What is Menthor Q?

Menthor Q is a leading TradeTech company with a focus on creating advanced quantitative models for active investors. Our dedicated team of industry experts is committed to simplifying the complexities of financial markets for our clients.

We provide users access to institutional-level data and analytics. Our journey begins by ingesting vast quantities of data from various sources and providers, we then create sophisticated quantitative models that simplify the dataset, transforming it into actionable information.

Our Company is powered by a team with unmatched expertise and diverse backgrounds. At the core, it is made of ex investment bankers, researchers, quants, data scientists, and developers.

This unique blend of experience allows us to build and always improve models in markets that are adaptable and constantly changing, providing our customers with the support they need to be successful.

Finally we create visually compelling charts and analytics, designed to empower traders with a clear understanding of the market dynamics. With these insights, our clients can effectively prepare for their trading days, making better informed decisions.

Trade using the same approach as Institutional Investors

The goal is to use the same approach used by the large institutions:

- Leverage a Data Driven Approach

- Simplify Complex Data

- And Create Actionable Signals that can help us improve our performance and manage our risk more effectively.

The Menthor Q Models

Over the past three years our team has developed a series of models to allow our clients to understand market dynamics, sentiment and investor positioning.

Post-Covid the financial landscape has changed. We have seen a tremendous increase in options volumes, systematic investing and algorithmic trading. Retail investors are now left with a disadvantage as they do not have access to the same tools used by the market.

We have also seen the importance of Market Makers activity in moving the spot price of an asset. Market Makers move markets and that is why looking at their activity is key for any investors.

Gamma Levels and Liquidity Models

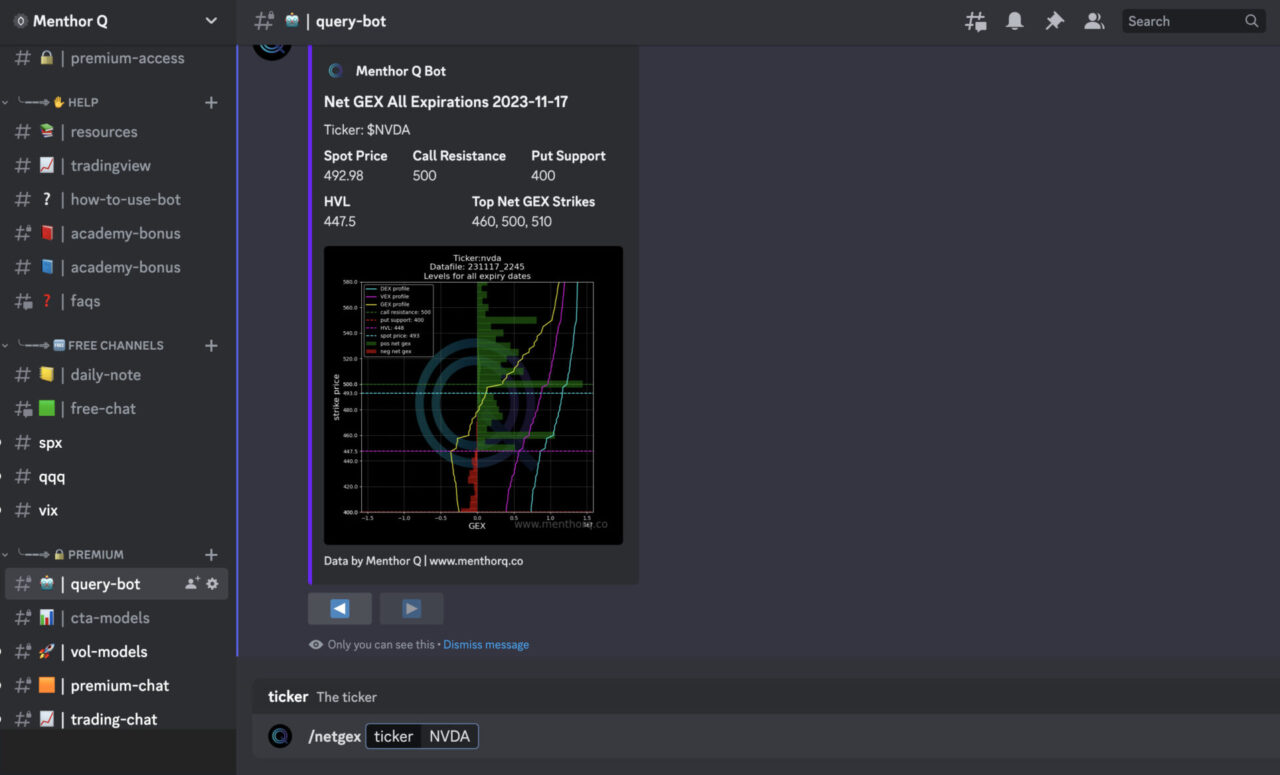

Menthor Q provides users access to our Gamma and Liquidity Models. We analyze the Options Chain data and the activity of Market Makers. Our cutting-edge analysis of option data enables us to:

✅ Predict Key Price Levels on Indices, Stocks and ETFs

✅ Anticipate Market Volatility

✅ Identify Market Momentum giving you the edge you need to make profitable trades

✅ Integrate our data into TradingView and trade with speed and confidence

How can you use Menthor Q for your Trading?

The Menthor Q product suite is divided into two categories: Membership and Academy.

Membership

If you are looking for data and insights to enhance your trading you can access Menthor Q Models via our Free Daily Report or our Premium Membership.

1. Free Daily Report

You will get access to our models and Key Levels on SPX, QQQ and VIX. The models can be integrated directly into TradingView. The report is available Monday to Friday before the market opens. By signing up you will also be able to join our free Discord Server and join a community of traders.

2. Premium Membership

You will get access to our Premium Discord Server where you will be able to access our Query and Auto Posting Bots and our models on Stocks, ETFs and Indices and soon Crypto and Futures (ES, CL, etc.).

Academy

The financial market is a complex and evolving ecosystem. Menthor Q has created an educational journey to help investors uncover these complex dynamics by looking at the options market.

With the Academy you will be able to learn how to read the Greeks, follow the activity of market makers, learn how to use volatility and build advanced options strategies. Join over 1500+ students.