Trend Following Strategy

What is the Trend Following Strategy?

It’s a strategy that invests by following the main trend and using available tools to identify areas of interest and optimal entry points to ride the trend. As technical analysts say, “Trend is your friend.” This approach allows us to select stocks that are trending and enter a trade efficiently to ride the market trend.

The Types of Trend

In financial markets, we have three primary types of trends:uptrends, downtrends, and sideways trends.

- An uptrend is characterized by higher highs and higher lows, signifying a general increase in prices over time, driven by greater demand than supply.

- A downtrend is marked by lower highs and lower lows, indicating a decline in prices, with supply outstripping demand.

- A sideways trend, or range-bound market, occurs when the price moves within a horizontal range, reflecting a balance between buyers and sellers, often due to uncertainty or consolidation within the market.

In the chart we can see an example where we have the uptrend in green, the sideways trend in orange and the downtrend in red.

How do Traders use Trend Following Strategies

Traders using trend following strategies typically:

- Identify the Trend. Use technical analysis tools like moving averages, MACD, or ADX to determine if a market is trending and its direction.

- Entry Points. Enter trades in the direction of the trend during pullbacks or upon breakout signals.

- Stop Losses. Implement stop-loss orders to manage risk, often placing them beyond key trendlines or moving averages.

- Ride the Trend. Hold positions as long as the trend persists, ignoring minor fluctuations that don’t signify a trend reversal.

- Exit Strategy. Exit trades based on signals like trendline breaks, moving average crossovers, or a set risk-to-reward ratio.

- Backtesting. Continuously backtest strategies against historical data to refine them and adjust to changing market conditions.

The Trend as a Level of Support and Resistance

To use the trend as support and resistance, traders typically follow these steps:

- Trendlines. Draw trendlines along swing highs and lows to establish the direction of the trend. In an uptrend, the line is drawn along the swing lows, acting as support. In a downtrend, it’s along the swing highs, serving as resistance.

- Bounce and Breakout. Watch for price action to bounce off the trendline, reaffirming it as support or resistance. A break through the trendline may signal a reversal or weakening trend.

- Entry and Exit. Enter trades when the price touches and bounces off the trendline in the direction of the trend, and consider exiting or taking profits if the price breaks through the trendline.

- Confirmation. Look for confirmation signals, such as candlestick patterns or trading volume, to validate the trendline as a support or resistance level before making trade decisions.

Indicators to look at Market Trend

When looking at Trend Following Strategies it is important to not only look at the trend of our stock or asset, but also at the Market Trend. To analyze the overall market trend, traders and analysts use a combination of technical indicators, chart patterns, and economic data:

- Technical Indicators. Tools like moving averages, MACD, and RSI can help identify the strength and direction of the market trend.

- Chart Patterns. Patterns such as head and shoulders, triangles, and flags can provide insights into market sentiment and potential trend reversals or continuations.

- Volume Analysis. High trading volume can confirm the validity of a trend, while low volume may suggest a lack of conviction.

- Economic Indicators. Fundamental analysis using economic reports, such as GDP growth rates, employment data, and interest rate changes, can provide a backdrop to the technical picture and give clues about potential shifts in the market trend.

- Market Breadth. Analyzing the number of advancing versus declining stocks can offer a sense of the trend’s health across the broader market.

Menthor Q Trend Following Indicators

We have developed a series of indicators and charts that you can find in our Premium Membership.

Market Breadth

Market breadth, using the 200-day moving average, is a signal of the overall health and direction of the market by assessing how many stocks are participating in the trend. By counting the number of stocks above their own 200-day moving average, we can determine if a market move is broadly supported.

A strong market trend will typically see a large proportion of stocks above this key moving average, indicating widespread bullish sentiment.

If fewer stocks maintain levels above their 200-day moving average, it may suggest underlying weakness in the market, even if the broader indices seem to be performing well. This divergence can often provide early warning signs of potential trend reversals or market corrections.

Within the indicator at the bottom you can see how many of the S&P 500 Stocks are above the 200-day moving average.

Menthor Q Trend Bias Indicator

The trend bias indicator uses a subset of all possible moving averages and tests how many cases exhibit a bullish cross (fast MA > slow MA).

We then create a trend model using this data, and the output visible in the lower part of the graph is an oscillator that indicates the most likely trend. In the upper part of the graph, you can observe past occurrences.

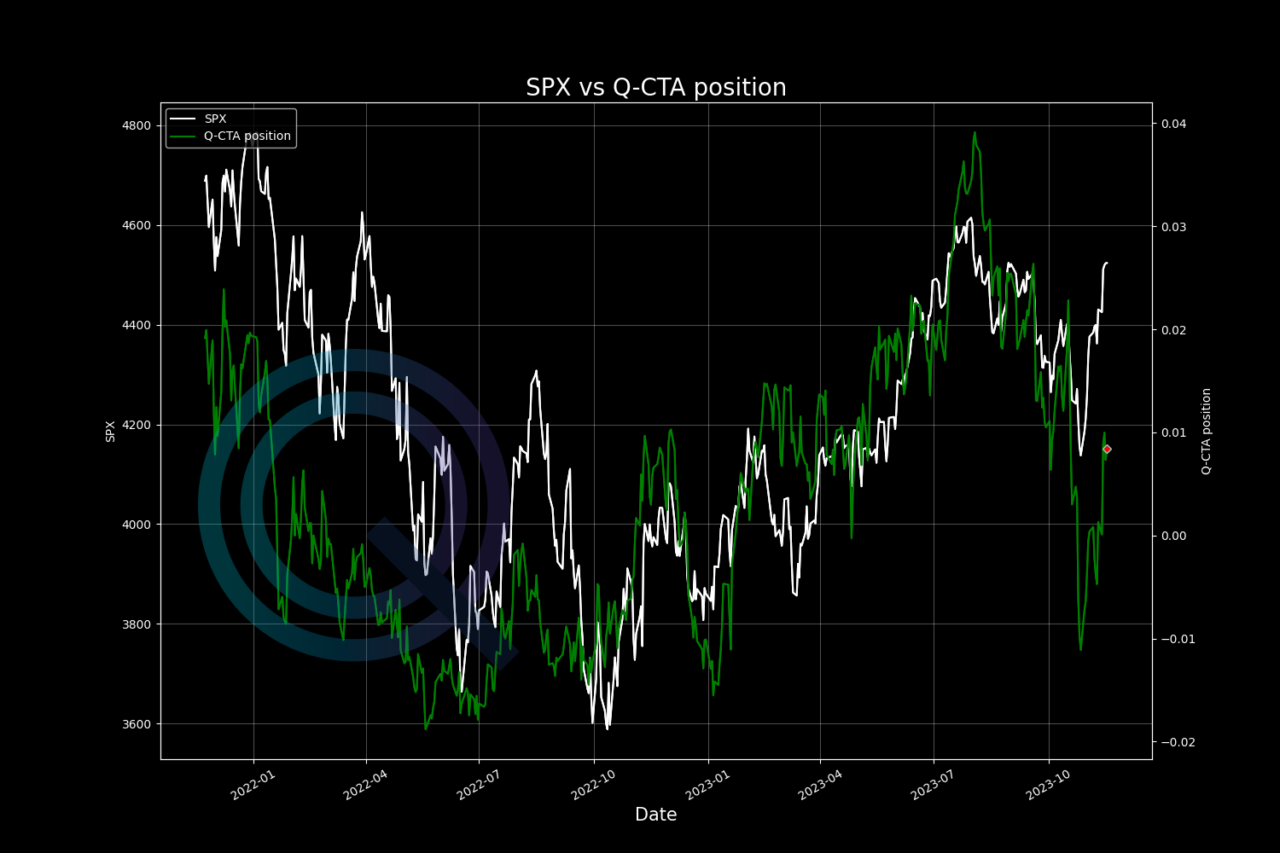

Menthor Q CTAs Model

CTAs funds, short for “Commodity Trade Advisors Funds”, represent a significant component of the financial landscape. These funds employ systematic trading strategies, primarily relying on technical & momentum analysis and price level triggers to implement trend-following strategies on the most liquid assets in the market. We have a separate article on the CTAs Model.

The Menthor Q-CTA Model offers a tool for tracking CTA positions and monitoring changes in their exposure. This analytical approach comprises tables and charts designed to understand the CTA positioning.

You can access all these Models within the Premium Membership.