally, since we have already made this note longer than usual, these are the takeaways, and the process that Doc is using:

- Find a name, that is either via our Option Screeners or by looking at a research. OKTA popped up after it was flagged by Goldman.

- Run the Q Models, a lot of which we have shown you in this case study. Via the Bot you have all the data you need.

- Look at the option chain, and focus on open interest and volumes too.

- Decide on expiry/strikes and structure of the trade. Is this going to be a short maturity trade or longer term, what are the strikes with most activity. All of this is in the Q-Models data.

- Do your arithmetic along the way to determine risk-reward capital allocation etc. We will focus on this on a following guide.

- Combine Option data with technical analysis – will focus on this in the future, we also have a course focused on this that will be released soon.

- While most people don’t usually look at fundamental analysis, a good trader should have a good handle on that. This is more important on longer frames of course.

- Pick your trade setup!

If you want to access our daily research Join our Premium Membership.