This was another crazy week in the markets with CPI and the Fed in the spotlight. Not only that, we also had a big option expiry on Friday. As we had been pointing out in our trading channels last week was particularly important, because the outcome of the first two events were key to see whether the market had support to run into year end.

CPI came close to expectation, and helped create support above spot. What was more surprising was Powell, who came in more dovish than expected. That really gave gas to the market. Question at this point is whether that was premature.

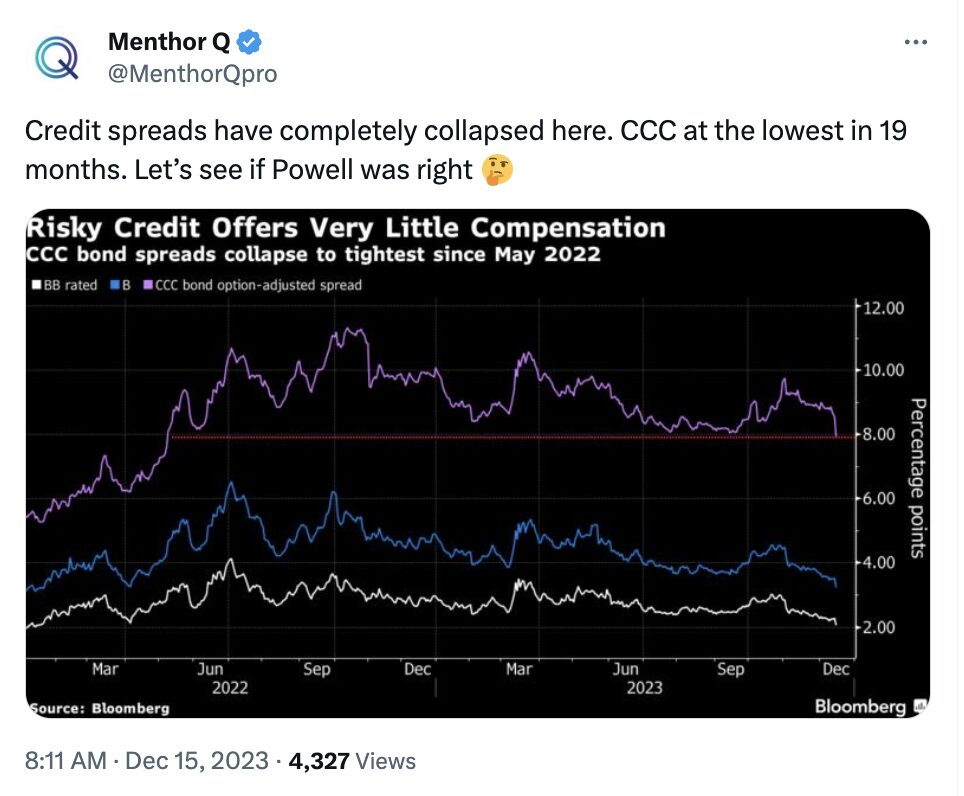

As Cem Karsan has been pointing out, while it looks premature, it could have been expected as we get into the presidential race in 2024. In the macro world we are already seeing the risk of effects as credit spreads drop, especially junk spreads.

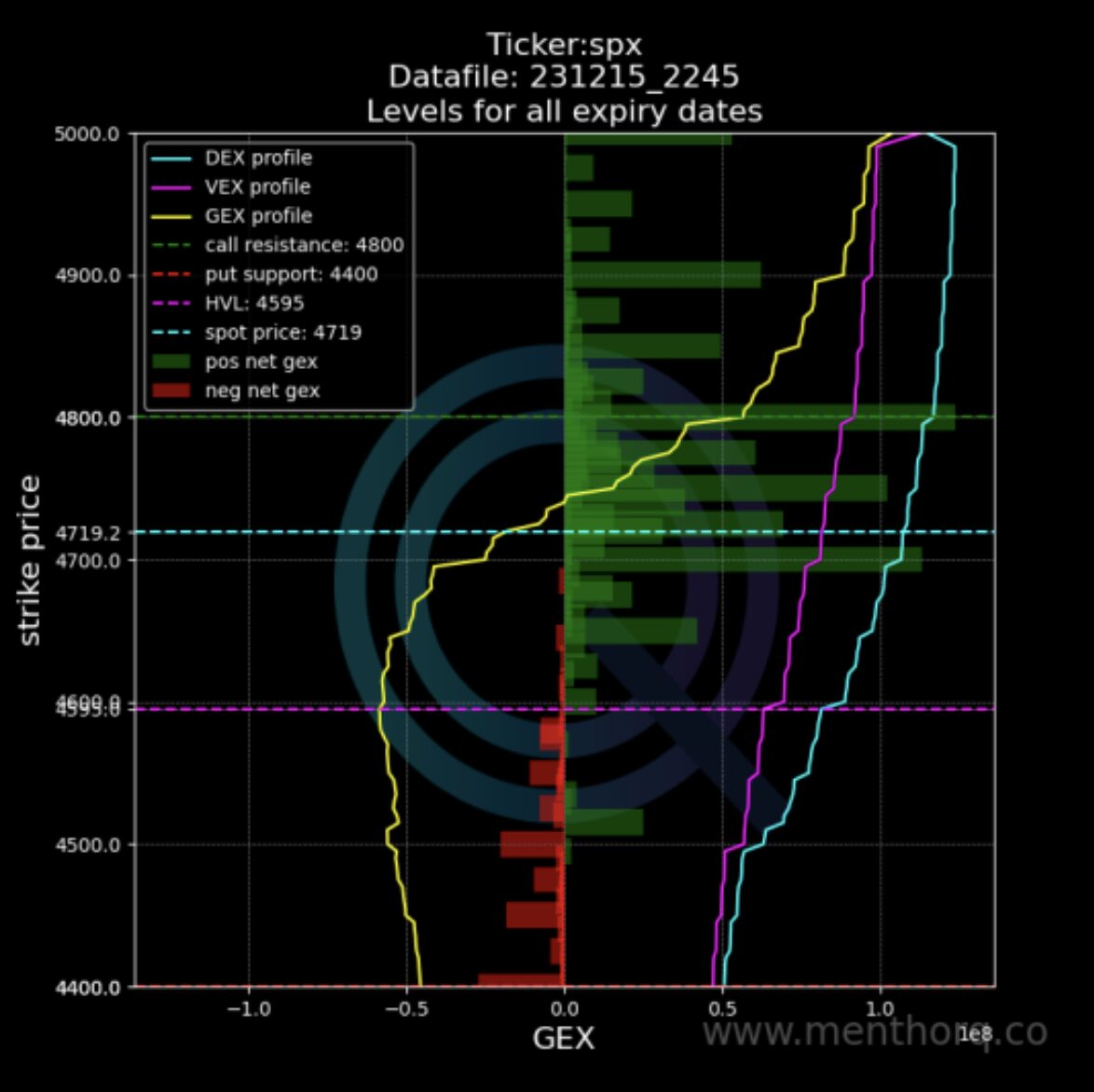

Either way we saw huge support into this market, and with positive seasonality, flows are looking supporting into mid January when we will have VIX expiration. Via the NetGex chart you can see how call gamma has been increasing.

This chart is updated post OpEx, and it clearly shows that the market and the flows are now supportive into year end. The thesis for the Santa rally holds more than ever – if nothing major geopolitically happens in the interim. Look how call gamma accumulated around that 4800 strike.

Even the Call Resistance level moved up from 4700 to 4800 a very bullish sign from a positioning point of view.

So OpEx unpinned that 4700 and let the market run. We wrote a thread about OpEx, how to think about pinning and unpinning. Worth reading and bookmarking for the next time, because these even become more and more important as option flows in markets increase. Here are some interesting content coming from our Twitter:

The 1D Exp Move Indicator

Systematics funds, CTAs and algo are becoming more and more active in these markets. Same goes for the use of options. What this means is that flows are becoming more and more important to follow, but also that some of the market moves can be more predictable if we understand some of the key levels that become support and resistance. We are not talking about technical analysis but levels with heavy option positioning.

One of the key indicators that we use is our proprietary 1D Expected Move. What we do is calculate a projected/expected move for indexes and stocks for the next day based on current positioning. While you cannot expect the index to be accurate 100% of the time (it does not predict unexpected events), it can help you narrow down for you the expected move of spot price.

This provides you with a price band. That band can be used in different ways depending on your strategy and risk management. The 1D Move provides a Minimum and Maximum price range.

Let’s look at an example from last week to see how one could have used it. Let’s look at the QQQ. Below we have the price action on the day. In this case the trader could have used the 1D Expected Move to enter into a spread trade. We always prefer option spread to directional only because those help you manage your downside risk. But you decide your risk levels, and can use the levels as you like.

In this case, we could have used the 1D expected move as a support level. Better to wait for the initial bounce before structuring your spread. The moment the spot hit and bounced off the 1D expected move, the trader could have sold a Put Spread. Depending on your risk appetite, you could have sold a put around the Call Resistance level or slightly above and bought a put at a lower strike.

That would have allowed you to collect premium on the put spread. As the price bounced to the upside you could have closed the spread and collect all or part of the premium.

Another way could have been using a Directional Strategy like Buying an ATM or slightly OTM Call when the price touched the 1D Exp Move Level.

We have backtested our 1D Expected Move indicator here. Please read more about it:

You can find more ways of using our levels at this link. We give more practical examples of how to use the levels:

Join our Premium Membership if you are looking to learn how to trade options and leverage our models.

Join us today and unlock the power of Options